In the latest updated report, Heraeus commented that gold has shifted from a "safe haven" role to a speculative asset.

The seeds of the price drop have been sown from the previous increase - a too strong increase for an asset that is considered to have low volatility.

Gold prices have increased 5 times in 10 years, while the USD index is still at a level equivalent to 2015. When prices fall so sharply, it is very likely that there has been a situation of fleeing leverage positions, triggering loss-cutting orders and causing margin requirements to increase. Exchanges are still continuing to raise margins for futures contracts" - experts said.

Heraeus also cited the World Gold Council's Q4 2025 gold demand trend report, showing that total global gold demand for the first time exceeded the 5,000-ton mark last year. The main reason comes from the sharp increase in investment demand, compensating for the decline in the jewelry and industry sectors.

Gold purchases by central banks reached 863 tons, down 21% compared to the record level of 1,092 tons in 2024 but still higher than any year before 2022. In the fourth quarter alone, gold demand reached a record level of 1,345 tons, with investment cash flow continuing to be the main driving force.

Heraeus warns investors to prepare psychologically for strong price fluctuations in the near future.

Last week, gold prices recovered more strongly than other precious metals, regaining more than 50% of the previous decrease, but this recovery momentum weakened at the end of the week. However, gold prices are still significantly higher than at the beginning of the year - something that "white" metals like silver cannot do" - the report said.

According to Heraeus, the possibility of gold hitting a new peak in the short term is very low, because the market needs months, not weeks, to absorb and adjust the excessive excitement that pushed prices up too quickly. The support level is determined around 4,400 USD/ounce and may be tested again.

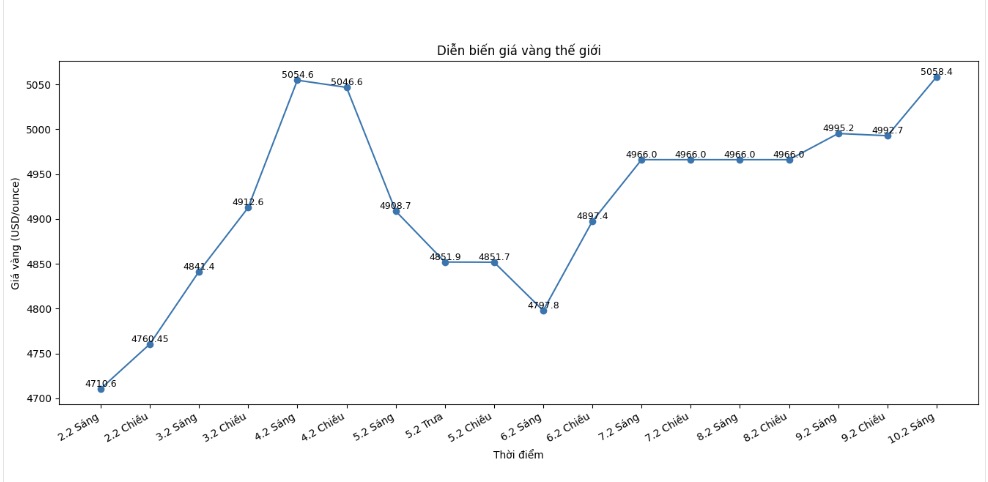

In the first trading session of the week, gold prices rebounded to the 5,000 USD/ounce mark, continuing to face a short-term resistance zone around 5,005 USD/ounce. Spot gold prices were last recorded at 5,036.84 USD/ounce, up 1.45% in the session.

For silver, analysts believe that this metal has officially entered a stronger fluctuation cycle.

“After a massive sell-off on Friday (30th), silver prices rebounded but quickly reversed in the middle of the week. Bottom-fishing activity by small investors has boosted large capital inflows into silver ETF funds, with nearly 32 million ounces added in just one day on Tuesday, bringing total holdings back to 850 million ounces” - Heraeus said.

Heraeus said that trading in China may be the reason for the sharp drop in silver prices on Thursday, likely due to selling when prices recovered to cut losses or take profits. Both the Shanghai Commodity Exchange and the Shanghai Gold Exchange have raised margin requirements.

The gold/silver ratio has increased to 64, reflecting that silver has fallen more sharply than gold. Previously, silver increased faster than gold as the market went up, but now it is also falling faster as the market adjusts" - the report said.

In the first trading session of the day in North America, silver prices returned above the 80 USD/ounce mark, increasing following the recovery momentum of gold prices.