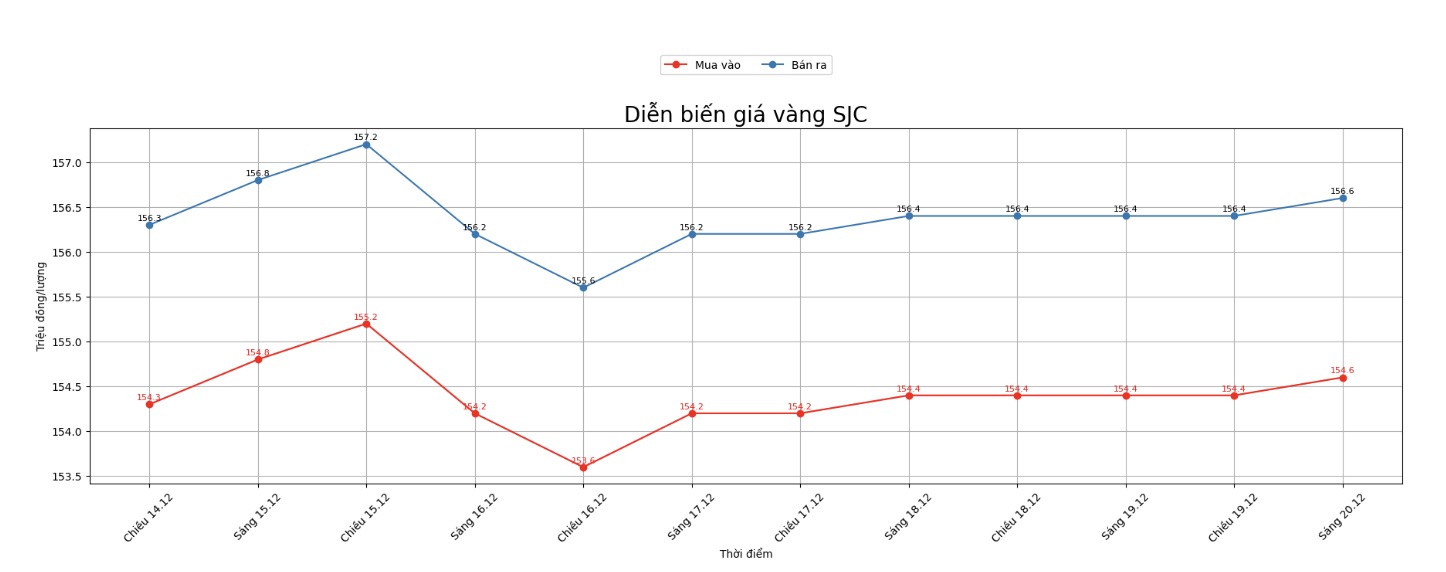

Updated SJC gold price

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at VND154.6-156.6 million/tael (buy in - sell out), an increase of VND200,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.6-156.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.6-156.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

