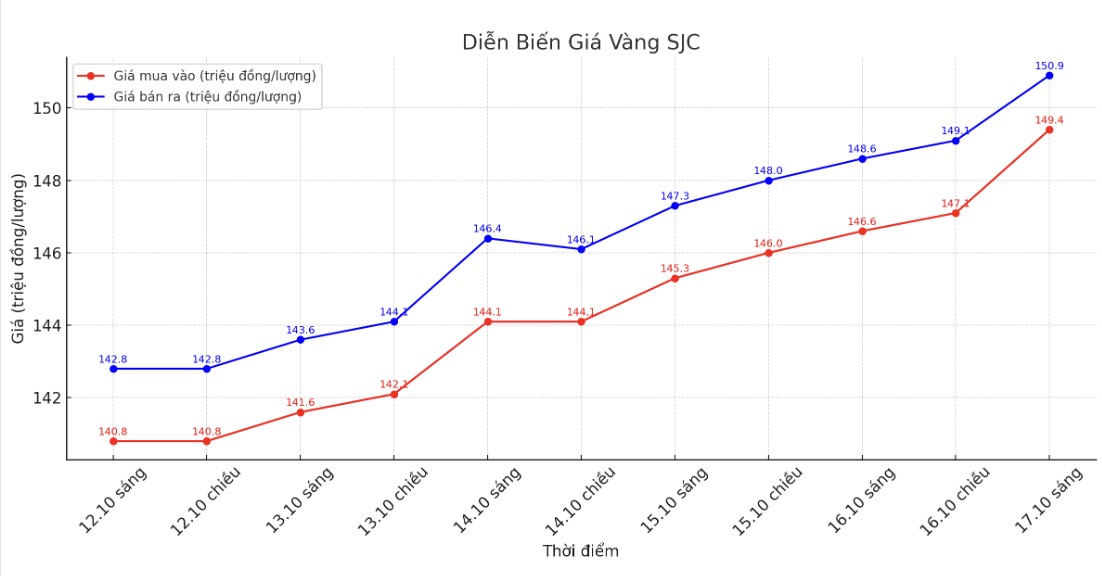

Updated SJC gold price

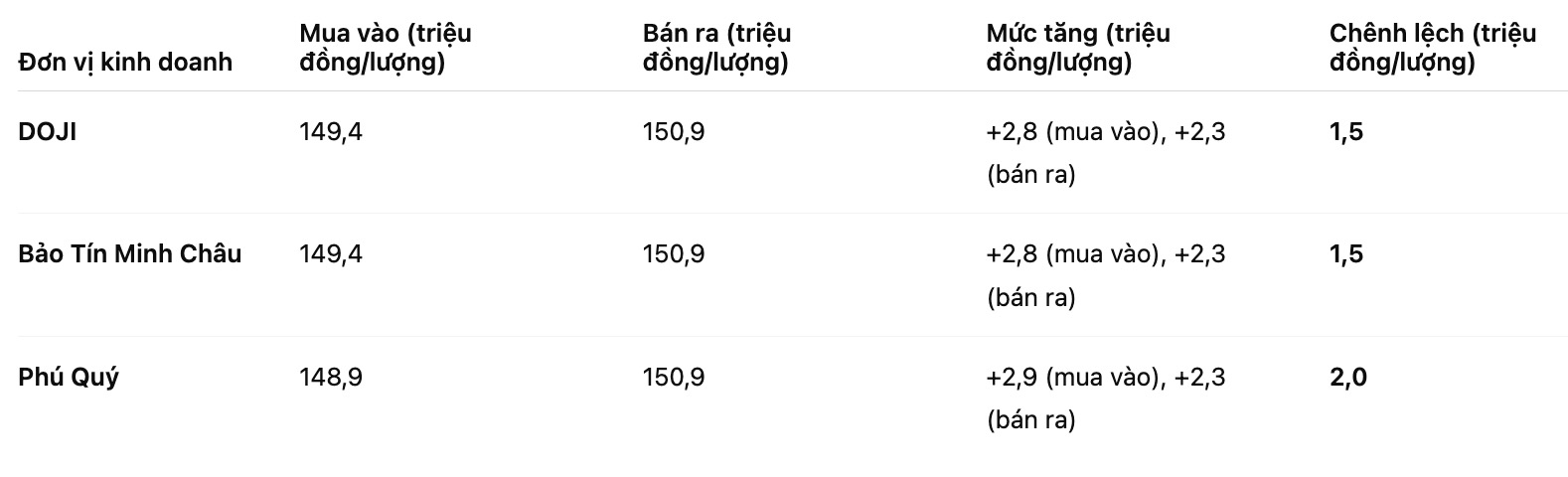

As of 9:45 a.m., DOJI Group listed the price of SJC gold bars at 149.4-150.9 million VND/tael (buy - sell), an increase of 2.8 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 149.4-150.9 million VND/tael (buy - sell), an increase of 2.8 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry One Member Co., Ltd. at 150.7-152.2 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 148.9-150.9 million VND/tael (buy - sell), an increase of 2.9 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

