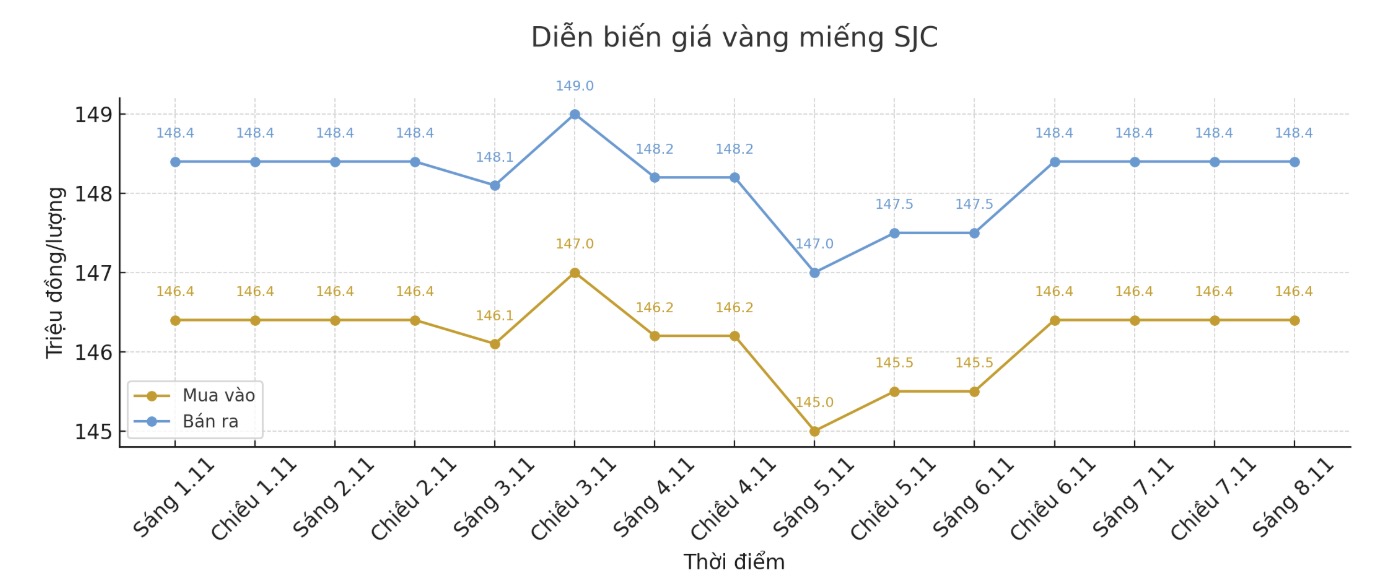

Updated SJC gold price

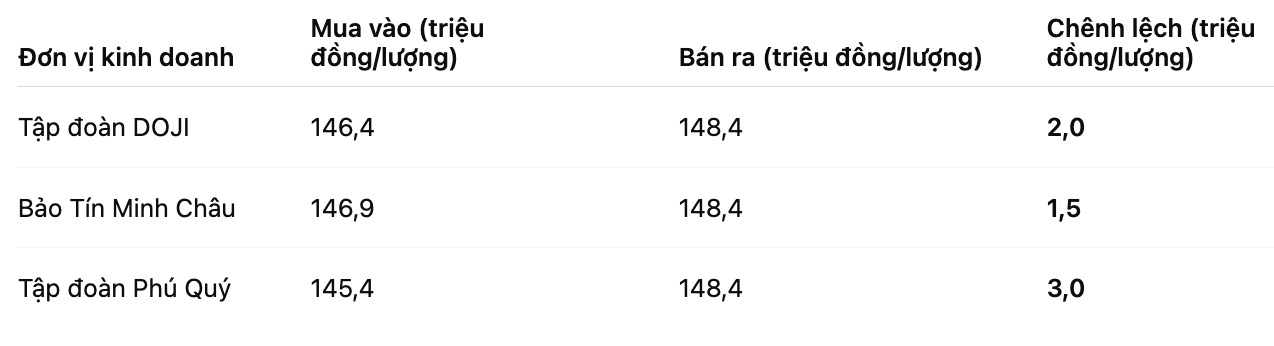

As of 10:00, the price of SJC gold bars was listed by DOJI Group at 146.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

