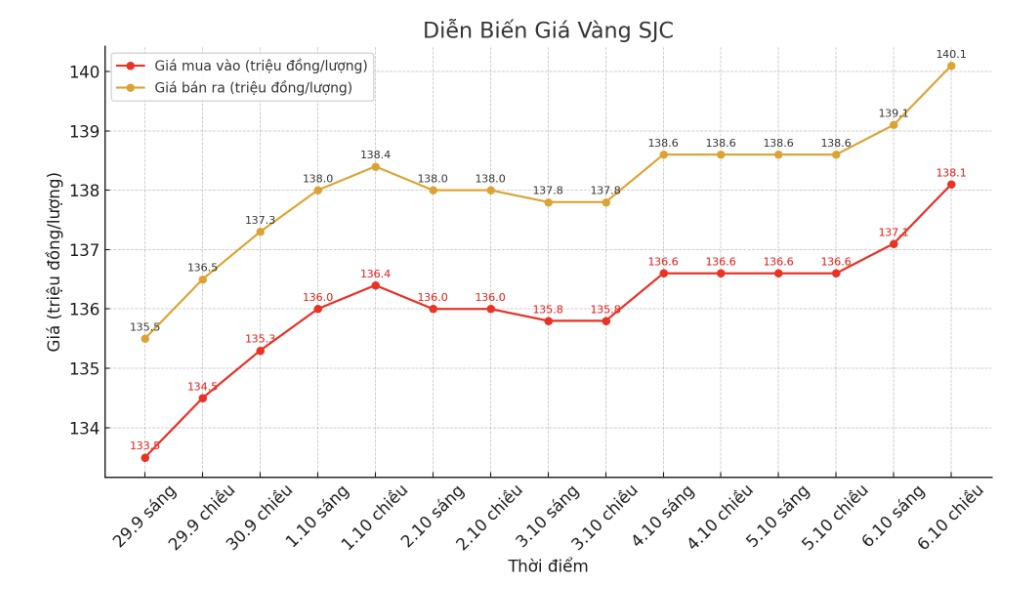

SJC gold bar price

As of 6:00 p.m., the price of SJC gold bars was listed by DOJI Group and Bao Tin Minh Chau at 138.1-140.1 million VND/tael (buy in - sell out), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 137.5-140.1 million VND/tael (buy - sell), an increase of 1.5 million VND/tael for buying and an increase of 1.3 million VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

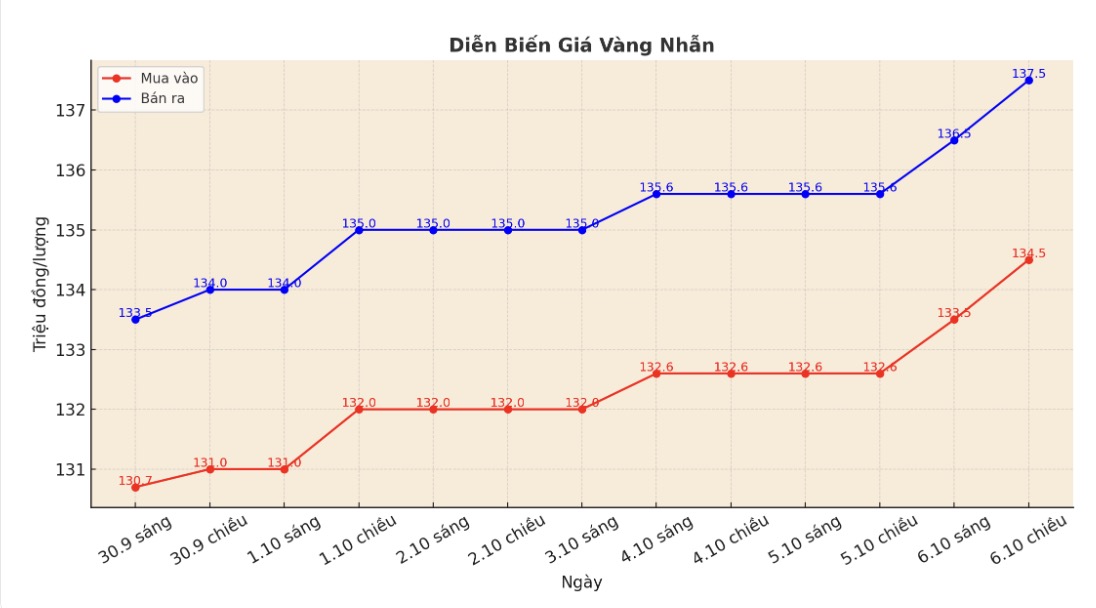

9999 gold ring price

As of 7:00 p.m., DOJI Group listed the price of gold rings at 134.5-137.5 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 135.3-138.3 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 134.5-137.5 million VND/tael (buy in - sell out), an increase of 2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

