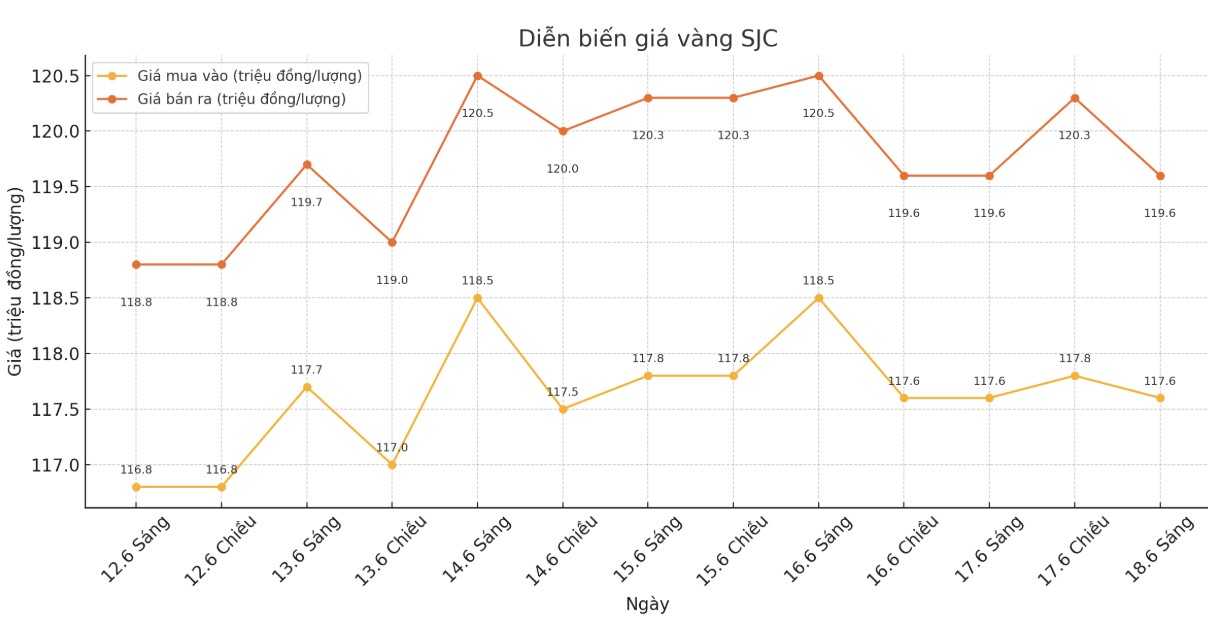

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.6-119 1.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.6-119 1.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.6-119 1.6 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117-119 1.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

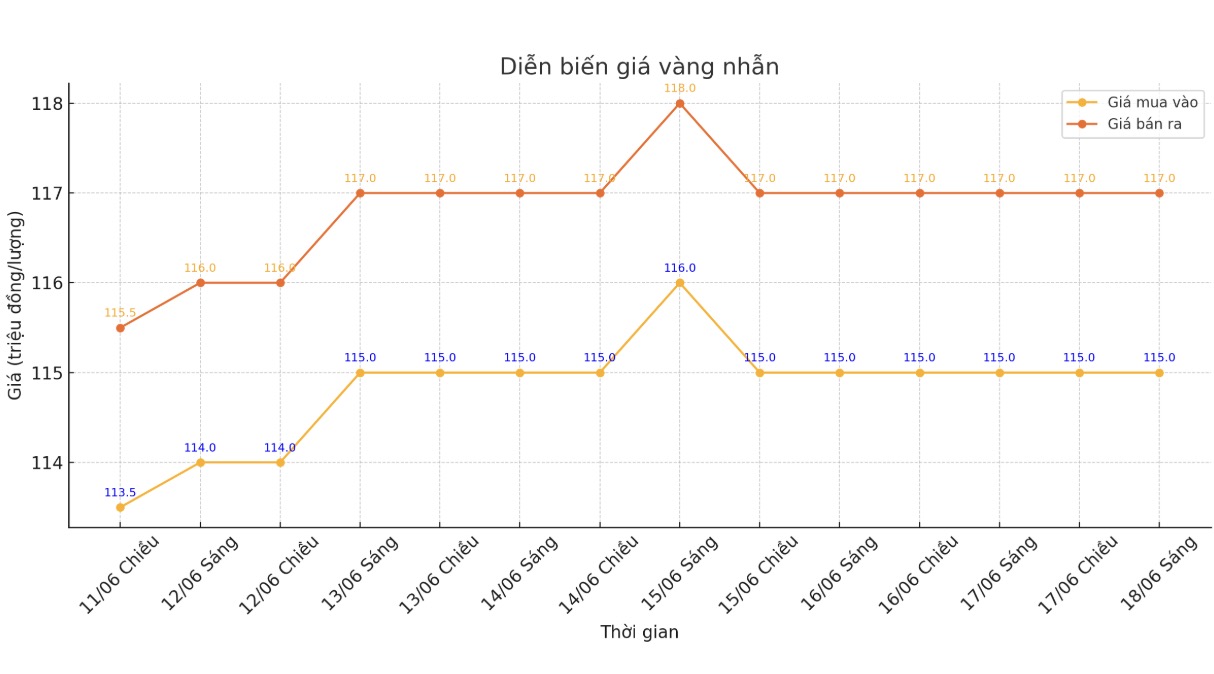

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 115-117 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.8-116.8 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The gap between domestic gold buying and selling prices is currently high, which increases risks for individual investors. Especially for investors who tend to "surf", investing needs to be carefully considered to avoid unnecessary risks.

