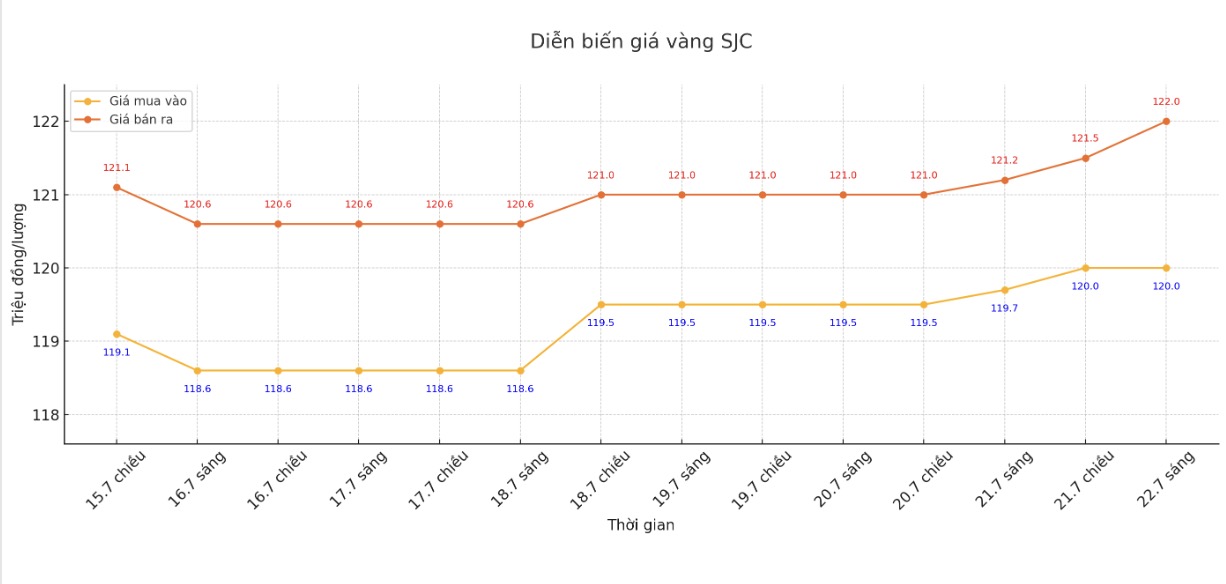

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND 120-122 million/tael (buy - sell), an increase of VND 300,000/tael for buying and an increase of VND 800,000/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-121.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 119.5-122.2 million/tael (buy - sell), an increase of VND 700,000/tael for buying and an increase of VND 1.2 million/tael for selling. The difference between buying and selling prices is at 2.7 million VND/tael.

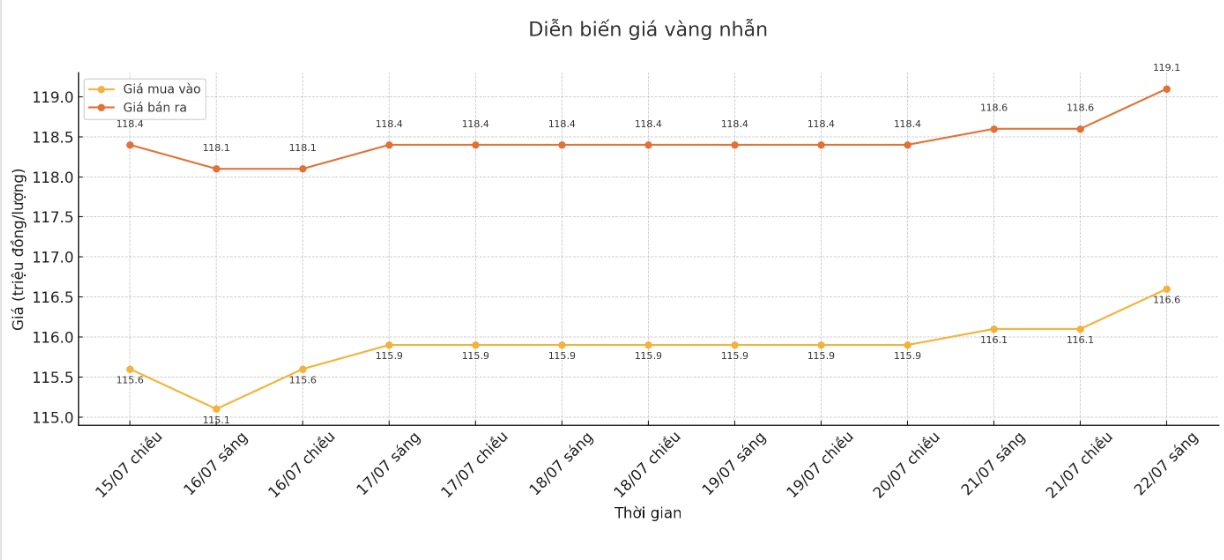

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 116.6-119.1 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.19.3 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

