Neils Christensen - an analyst at Kitco News said that since the end of 2022, gold prices have entered an unprecedented uptrend, continuously breaking important resistance levels and setting 41 historical peaks this year alone.

Along with that, the silver market - which has just surpassed the $50/ounce mark, an all-time high - is at a turning point, causing investors to question: Is this the peak of gold?

New peak, but not necessarily the end

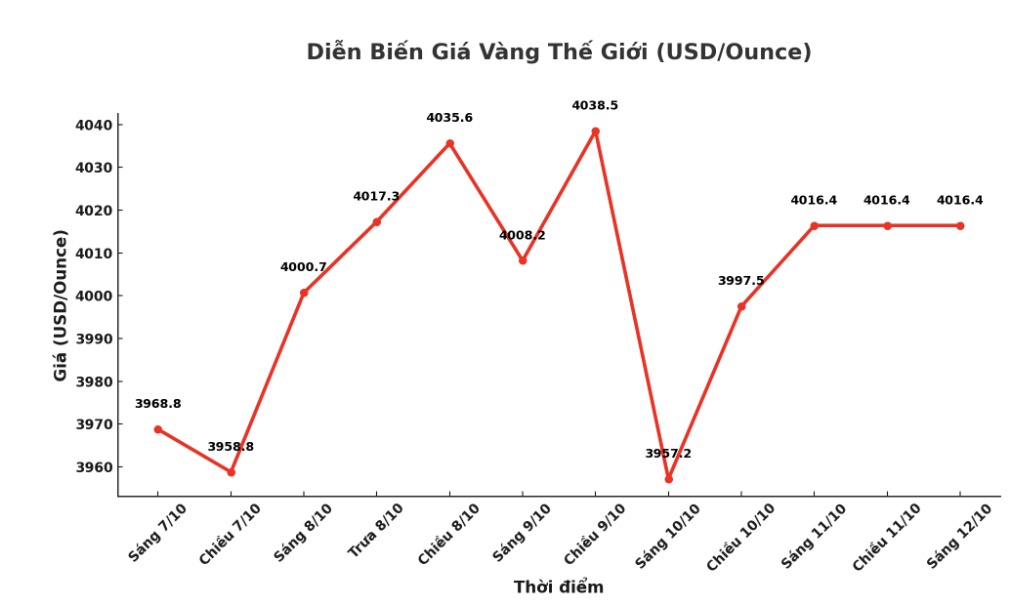

Since the beginning of the year, many experts and major banks have predicted that gold prices will reach the mark of 4,000 USD/ounce - a not-so-new expectation. The same question was raised when gold surpassed $2,000/ounce three years ago, then hit resistance at $2,400 and then $3,000/ounce.

Each time like that, the barriers are broken, paving the way for new higher prices.

Now, as gold is hovering around $4,000 an ounce, investors are starting to be more cautious. The difference of this increase compared to previous periods is that investment demand has increased dramatically in a very short time.

According to the World Gold Council (WGC), in the third quarter, the amount of gold poured into gold-backed ETFs reached 221.7 tons, worth nearly $26 billion - a record level. Thanks to that, the total holding of funds is only about 2% lower than the peak in 2020.

The market is "shelved", but not "overloaded"

Despite strong cash flow, gold still accounts for about 2% of total global assets, while many experts recommend that investors should allocate 5-10% of their portfolio to this precious metal.

Factors that have pushed gold to $4,000 an ounce such as geopolitical instability, high inflation, concerns about recession, huge public debt and declining confidence in the US dollar and other legal currencies are still present, even increasing.

In that context, Neils Christensen said it was difficult to confirm that gold's rally had hit the ceiling.

Risk of adjustment after the 50% increase

Although the long-term outlook remains positive, the increase of more than 50% for gold and 71%, for silver alone this year is too big to ignore. Many experts warn of the possibility of a 10% correction, pulling gold prices around $3,600/ounce - a significant but not too surprising decline.

Since the rally began in November 2022, the gold market has only recorded a three-week streak of decline (from May 20 to June 3, 2024), down 2.8%. The biggest decline came in November last year when gold lost 6.3% in two weeks, but soon after recovered 6% in just one week.

According to Neils Christensen, the long-term outlook for gold is still highly appreciated. "However, after a long and strong rally, taking profits may be a somewhat wise strategy. Because sometimes, the best way to invest is to know how to stop" - this expert said.

See more news related to gold prices HERE...