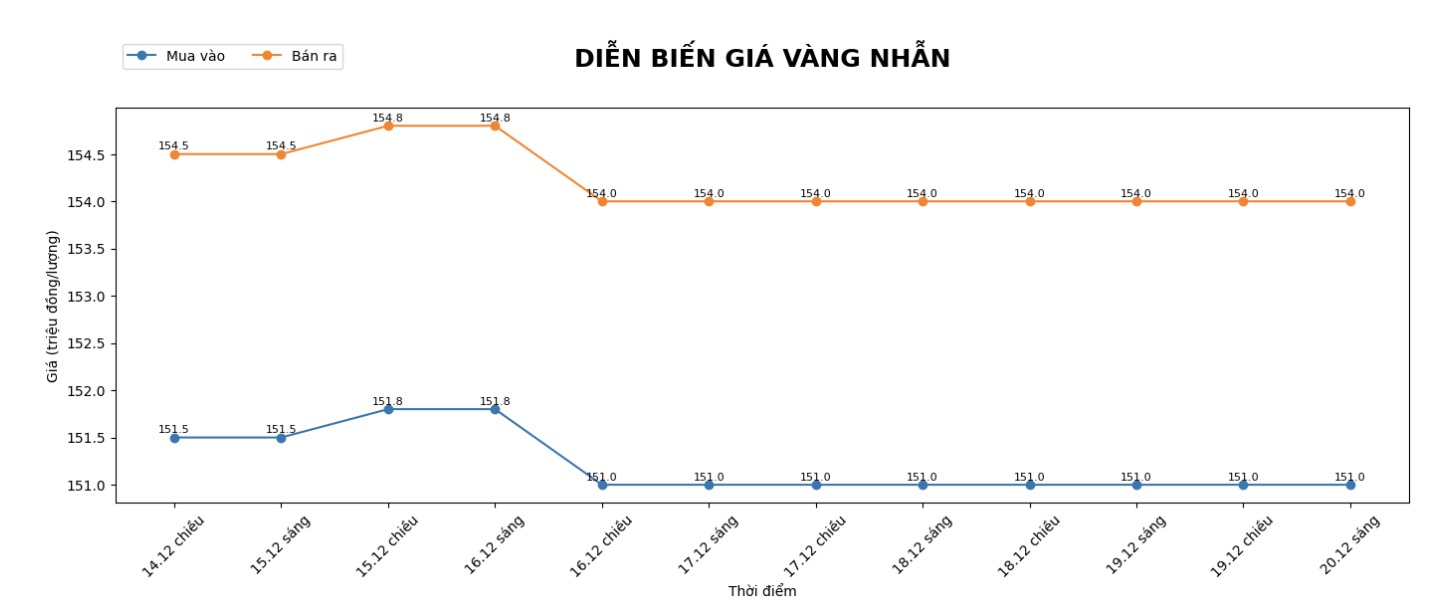

9999 round gold ring price

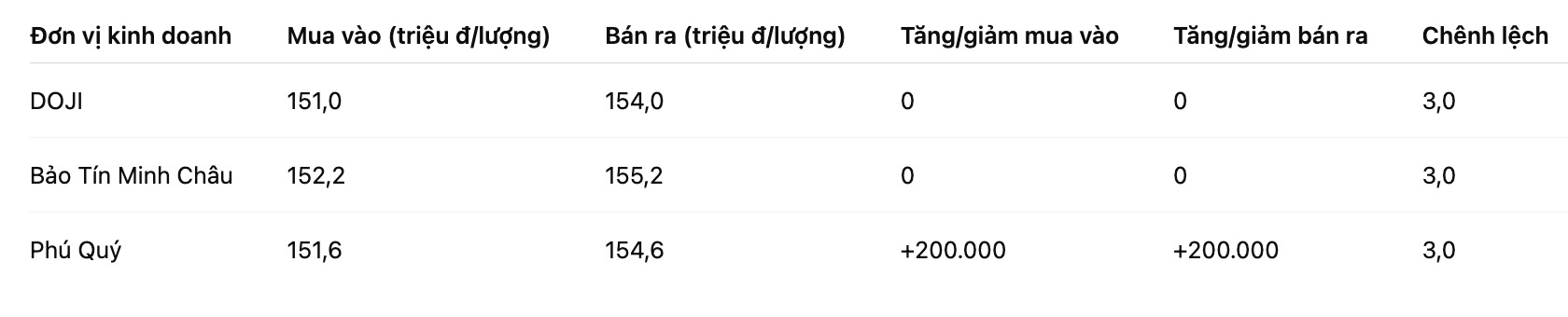

As of 9:10 a.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.6-154.6 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