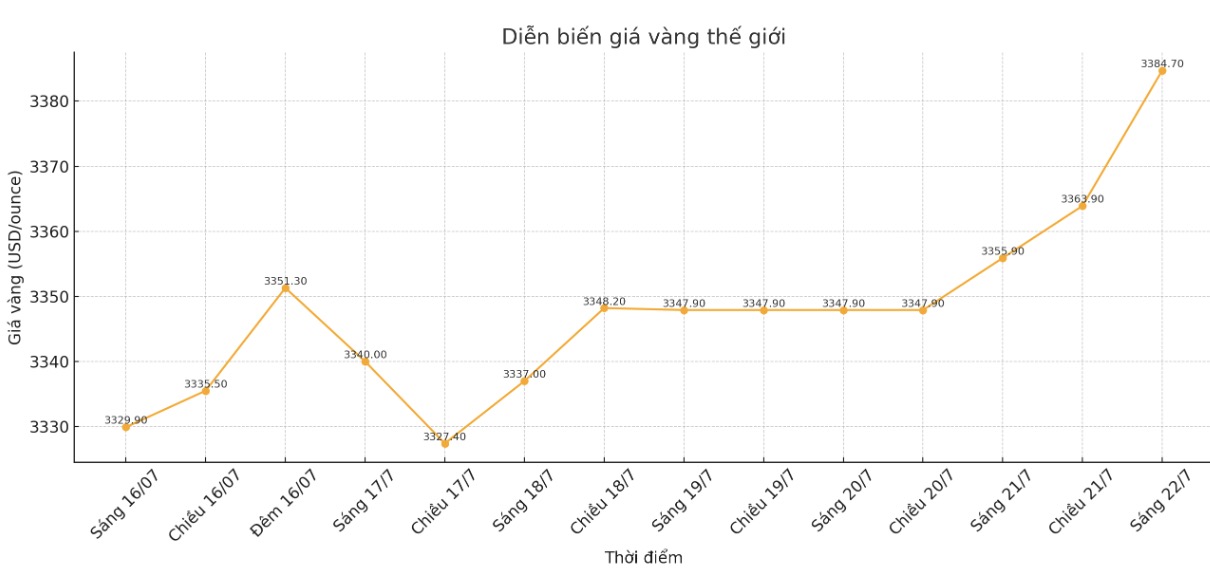

World gold price

At 9:00 a.m., the world gold price was listed around 3,384.7 USD/ounce, up 28.8 USD/ounce.

Gold price forecast

The combination of a weak US dollar and falling bond yields has created an ideal environment for gold, an asset that is often more favored when investment yields fall.

Security shelter demand has increased as trade tensions between the US and major partners have escalated, increasing market uncertainty.

A recent speech by US Secretary of Commerce Howard Lutnick has further accelerated trade talks. Although optimistic about the possibility of reaching an agreement with the European Union, Mr. Lutnick emphasized that the deadline of August 1 is a "hard deadline" for negotiations.

He also affirmed that the basic tax rate of 10% will be maintained throughout the negotiation process, showing the government's steadfastness in the current trade policy framework.

Previously, US President Donald Trump officially informed trading partners about specific tariffs that would be applied if negotiations failed.

In response, the European Union has prepared response measures, in the context of the increasingly fragile possibility of reaching a mutually beneficial deal.

In addition, expectations for monetary policy continue to fluctuate. Traders are now pricing in a 60% chance that the Federal Reserve will cut interest rates in September, reflecting growing speculation about the central bank's ability to change leadership and restructure.

This puppet view also contributes to the weakening of the US dollar and falling bond yields, thereby supporting gold prices.

According to analysts at CPM Group, gold prices are expected to continue to increase, with the target of reaching 3,425 USD/ounce from now until mid-August. The buy recommendation was made on July 10, when gold prices were around $3,328.5 an ounce. Just one day later, prices quickly surpassed $3,375 and hit $3,381.6 on July 11.

In the next six trading sessions, gold prices fluctuated in the range of 3,326.1 - 3,389.3 USD/ounce. CPM Group believes that prices will continue to anchor around the 3,320 - 3,400 USD area in the next few days, before being able to surpass 3,400 USD and approach the set target.

Meanwhile, the World Gold Council (WGC) believes that gold prices could reach $4,000/ounce by the end of this year if geopolitical risks and economic fluctuations continue to increase. However, the WGC also notes that annual growth could be just a single digital threshold, depending on many macro factors.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...