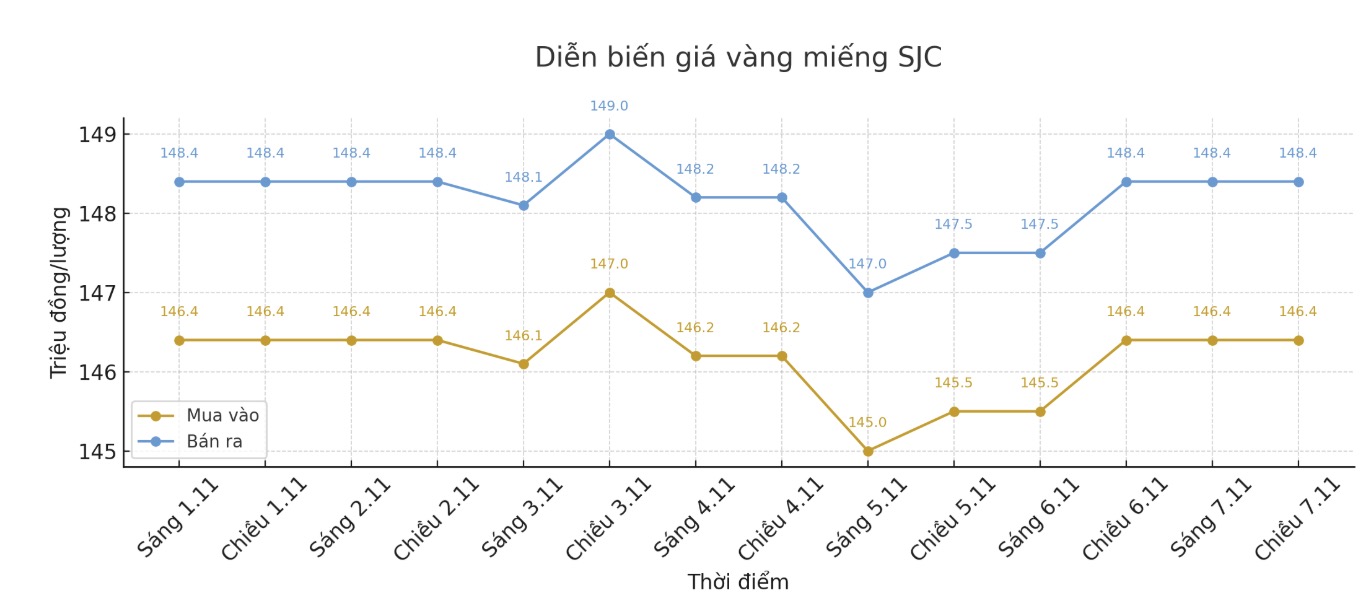

SJC gold bar price

As of 5:00 p.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148.4 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