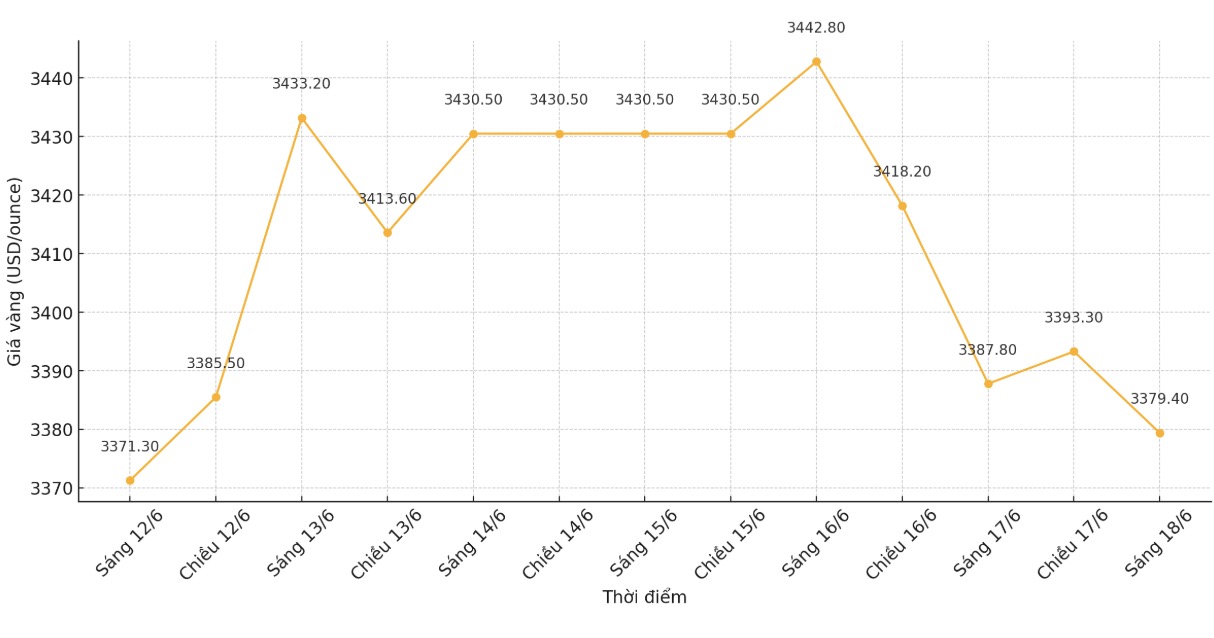

World gold price

At 9:06, the world gold price was listed around 3,379.4 USD/ounce, down 8.4 USD compared to 1 day ago.

Gold price forecast

The gold market continues to fluctuate below the threshold of 3,400 USD/ounce, while tensions in the Middle East are still under control within the region.

Although risk factors still create certain fluctuations in gold prices, many portfolio managers recommend that investors should focus on the global economic picture instead of being caught up in short-term events.

These experts commented that gold still maintains a solid upward trend, continuing to affirm its important role as a monetary asset and a protective barrier against the depreciation of globally stable currencies.

Recently, the World Gold Council published the Central Bank's Gold Survey Report, with 73 responses recorded this year, the highest participation rate since the survey was conducted eight years ago.

Mr. Shaokai Fan - Head of the Global Central Bank Department of WGC - said that about half of global central banks participated in the survey this year.

The survey shows that central banks see the value of holding gold as a global reserve asset, the expert said.

In the report, the WGC said that increasing participation is not just a number; it is a strong signal of interest in gold in the central banking community.

"These responses add depth to our understanding of the role of gold in reserve management," the WGC said.

According to the survey, 95% of central banks participating in the survey expect global gold reserves to increase in the next 12 months. In addition, 43% of central bank reserve managers said they plan to increase their official gold holdings this year, up 29% from the previous survey.

This positive sentiment comes as central banks have purchased more than 3,000 tonnes of gold over the past three years and analysts predict they could add 1,000 tonnes to their reserves this year.

Mr. Fan emphasized that the survey continues to show that demand mainly comes from central banks in emerging markets. He also said that this trend is not surprising, because central banks of developed economies often have more diverse economies to support their currency.

This feeling shows great interest in gold and there is still room for central banks to increase their gold holdings, said Mr. Fan.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...