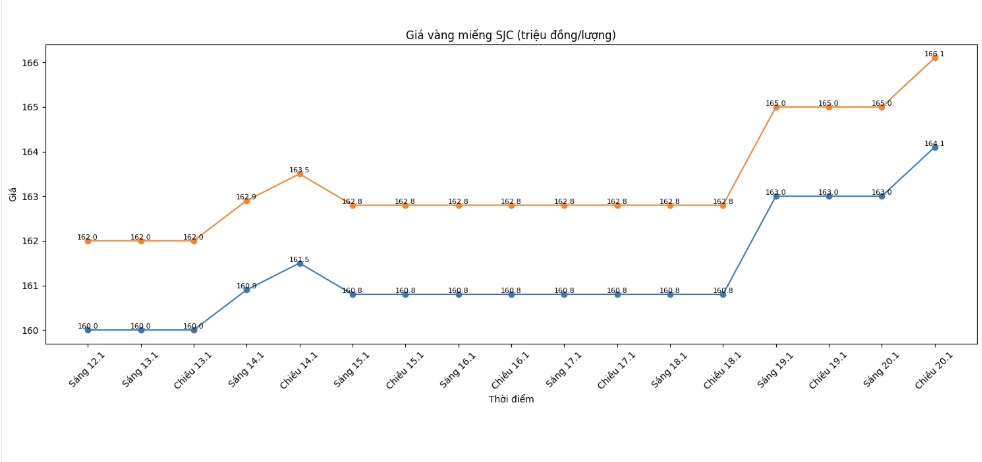

SJC gold bar price

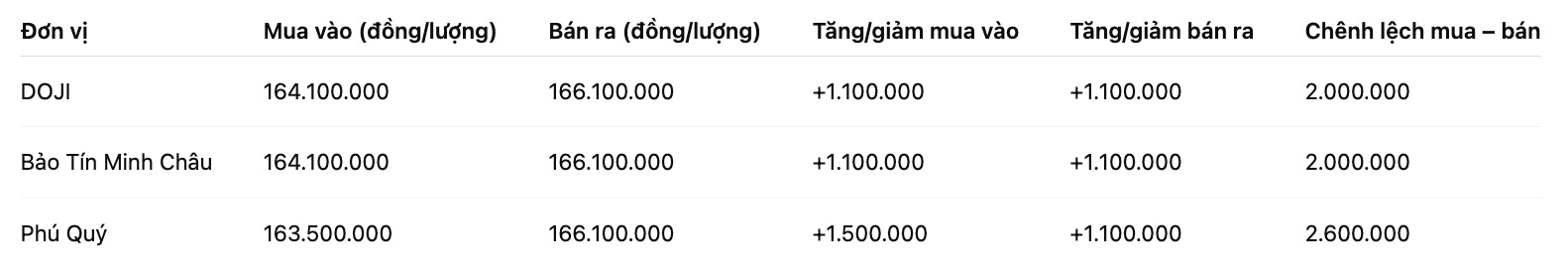

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 164.1-166.1 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 164.1-166.1 million VND/tael (buying - selling), an increase of 1.1 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 163.5-166.1 million VND/tael (buying - selling), an increase of 1.5 million VND/tael on the buying side and an increase of 1.1 million VND/tael on the selling side. The difference between buying and selling prices is at 2.6 million VND/tael.

