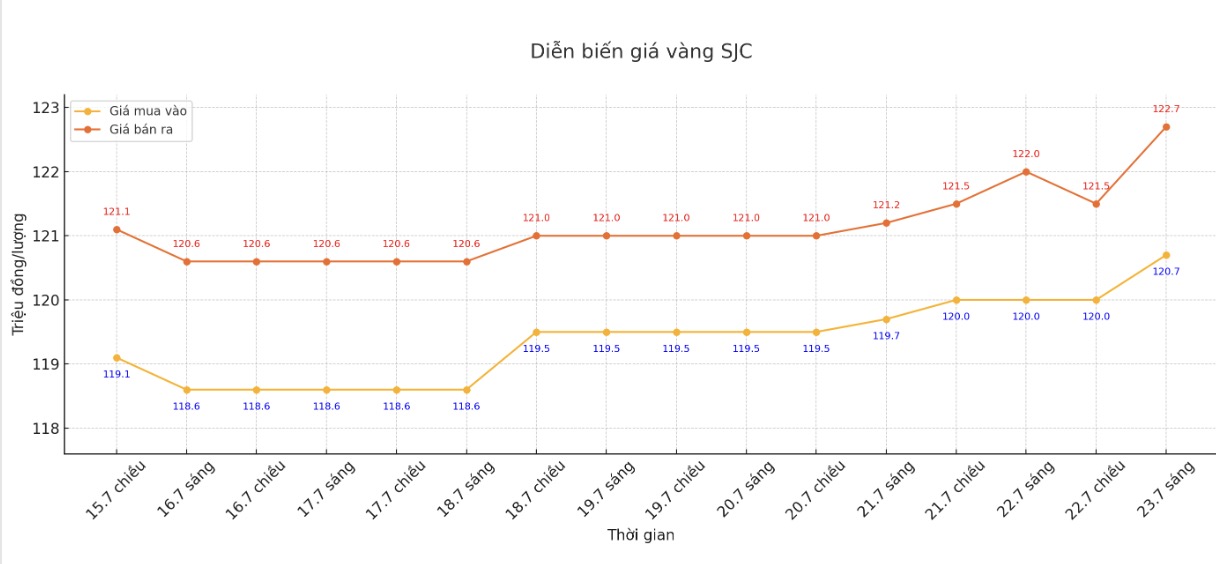

Updated SJC gold price

As of 9:25, the price of SJC gold bars was listed by DOJI Group at VND 120.7-122.7 million/tael (buy in - sell out), an increase of VND 700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.7-122.7 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 120.2-122.7 million VND/tael (buy - sell), an increase of 700,000 VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

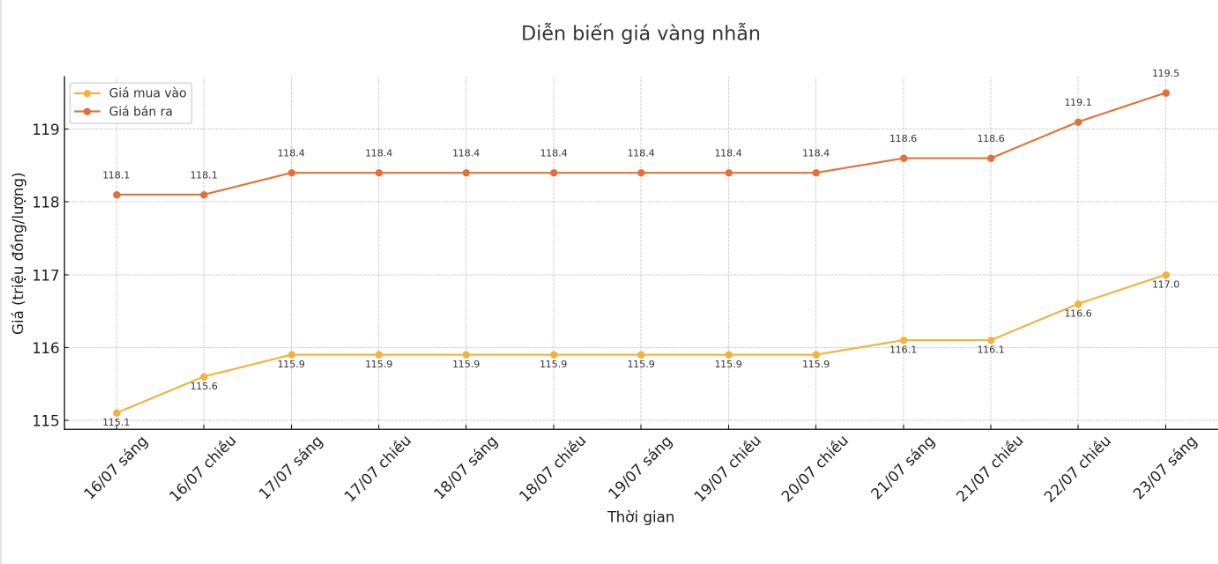

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 117-119.5 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

