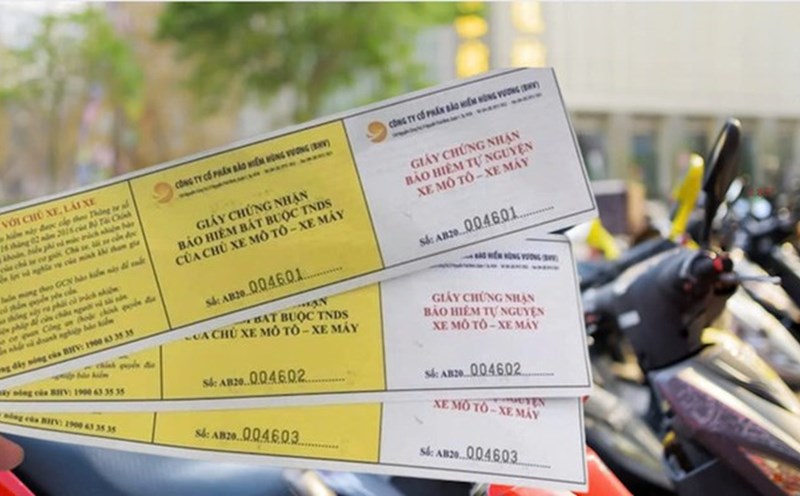

Voters in Long An province have sent a petition to reconsider the requirement for people participating in traffic to buy motorbike insurance. Because this is a civil contract, people should voluntarily buy it, and at the same time, when an incident occurs, it is very difficult for the buyer to carry out the procedures to receive payment or it is not resolved satisfactorily.

Responding to this issue, the Ministry of Finance said that the Law on Insurance Business, which will take effect from January 1, 2023, stipulates that compulsory insurance includes compulsory civil liability insurance for motor vehicle owners and assigns the Government to specify in detail the insurance conditions, insurance premiums, and minimum insurance amounts for compulsory insurance.

On September 6, 2023, the Government issued Decree No. 67/2023/ND-CP on compulsory insurance, including compulsory liability insurance for motor vehicle owners. Accordingly, the Insurance Certificate must include the name, address, and hotline number of the insurance company.

Decree No. 67/2023/ND-CP has provisions on the responsibility of insurance companies to resolve customer benefits, specifically as follows:

A 24/7 hotline must be established and maintained to promptly receive accident information, provide guidance, and answer questions for vehicle owners. Calls to the hotline must be recorded to ensure vehicle owners' rights.

Upon receiving notification of an accident, within 1 hour, the vehicle owner must be instructed on the documents and procedures for claiming compensation. Within 24 hours, the damage assessment organization must determine the cause and extent of the loss as a basis for settling insurance compensation.

Within 3 working days from the date of receiving the vehicle owner's notification of the accident, the insurance company must make an advance payment for compensation for damage to health and life, even in cases where it has not been determined that the accident is within the scope of compensation for damages.

Collect insurance claim documents including relevant documents from the police and appraisal records.

According to the Ministry of Finance, Decree No. 67/2023/ND-CP has inherited and supplemented many new regulations compared to previous legal documents on compulsory civil liability insurance of motor vehicle owners to simplify compensation procedures and ensure the rights of insurance buyers such as:

Simplify compensation procedures. Compensation assessment is done by the insurance company, only in case of death do police records are required.

The vehicle owner may provide documentation of the claim in electronic form or may provide evidence of repair or replacement of the damaged property.

Within 03 working days, the insurance company must make an advance payment for compensation for damage to health and life.

Ensuring car owners' rights: Increase or decrease insurance premiums by up to 15%.

Insurance liability is excluded in cases where the driver has an alcohol concentration exceeding the level prescribed by the Ministry of Health.

Expand the scope of humanitarian assistance to cases not covered by insurance, increase the level of support for total disability cases.

In the coming time, the Ministry of Finance will closely monitor compliance with these regulations to ensure the objectives of the compulsory insurance regime. At the same time, the Ministry of Finance will summarize, evaluate and report to competent authorities to adjust policies if necessary.