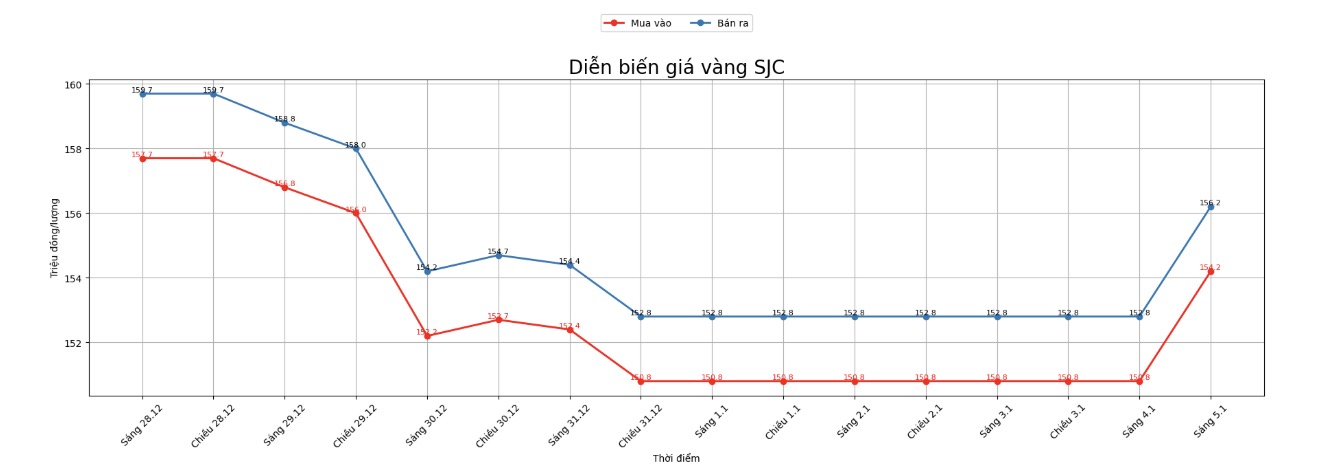

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 154.2-156.2 million VND/tael (buying - selling), a sharp increase of 3.4 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 154.2-156.2 million VND/tael (buying - selling), increasing sharply by 3.4 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 153.7-116.2 million VND/tael (buying - selling), an increase of 2.9 million VND/tael on the buying side and an increase of 3.4 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

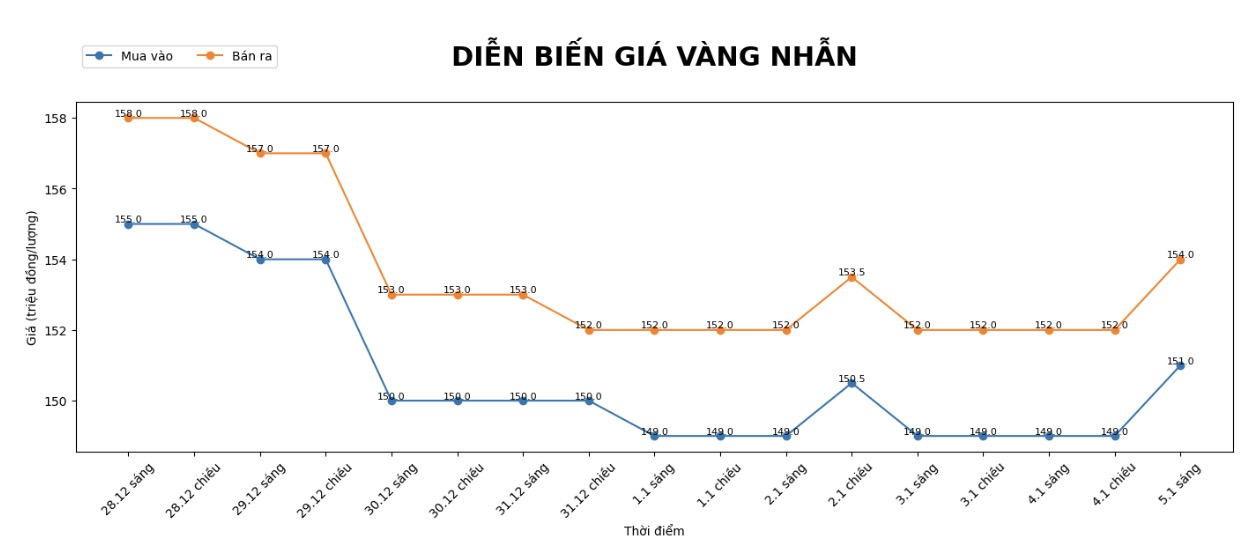

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at the threshold of 151-154 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 153.7-156.7 million VND/tael (buying - selling), an increase of 1.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 151-154 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