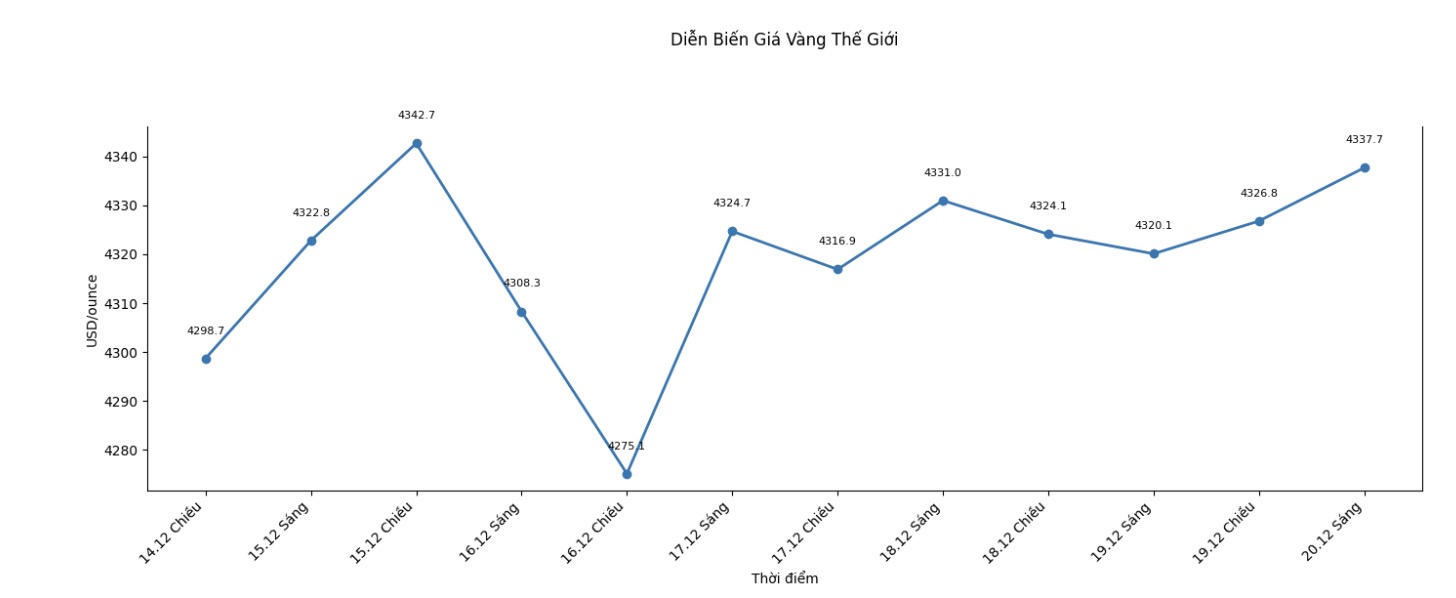

World gold price

At 9:12 a.m., the world gold price was listed around 4,337.7 USD/ounce, up 17.6 USD compared to a day ago.

Gold price forecast

Spot gold prices soared to $4,343 an ounce after the US Consumer Confidence Index fell to 52.9, expecting inflation to cool down.

The precious metal is under pressure from a stronger US dollar and investor position adjustments at the end of the year. Despite the pressure, gold prices are still expected to record an increase this week, thanks to cooling US inflation data, thereby strengthening expectations that the US Federal Reserve (Fed) will cut interest rates.

The US dollar has risen to its highest level in more than a week, making USD-denominated gold bars more expensive for holders of other currencies.

"Gold prices are under some slight pressure today, perhaps due to year-end price adjustment and general stagnation before the holidays," said Zain Vawda - analyst at MarketPulse by OANDA. Mr. Vawda added that recent US economic data has been somewhat weaker, helping to strengthen the prospect of interest rate cuts next year.

Goldman Sachs forecasts gold prices to increase by 14% to $4,900/ounce by December 2026 in its base scenario, thanks to high demand from central banks and cyclical support from the Fed's interest rate cuts.

Meanwhile, Morgan Stanley forecasts gold prices to reach $4,500/ounce by mid-2026, while JP Morgan expects gold prices to average more than $4,600 in the second quarter and more than $5,000 in the fourth quarter of 2026. Sharing the same view, Metals Focus forecasts gold prices to reach $5,000 by the end of 2026.

Technically, the next bulls' bullish price target for February gold futures is to create a close session that surpasses the strong resistance zone at a record high of $4,433/ounce.

On the other hand, the bears' next short-term bearish target is to push the futures price below the solid technical support zone at 4,200 USD/ounce.

The first resistance level recorded at the peak of this week was 4,409.5 USD/ounce, then 4,433 USD/ounce.

The first support level was at the bottom of last night's session at 4,336.3 USD/ounce, followed by the bottom of this week at 4,297.4 USD/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...