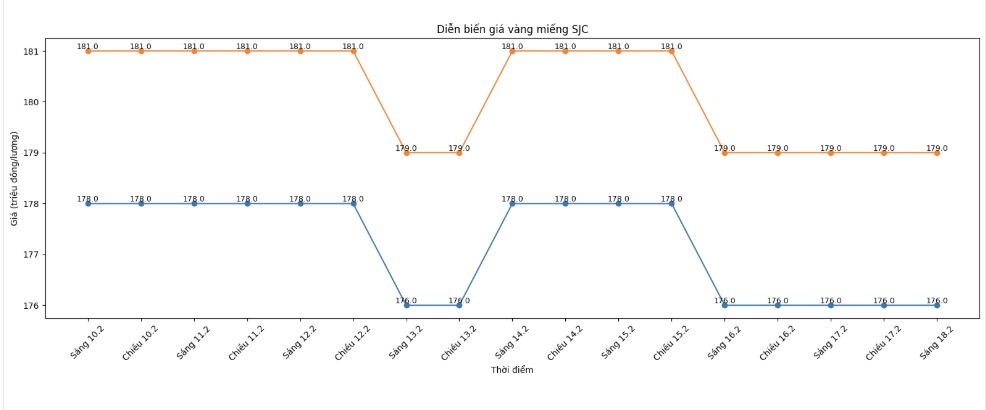

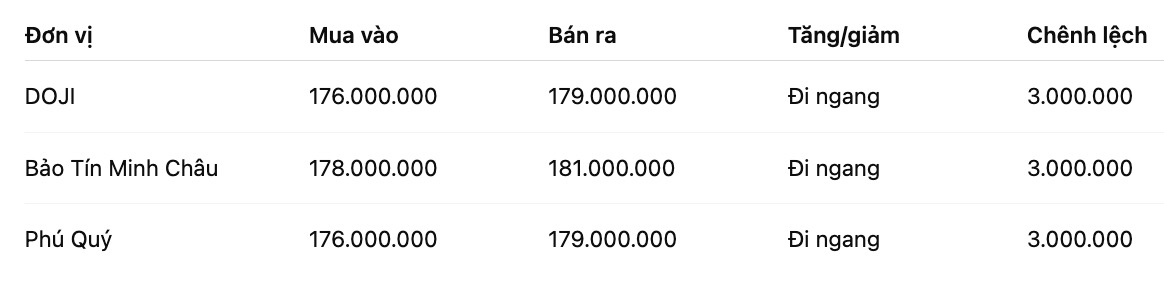

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

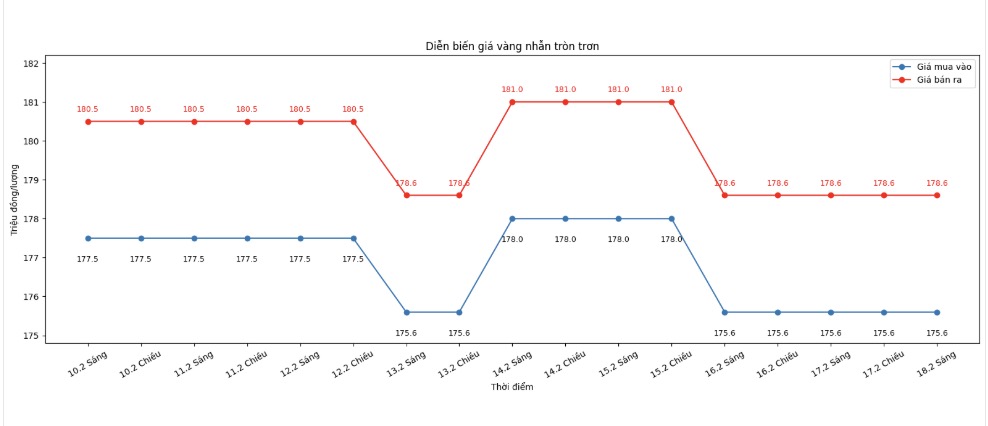

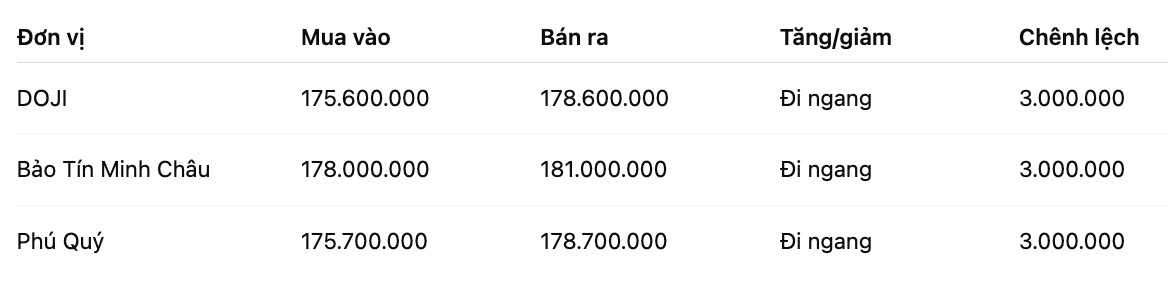

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

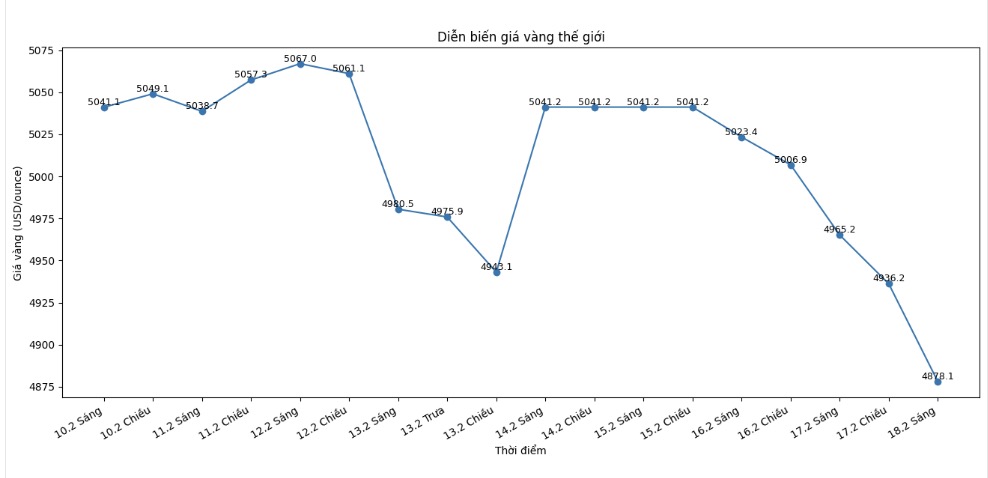

World gold price

At 1:23 am, world gold prices were listed around the threshold of 4,878.1 USD/ounce, down sharply by 178.3 USD/ounce.

Gold price forecast

Gold and silver prices fell sharply as weak buy position clearing activities appeared from short-term futures traders. The upward momentum of the USD index and the downward decline in crude oil prices in today's session also became external factors that disadvantage precious metals right at the beginning of the shortened trading week due to the holiday in the US.

The most recent gold contract for April delivery fell 141.50 USD, to 4,904.1 USD. Silver for March delivery fell 4.174 USD, to 73.66 USD.

Iran and the US have conducted the second round of nuclear talks in Geneva (Switzerland), to find ways to avoid the risk of a recurrence of conflict in the Middle East. This information also puts pressure on safe-haven metal groups, although the possibility of reaching an agreement between the two sides is assessed as still far away.

Technically, buyers on the April gold futures market are holding a certain advantage, with the next goal of bringing the closing price above the strong resistance level of 5,250 USD/ounce. In the opposite direction, sellers expect to pull the price down below the important technical support zone at the bottom of last week, 4,670 USD/ounce.

The nearest resistance levels are determined at 5,000 USD/ounce and the daily peak of 5,074.40 USD/ounce. Meanwhile, the immediate support zone is at 4,900 USD/ounce, followed by 4,800 USD/ounce.

The Wyckoff market rating index reached 6.0 points, showing that the price trend is still slightly in the upward direction, although the buying force is not strong enough to create an overwhelming advantage.

On outside markets, the USD index rose, while crude oil prices weakened, trading around 62.25 USD/barrel. The yield on 10-year US Treasury bonds is currently at around 4.03%, the lowest in 2.5 months.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...