Updated SJC gold price

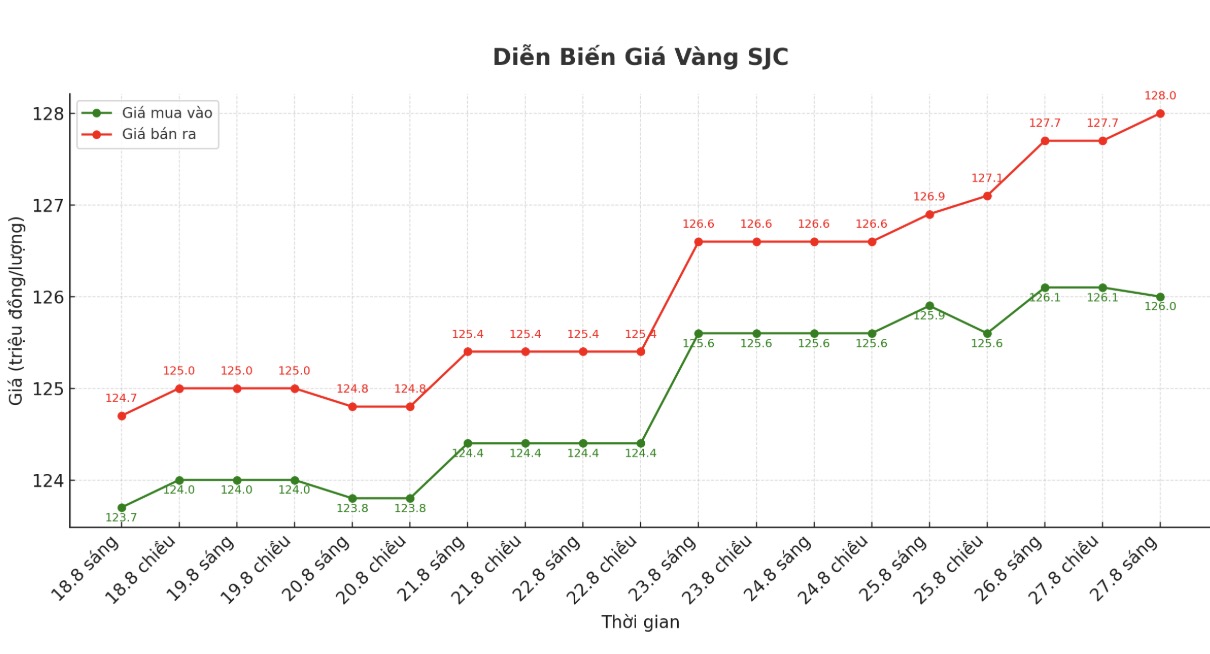

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 126-128 million VND/tael (buy - sell), down 100,000 VND/tael for buying and up 300,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 125.8-128 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and an increase of 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 125.4-128 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 119.6-122.6 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 119.8-122.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 119.5-122.5 million VND/tael (buy in - sell out), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Domestic gold prices continue to increase despite the news of abolishing the State's monopoly mechanism for the production of gold bars, exporting raw gold and importing raw gold to produce gold bars. This could reduce the gap between domestic and world gold as supply increases.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

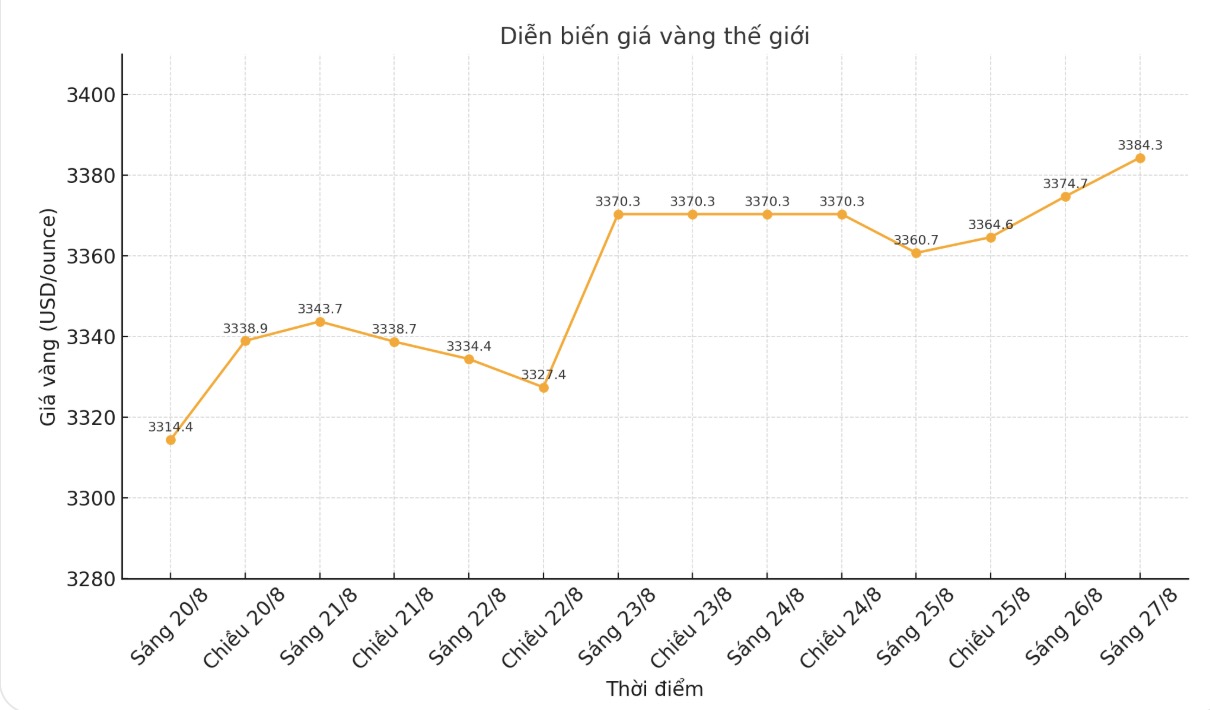

At 9:15 a.m., the world gold price was listed around 3,384.3 USD/ounce, up 9.6 USD compared to a day ago.

Gold price forecast

On Monday evening ( EDT), US President Donald Trump announced that he would fire US Federal Reserve Governor Lisa Cook, a move considered the most serious attack on central bank independence, while also stirring up the market and politics and pushing gold prices up sharply.

Mr. Trump posted a " dismissal letter" on the Truth Social platform, accusing Ms. Cook of giving false information in two mortgage loan applications in 2021, before she was appointed to the Fed.

With her dishonest behavior and the potential for financial crimes, the American people cannot trust her integrity, and so can I. Trump wrote.

The above information shocked the financial market, gold prices broke 3,390 USD/ounce.

This week, the market focused on closely monitoring the US Personal Consumption Price Index (PCE) report to be released on August 29.

As a measure of the Fed's inflation, this Personal Price Index data will be an important clue for investors to predict the Fed's interest rate cut plan.

Regarding the world gold price trend, gold is still the leading safe haven in the current context. The prospect of the FED reversing policy soon will weaken the USD, creating momentum for the world gold market. In addition, rising geopolitical uncertainties globally have also led investors to seek gold as a safe haven for asset protection.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...