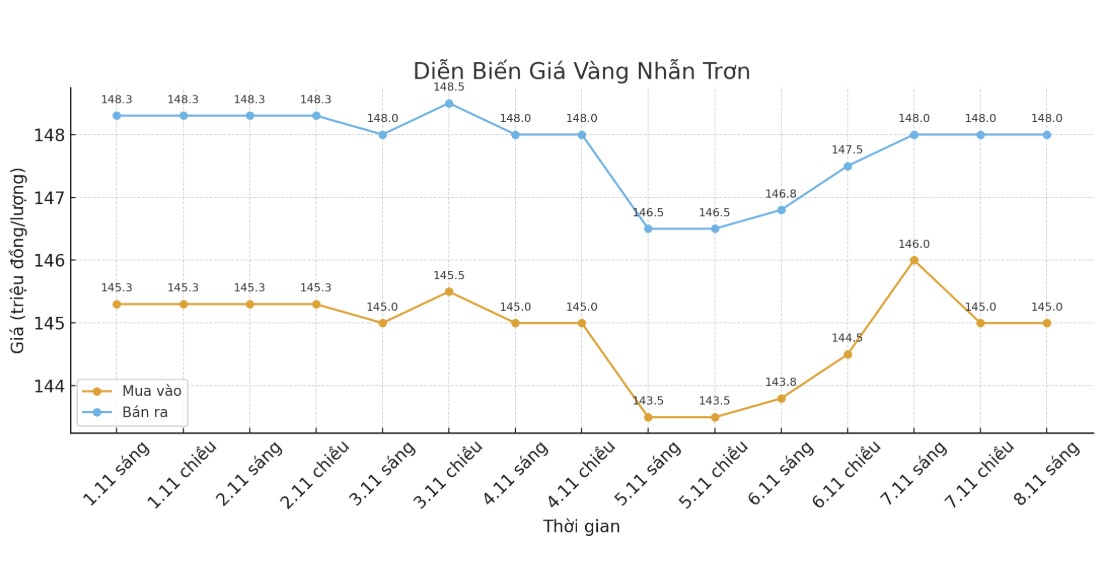

9999 round gold ring price

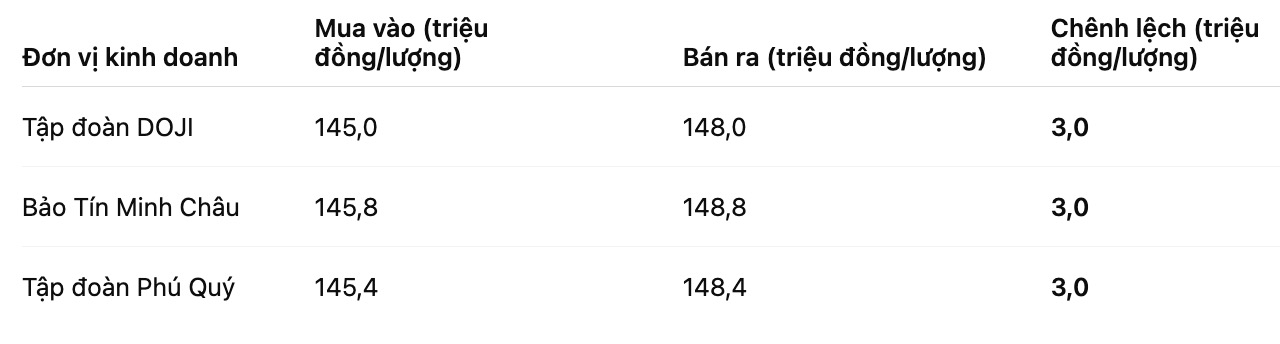

As of 10:00, DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

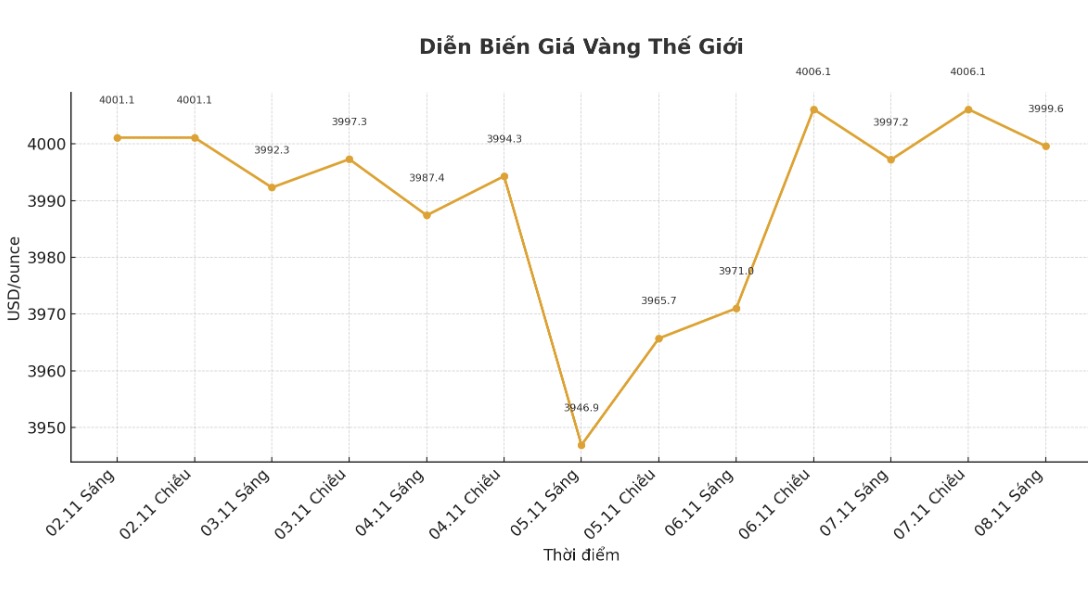

World gold price

At 10:05, the world gold price was listed around 3,999.6 USD/ounce, up 2.4 USD compared to a day ago.

Gold price forecast

World gold prices received support as the USD weakened after the US private sector employment report showed signs of slowing down in the labor market, thereby raising expectations for another interest rate cut by the US Federal Reserve (FED). In addition, the risk of a prolonged US government shutdown has also boosted demand for safe-haven assets such as gold.

According to data released on Thursday, the US economy lost jobs in October, mainly in the government and retail sectors, while cost cuts and the application of artificial intelligence (AI) in businesses caused the number of announced fires to increase sharply.

Private employment data shows the possibility of the Fed cutting interest rates in December, which is why gold prices are receiving support, said Soni Kumari, commodity strategist at ANZ Bank.

The US dollar depreciated, leading the decline of other major currencies, as investors in the context of a lack of official data on the US labor market have grasped weakness signals from private sector surveys.