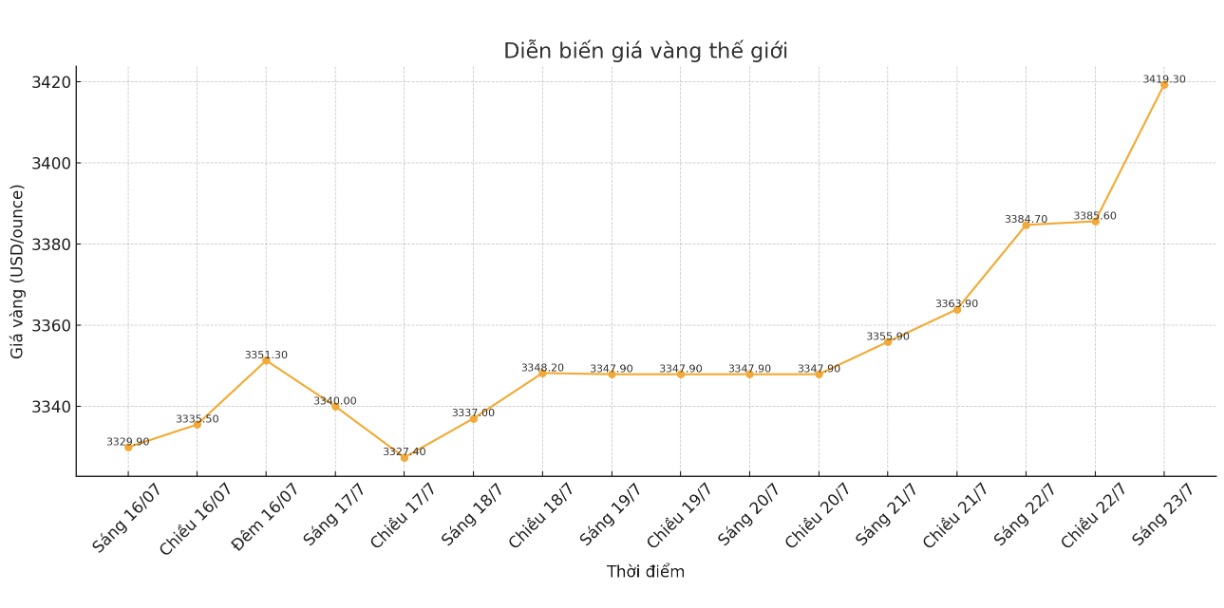

World gold price

At 9:30 a.m., the world gold price was listed around 3,419.3 USD/ounce, up 34.6 USD/ounce.

Gold price forecast

World gold prices skyrocketed to a 5-week peak due to the weakening of the USD and decreasing US Treasury bond yields. At the same time, silver prices also increased slightly and reached their highest level in 14 years.

In addition to macro factors, technical buying activities also contribute to supporting the gold and silver markets, as the chart trend of both precious metals is clearly leaning towards price increases.

The USD is currently losing its upward momentum. Although last week the USD Index reached a three-week high and recovered well from the bottom in early July, currency options trading showed that the greenback trend may continue to weaken in August.

Mr. Peter Kinsella - Director of currency strategy at Union Bancaire Privee (Ubp SA) - commented: "We may see a weaker USD" and that "the USD may not have hit bottom yet".

Previously, expert James Stanley from Forex said that spot gold prices could surpass the threshold of 3,400 USD/ounce and if successful, this would be a signal confirming the uptrend.

Central bank purchases along with safe-haven demand continue to support gold prices. Investors still see gold as a tool to diversify their portfolios in the context of rising geopolitical tensions and trade policy uncertainty.

Trade policy developments are currently a major catalyst for market sentiment. US President Donald Trump has said he will impose tariffs on most of his trading partners if they do not reach an agreement before August 1, creating a major wave of unrest in global trade.

The proposed 30% tax rate on imports from the European Union has prompted the EU to consider response measures, raising concerns about a large-scale trade war that could seriously affect the global economy.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...