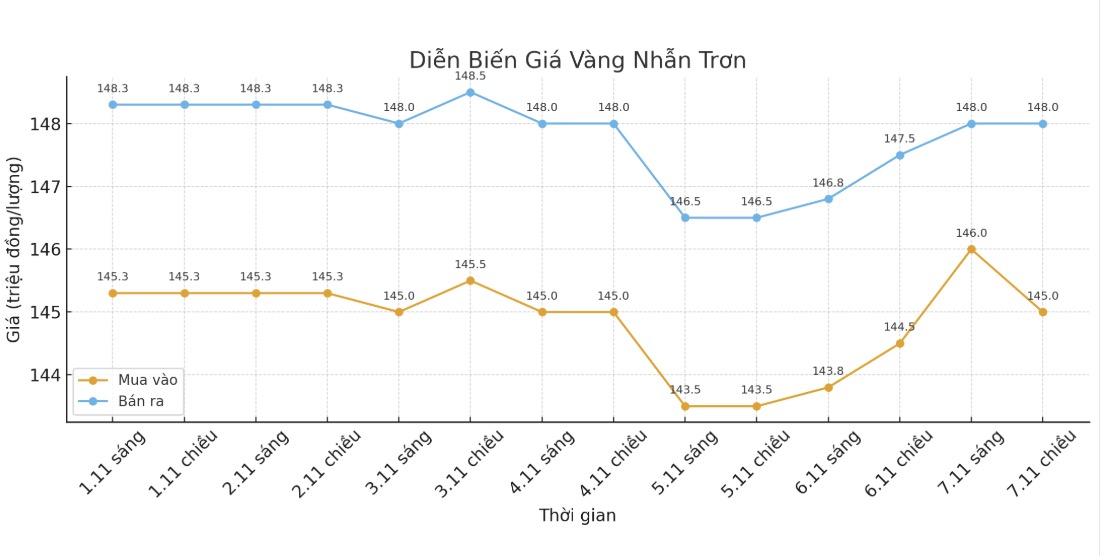

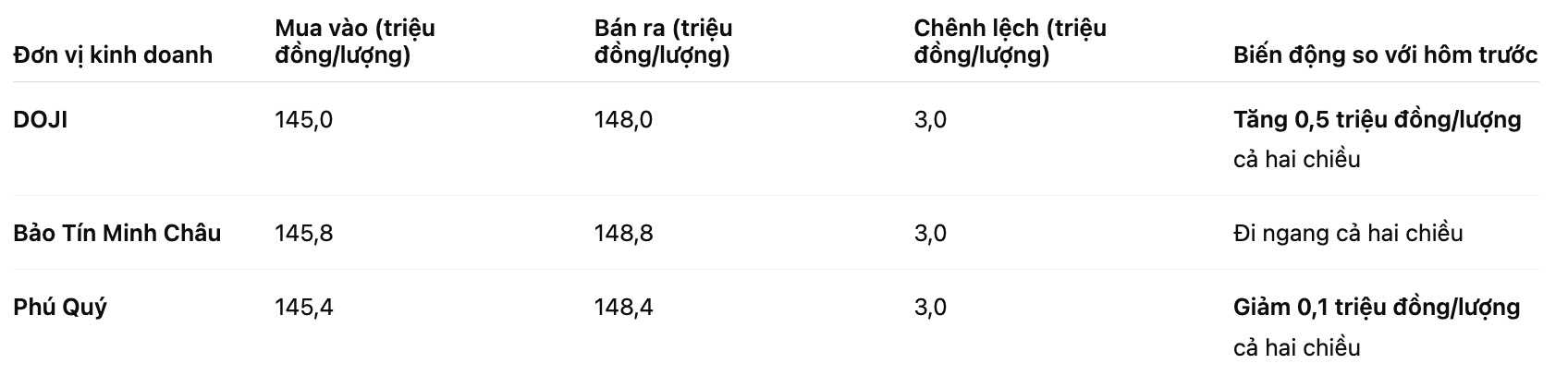

9999 gold ring price

As of 5:00 p.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.8-148.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

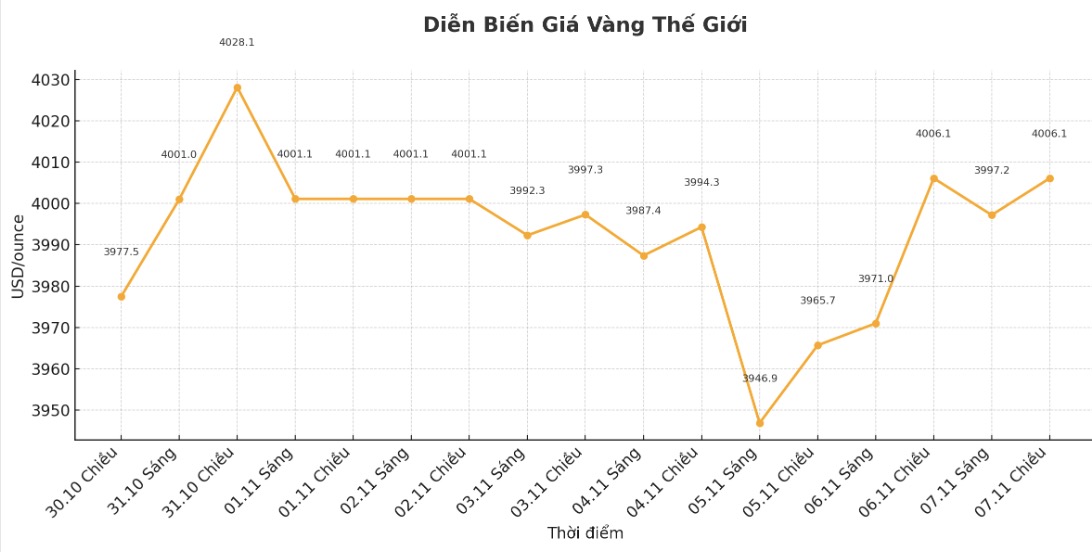

World gold price

The world gold price was listed at 5:05 p.m., at 4,006.1 USD/ounce, unchanged from a day ago.

Gold price forecast

Gold prices increased as the USD weakened and expectations of the FED cutting interest rates increased soon, in the context of the US labor market sending weak signals.

Gold prices increased in the trading session on Friday, regaining the important resistance level of 4,000 USD/ounce when the USD decreased. The move comes after US private sector jobs reports showed signs of weakness in the labor market, raising expectations for another rate cut by the Federal Reserve (FED). In addition, the prolonged US government shutdown has also boosted safe-haven demand.

According to data released on Thursday, the US economy lost jobs in October, mainly in the government and retail sectors, while the wave of cost cuts and businesses' push for the application of artificial intelligence (AI) caused the number of layoffs to increase sharply.

Private employment data still shows that the possibility of the FED cutting interest rates in December is very high, and that is why gold prices are receiving support, said Soni Kumari, commodity strategist at ANZ.

The US dollar weakened, falling sharply against other major currencies, as investors - in the context of a lack of official data on the labor market - relied on private sector surveys to assess the situation. A weak labor market often increases the likelihood of interest rate cuts.

Investors now see a 67% chance of a rate cut in December, up from nearly 60% in the previous session. The Fed cut interest rates last week and Chairman Jerome Powell said this could be the last cut of the year.

The focus is on macroeconomic data and the timing of the US government's end of the shutdown, which is contributing to boosting safe-haven demand for gold, according to Kumari.

The Congressional deadlock has dragged the US into the longest government shutdown in history, forcing investors and the Fed - which rely on data - to rely on private sector indicators.

In the context of low interest rates and economic instability, gold - a non-yielding asset - often tends to increase in price.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...