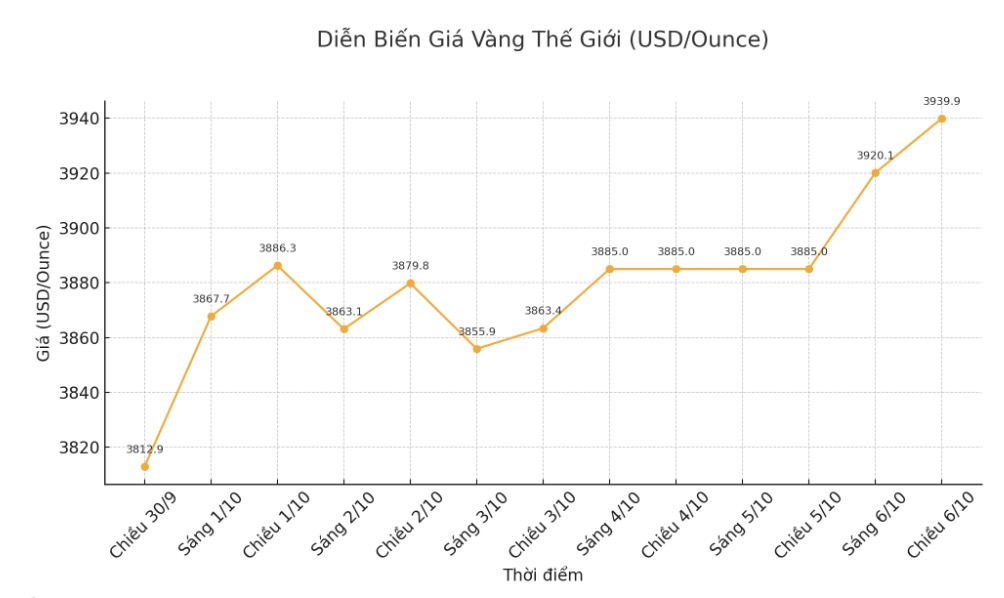

World gold price

The world gold price was listed at 6:00 p.m. at 3,939.9 USD/ounce, up 54.6 USD compared to a day ago.

Gold price forecast

World gold prices have hit an all-time high, surpassing $3,900/ounce as investors rush to precious metals as a safe haven amid the US government's closure, global economic uncertainty and expectations that the US Federal Reserve (FED) will continue to cut interest rates.

At 9:10 GMT (ie 4:10 p.m. Vietnam time), December gold futures on COMEX increased by 1.5%, to $3,967.1/ounce.

According to a source from the White House quoted by Reuters, Washington could have to cut federal personnel if negotiations between the Trump administration and the US Congress to end the government's closure continue to be at a standstill.

Gold confidence is still strongly strengthened by the prolonged US government shutdown, said Lukman Otunuga, senior analyst at FXTM.

There may be a wave of psychologically buying FOMO at the current price, but for many others, it would be as good as the financial boat has left the port, said independent expert Ross Norman.

Since the beginning of the year, gold has increased by nearly 50%, supported by strong net buying from central banks, increased demand for gold ETFs, a weaker US dollar and growing interest from individual investors seeking hedge against trade and geopolitical tensions.

This increase, according to Norman, is characterized by limited participation and mainly from central banks and long-term investors rather than speculators, showing that if there is a price adjustment, the decrease could be lighter than expected, while opening up buying opportunities when prices fall while the uptrend remains.

Data from many public and private sources also shows signs of weakening the US labor market during the government's closure.

Investors are now predicting the Fed will cut interest rates by 0.25 percentage points at its meeting this month, and another 0.25 percentage points in December.

We see both fundamental factors and technical drivers supporting golds rally, and now forecast prices to reach $4,200/ounce by the end of the year, UBS Bank wrote in a report.

Gold - a non-yielding asset - often benefits in a low interest rate environment and period of economic instability. Spot gold prices first surpassed $3,000/ounce in March.

Many brokerage companies are also optimistic about this increase. Spot silver prices rose 1.5%, to $48.68 an ounce, their highest level in more than 14 years. platinum increased by 0.5%, to 1,613.75 USD/ounce, while gold increased by 0.7%, to 1,269.06 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...