Gold prices fell sharply after the US and China were close to a major trade deal over the weekend. Increased risk-off sentiment has prompted the global stock market to bounce strongly, with US stock indexes forecast to open at a new record level.

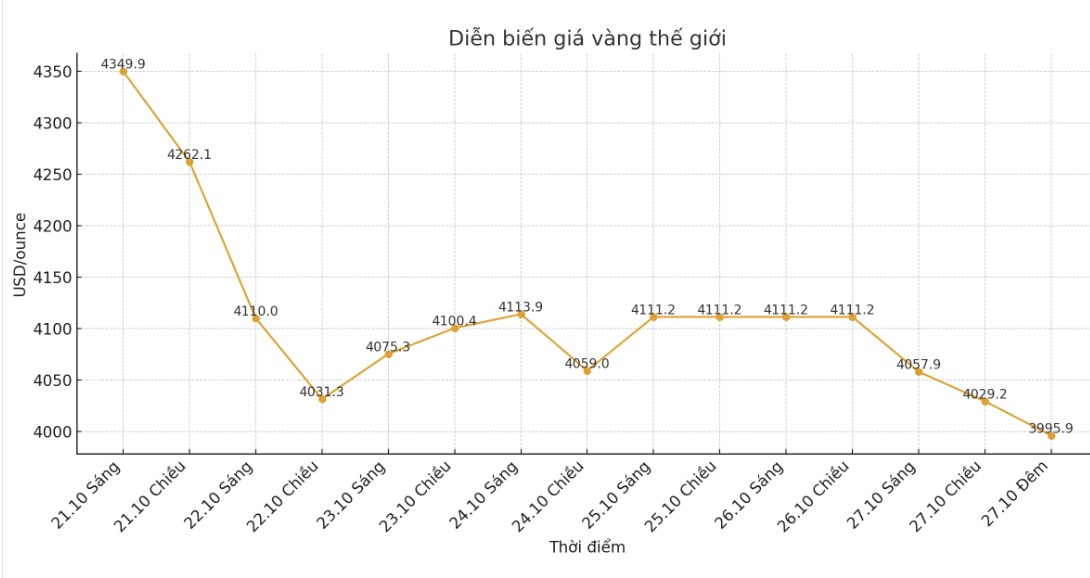

December gold contract fell 100.4 USD to 4,037.2 USD/ounce; December silver contract fell 1.356 USD to 47.22 USD/ounce.

According to Bloomberg, the cost of borrowing money in London has cooled down from a recent record, showing improved liquidity in the silver market. Silver rental interest rates fell to 5.6% on October 9, after soaring to an unprecedented 34%.

The London Gold Market Association (LBMA) is considering weekly issuance of Treasury inventory data and prioritizing transparency with white metals over gold, according to CEO Crow Ruthell.

Notably, the heads of the China-US negotiation delegations last weekend said they had reached consensus on many key issues, paving the way for the leaders of the two countries to sign an agreement at this weekend's meeting.

US Treasury Secretary Bessent told CBS News that the risk of a 100% tax on Chinese goods is seen as being lifted, while Beijing plans to increase soybean purchases and expand control of rare earths.

He said a broader deal could extend the tariff war, address TikTok and maintain a rare earth magnet supply chain.

The leaders of the two countries are also expected to discuss a global peace plan, after Mr. Trump publicly expressed his hope that China will help resolve the Russia-Ukraine conflict. They want a deal and so do we, Trump said. This positive sentiment has pushed up global stock prices and put safe-haven assets such as gold and silver under strong selling pressure.

President Trump also said the US is getting closer to a series of trade deals with Southeast Asian countries such as Thailand, Cambodia, Malaysia, etc. The deals aim to increase access to strategic minerals and the US agricultural market, while exempting some export tariffs, which could be implemented in the next few weeks.

In another development, the US Federal Reserve (FED) plans to cut interest rates by another 0.25 percentage points at its meeting this Wednesday to support the labor market. However, the Fed is divided internally as some members are concerned about the risk of inflation.

Data released at the end of the week showed that US consumer inflation increased the slowest in three months in September, strengthening the possibility of the Fed taking action.

Finance Minister Bessent confirmed the list of 5 candidates to replace Chairman Jerome Powell, including Christopher Waller, Michelle Bowman, Kevin Warsh, Kevin Hassett and Rick Rieder. Mr. Trump is expected to choose before the end of this year.

Meanwhile, the US government's fourth week of closure has begun to put great pressure on the aviation industry as it lacks air traffic control personnel. Transport Minister Sean Duffy warned that the situation of flight delays and cancellations will spread in the coming days as many unpaid employees are forced to quit or find other jobs. Observers say both parties are concerned about backlash from voters, which could prompt a yield to reopen the government.

Technically, December gold buyers still have a short-term advantage but the increase has weakened significantly. The target for buyers is to close above the strong resistance zone of 4,200 USD/ounce, while the target for sellers is to push prices below the important support of 3,900 USD/ounce.

The most recent resistance level was 4,100 USD/ounce and 4,123.80 USD/ounce; the most recent support: 4,021.1 USD/ounce and 4,000 USD/ounce.

In other markets, the USD index decreased slightly; WTI oil prices retreated to around 61.28 USD/barrel; the yield on the 10-year US Treasury note remained at about 4.028%.

See more news related to gold prices HERE...