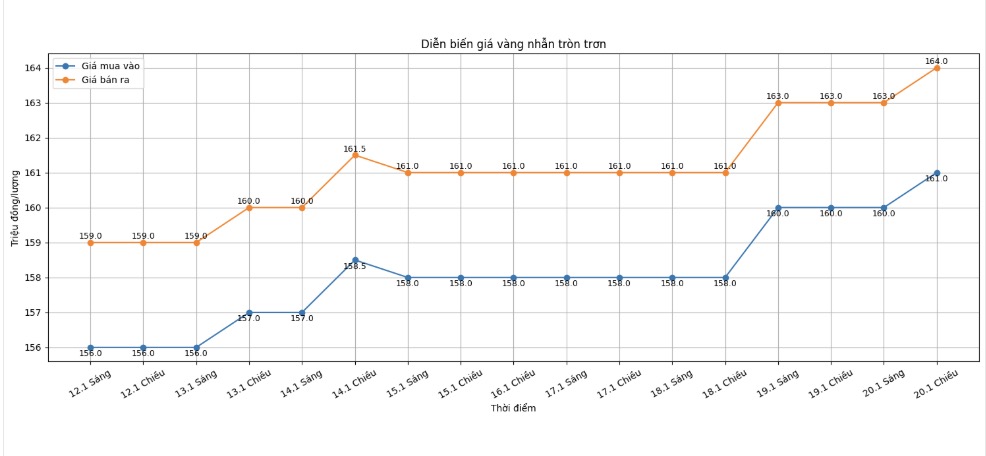

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 161-164 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 163.1-166.1 million VND/tael (buying - selling), an increase of 1.6 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 161.5-164.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

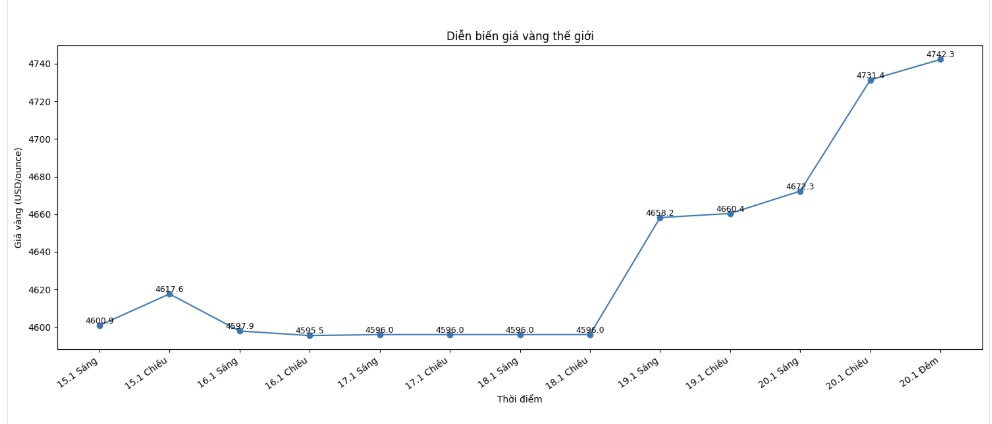

World gold price

At 11:45 PM on January 20, world gold prices were listed around the threshold of 4,742.3 USD/ounce, a sharp increase of 71.6 USD compared to the previous day.

Gold price forecast

Gold and silver markets increased sharply in the last night's session, simultaneously setting new record highs, in the context of increasing risk avoidance sentiment in the global financial market.

International financial markets are in a sensitive state as tensions between the US and Europe increase, causing global stocks to fall in the first days of the week, while gold continues to attract safe-haven cash flow and set new peaks.

Trade and policy developments between the US and some European countries have increased concerns about risks, making investor sentiment more cautious. Strong statements and the possibility of new tax imposition are believed to potentially increase volatility in the international financial market.

According to Bloomberg, the risk of reciprocal trade remedies is causing investors to worry about the possibility of a recurrence of strong fluctuations that occurred before. This is happening in the context that the market is both supported by stable corporate profits and large capital flows into the field of artificial intelligence (AI).

Market prospects in the coming time will depend heavily on the reaction of the European Union, including the possibility of considering reciprocal trade measures for US goods, with a scale of up to tens of billions of euros.

The volatile Japanese bond market is spreading to global debt markets, pushing US bond yields to their highest level in more than 4 months. US 30-year bond yields rose 9 basis points to 4.93%, while 10-year terms rose 7 basis points to 4.287%.

According to Bloomberg, concerns about Japan's fiscal prospects have caused the country's long-term bond yields to soar, putting pressure on the long-term bond market globally, including Europe and the US.

In another development, the Chinese economy continued to lose momentum in the latest quarter, despite still achieving the full-year growth target. According to Bloomberg, industrial production remained stable in December, but consumption and investment weakened more strongly than forecast.

China's gross domestic product (GDP) in the past quarter increased by 4.5% compared to the same period last year, the lowest level since the country reopened after the pandemic. For the whole year, GDP increased by 5%, in line with the set target.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...