According to Kitco, gold prices have fallen below a record high of $3,005 an ounce, but still receive strong support from weak consumer sentiment and rising inflation expectations, highlighting concerns about a prolonged recession environment.

The University of Michigan released preliminary results of its consumer psychology survey on Friday, showing that the index fell to 57.9 in March, below the February adjustment of 64.7. The data was well below forecasts, with economists predicting the index will be at 63.1.

According to the survey, consumer sentiment has now declined to its lowest level since November 2022.

"Consular sentiment has fallen for three consecutive months and is now 22% lower than in December 2024. Although current economic conditions have not changed much, expectations for the future have deteriorated in many areas, including personal finance, the labor market, inflation, business conditions and the stock market.

Many consumers believe that the level of policy uncertainty and other economic factors is very high; frequent fluctuations in economic policies make it difficult for consumers to plan for the future, regardless of their policy preferences" - Joanne Hsu, Director of Consumer survey said.

Along with the decline in psychology, consumers continue to worry about inflation. The report said inflation expectations for a year have risen to 4.9%, up from 4.3% in the previous month.

This is the biggest increase since last month since 1993, stemming from a significant increase in independent voters, and following a major increase in February, the report said.

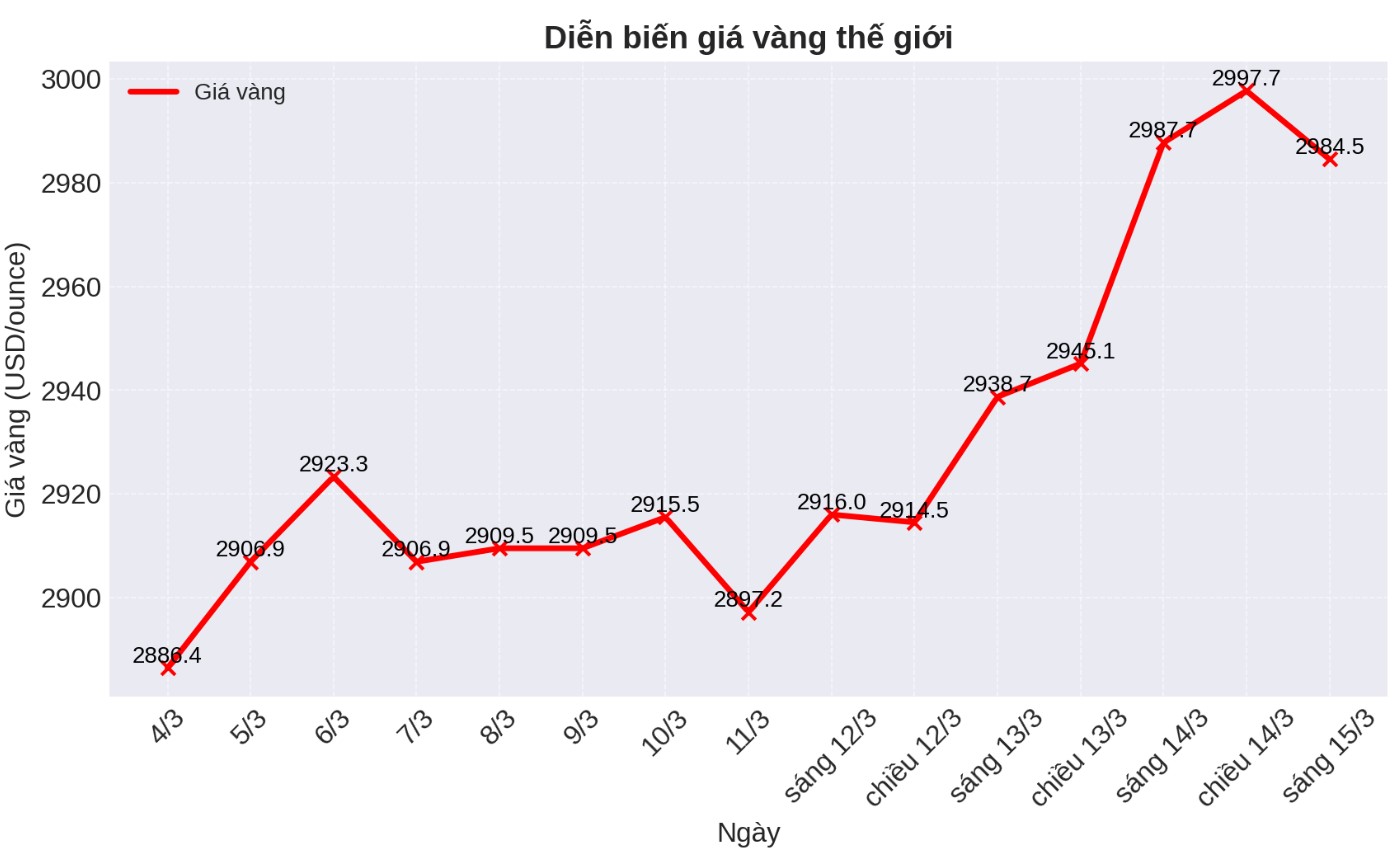

In the trading session on Friday, spot gold prices increased to a new record high of $3,005.04/ounce. However, the precious metal has seen continued profit-taking since then. Gold prices at the end of the trading session of the week were listed on Kitco at 2,984.91 USD/ounce.

Experts predict positively about short-term gold prices

This week, 15 analysts participated in the Kitco News gold survey. Nine experts, or 60%, predict gold prices will continue to rise next week. Three analysts, or 20%, predict gold prices will fall. The remaining three experts see gold prices moving sideways.

Meanwhile, 262 votes were cast in Kitco's online survey the strongest participation in 2025 with retail investors' sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week. While another 47 people, accounting for 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.