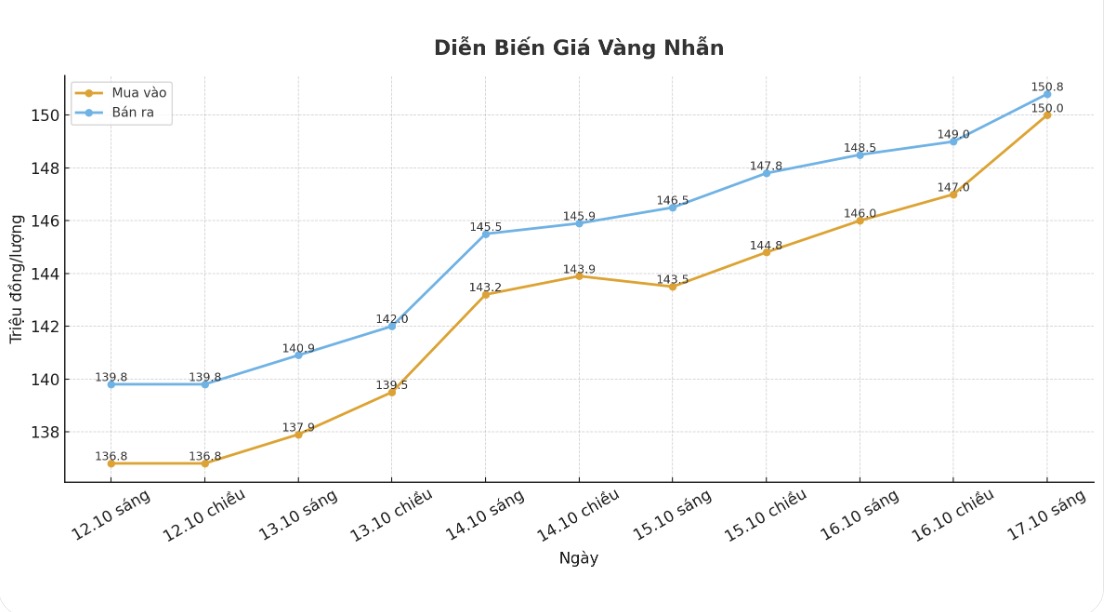

9999 round gold ring price

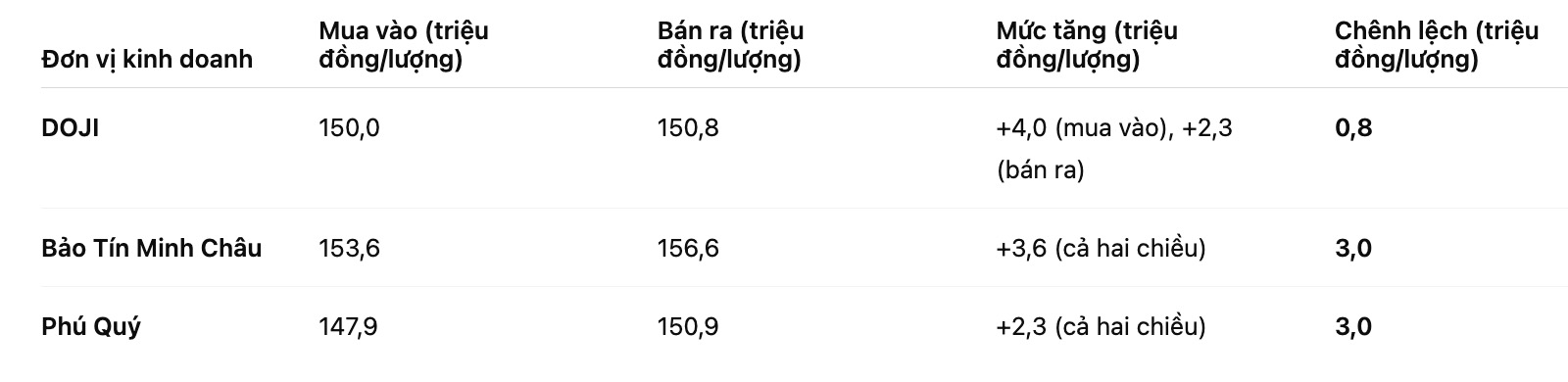

As of 9:45 a.m., DOJI Group listed the price of gold rings at 150-150.8 million VND/tael (buy - sell), an increase of 4 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling is 800,000 VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 153.6-156.6 million VND/tael (buy - sell), an increase of 3.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147.9-150.9 million VND/tael (buy - sell), an increase of 2.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is showing signs of decreasing, but is still basically too high. increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

