Gold prices marked a third consecutive day of strong gains as Russian President Vladimir Putin's recent statements on revising Russia's nuclear doctrine created a wave of concern in the international market.

On November 19, Russian President Vladimir Putin approved a new nuclear doctrine, which came into effect with changes compared to the one announced in September.

“In order to improve the state policy of the Russian Federation in the field of nuclear deterrence, I decided to approve the basic principles attached to the state policy of the Russian Federation in the field of nuclear deterrence,” the decree signed by President Putin and effective from November 19 stated.

“The state policy in the field of nuclear deterrence is defensive in nature, aimed at maintaining the potential of nuclear forces at a level sufficient to ensure nuclear deterrence, while ensuring the protection of the sovereignty and territorial integrity of the state, deterring a potential enemy from acts of aggression against the Russian Federation and (or) its allies, and in the event of a military conflict - preventing the escalation of hostilities and terminating them on terms acceptable to the Russian Federation and (or) its allies,” the decree reads.

According to the new doctrine, Russia can use nuclear deterrence to prevent aggression from hostile powers and military blocs possessing weapons of mass destruction or large conventional arsenals. Countries that provide their sovereign space for others to prepare and launch an attack against Russia must also comply with this policy, Reuters reported.

Many experts see the change as a diplomatic move designed to strengthen deterrence against Western intervention rather than a true sign of impending nuclear escalation.

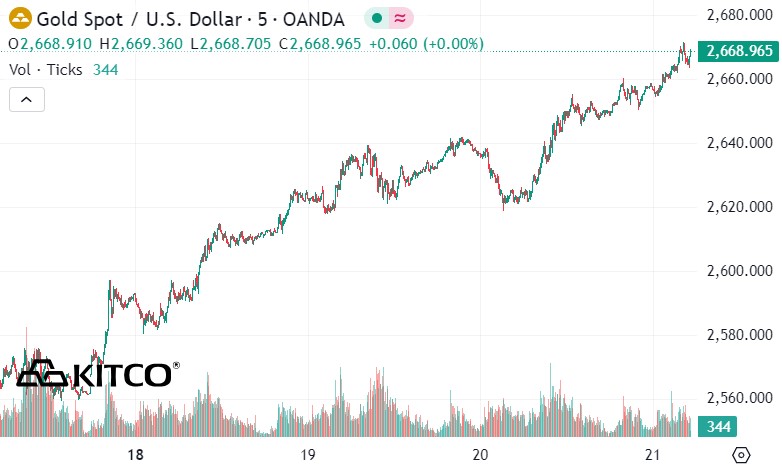

Financial markets reacted predictably to the news, with gold futures showing remarkable resilience, hitting a new high this week.

The total increase in the first three days of the week amounted to $86.7, with significant daily increases of $49 on Monday, $20 on Tuesday and another $18 on Wednesday.

Not only gold, the USD index rose sharply by 0.45% and stabilized at 106.705. US Treasury yields also showed great volatility, with the two-year bond rising to 4.31% and the ten-year bond reaching 4.413%.

Investors are now focused on the Federal Reserve's Open Market Committee meeting in December, with the CME's FedWatch tool showing a 53.9% chance of a 25 basis point rate cut.

Persistent conflicts in the Middle East and Ukraine continue to highlight the enduring appeal of gold as a safe haven asset. As geopolitical uncertainty persists, investors tend to turn to gold as a reliable store of value in times of turmoil.

Gold’s current trajectory suggests that geopolitical tensions and economic uncertainty will likely continue to dominate investment strategies in the near term, with the precious metal remaining an important hedge against geopolitical risks.

See more news related to gold prices HERE...