A weak job market is often seen as a signal to strengthen the possibility of interest rate cuts. According to CME's FEDWatch tool, investors now have a 67% probability of the Fed cutting interest rates in December, up from about 60% in the previous session. The Fed cut rates last week, and Chairman Jerome Powell hinted that this could be the last rate cut this year.

Currently, the focus of the market is macroeconomic indicators and the end of the US government shutdown crisis, which is continuing to boost safe-haven demand for gold, added Soni Kumari.

Currently, major banks in the world are still optimistic, simultaneously forecasting a notable milestone of gold prices in 2026.

The latest report from UBS Bank (Sweden) emphasizes that "the current pullback is only temporary" and gold is still on the path to 4,200 USD/ounce in the short term, with the scenario of expanding to 4,700 USD/ounce if geopolitical risks increase.

UBS strategist Sagar Khandelwal believes that lower real interest rates, a weaker US dollar and increased public debt will be a catalyst to take gold prices further in 2026.

The US bank Goldman Sachs is even more daring, forecasting a potential peak of 5,055 USD/ounce by the end of 2026, equivalent to an increase of more than 25% compared to the present.

Meanwhile, Bank of America (USA) and Societe Generale (France) both believe that gold prices could surpass the 5,000 USD/ounce mark, especially as safe-haven demand and net buying from central banks continue to increase strongly.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...