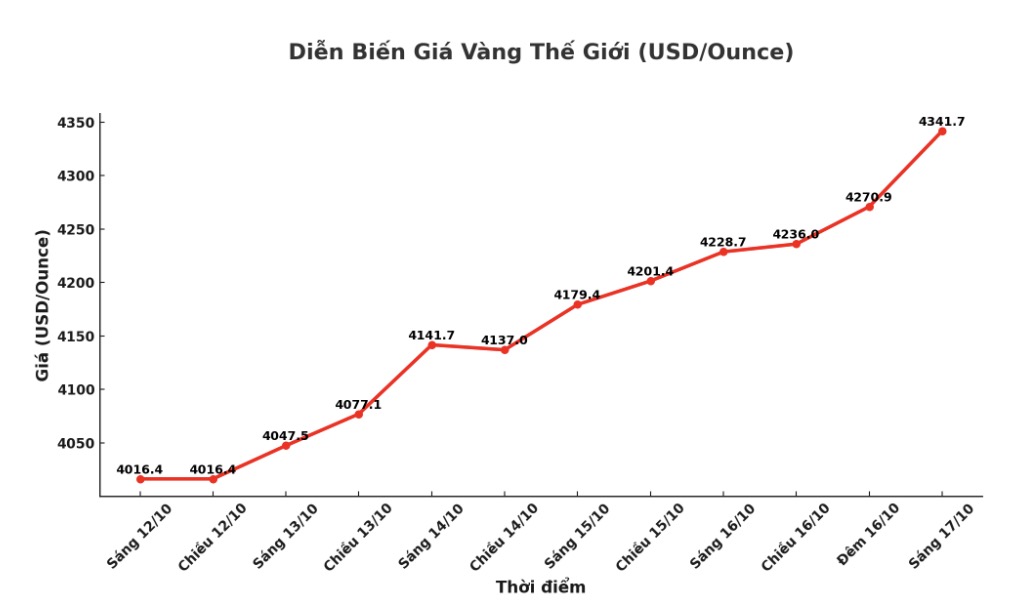

World gold price

At 9:55 a.m., the world gold price was listed around 4,341.7 USD/ounce, up 113 USD.

Gold price forecast

World gold prices increased in the context of US stocks falling sharply in the session of October 17, when financial stocks fell sharply and trade tensions between the US and China escalated, causing investor sentiment to stagnate.

All three of Wall Street's key indicators turned down after increasing at the beginning of the session, in the context of cash flow looking for safe-haven assets, causing gold prices to set new records.

Financial stocks led the decline as Travelers announced disappointing business results, while Zions Bancorp said it would suffer a loss of 50 million USD in the third quarter, causing the S&P (.SPXBK financial index) to decrease by 2.75%.

In the context of a lack of macroeconomic data, results from banks are becoming an alternative source of information, said Mr. Chu Chu Chu Carlson, CEO of Horizon Investment Services ( indiana). Some credit-sensitive banks and financial institutions are falling sharply, which could be a sign of deteriorating credit quality.

In addition, the weakening USD is supporting the precious metal. Mr. Carlson added: The USD is quite weak today, and cryptocurrency is also plummeting. This is a clear "risk-off" day.

In addition, signals from the US labor market are reinforcing expectations that the US Federal Reserve (FED) will continue to cut interest rates, this information is beneficial for gold. Fed Governor Christopher Waller said: Based on all the available data, I think the Fed should cut another 25 basis points at its monetary policy meeting on October 29.

Despite record high gold prices, according to Marcella Chow - Market Strategist at JP Morgan Asset Management, the current supply-demand factors are still very favorable, showing that there is still room for price increase for this precious metal, but investors need to clearly understand why they hold gold.

In an interview with CNBC on Thursday, when asked if gold is still worth buying when the price has surpassed 4,200 USD/ounce, Ms. Chow firmly affirmed: " Yes".

She explained: "If we consider the supply-demand dynamics, we see that the basic factors from the demand side are very positive. The interest rate cutting cycle continues, the weaker USD is the medium- and long-term trend. In addition, continued demand from central banks and consumers in emerging markets, especially China and India. Therefore, on the demand side, fundamental factors are supporting gold prices.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...