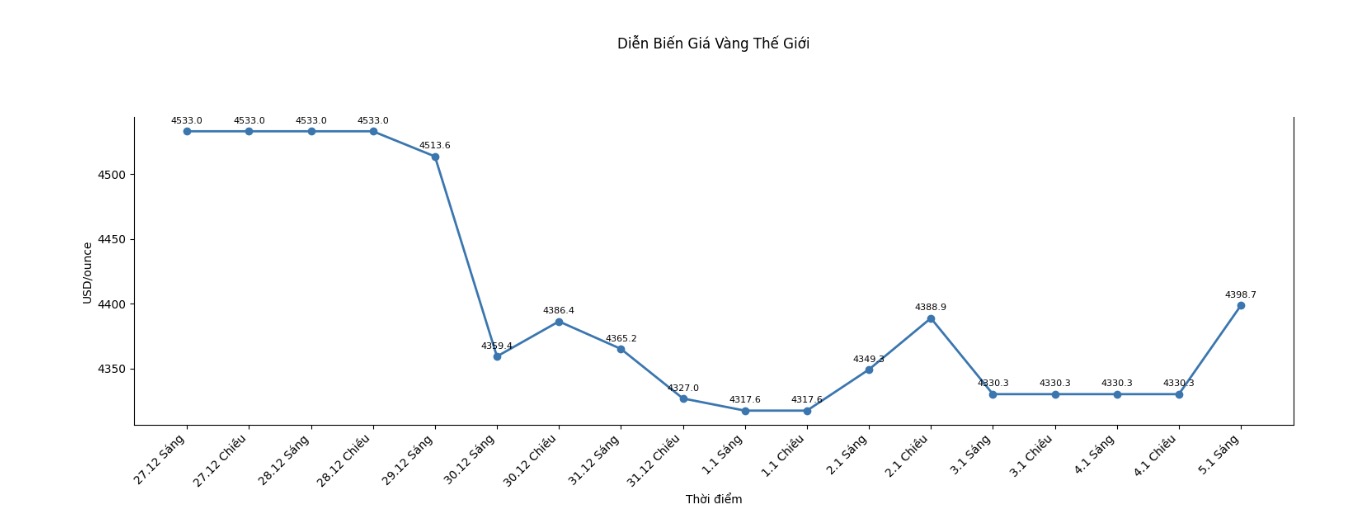

World gold price

At 9:00 AM, world gold prices were listed around the threshold of 4,398.7 USD/ounce, up 68.4 USD compared to the previous day.

Gold price forecast

Gold prices soared amid the market facing a new wave of geopolitical risks after the US arrested Venezuelan President Nicolas Maduro.

At 4:21 am on January 3 (local time), US President Donald Trump posted on Truth Social that the US had carried out an operation to arrest Venezuelan President Nicolas Maduro and his wife.

This is one of the most complex US operations in recent times and has been carefully prepared for months.

According to Reuters, the above move could pave the way for exploiting the giant oil source of this South American nation.

US President Donald Trump announced that Washington will take over this oil-producing nation. Meanwhile, Mr. Maduro has been detained at a detention center in New York since Sunday pending prosecution. This is the first time the US has conducted such a direct intervention in Latin America since 1989.

Speaking at a press conference on Saturday, President Trump said the US would "run this country until it can carry out a safe, appropriate and cautious transition process." He did not provide much details, but emphasized that the possibility of deploying US troops is not ruled out.

These developments show that geopolitical tensions are still dominating news headlines and have a strong impact on the market," said Marchel Alexandrovich - economist at Saltmarsh Economics - "It is clear that the market is facing significantly higher levels of risk from news than previous US administrations.

After this information, gold-silver prices and some precious metals surged strongly. US stock futures and Asian stock markets simultaneously increased in the first session of Asian time on Monday.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...