Previously, at an investor meeting held in early May, Mr. Danny Le - General Director of Masan Group, talked about the capital mobilization plan this year. Mr. Danny Le said that with an average growth rate of 15% per year over the past 6-7 years of Masan Consumer, "it is time to consider implementing a potential IPO plan".

Double-digit growth for 7 consecutive years

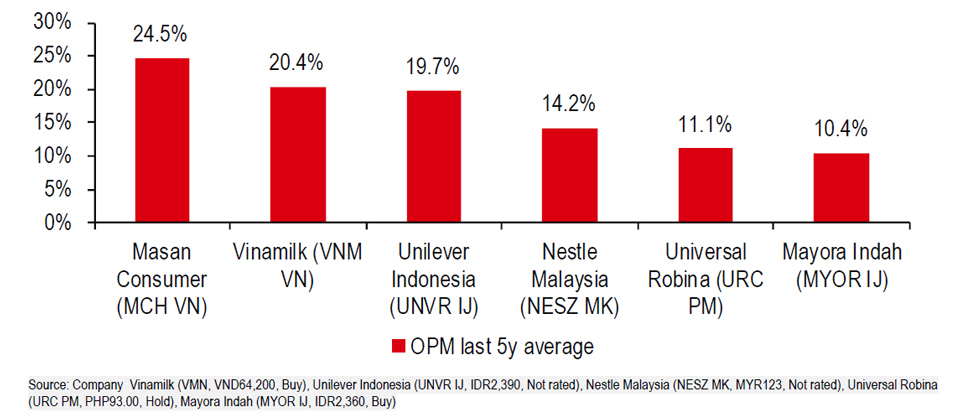

Masan Consumer has a history of stable business with high growth, significantly outperforming its regional FMCG and packaged food peers. Specifically, according to HSBC's report, from 2017 to 2023, Masan Consumer grew at a rate 2.2x faster than the general market.

HSBC’s report also highlighted Masan Consumer’s plan to list MCH shares on the HOSE. The financial group believes that switching to listing on the HOSE could help MCH shares improve liquidity, in line with the outstanding capacity the company has achieved over the years.

With the approval of shareholders on the plan to list MCH on the HOSE, it can be seen that this strategic step of the enterprise is on track. In addition, the successful IPO of Masan Consumer will help increase the valuation of Masan stocks such as MCH, MSN and this roadmap is becoming clearer with positive information from the enterprise and the market.

Serving 98% of Vietnamese households

Masan Consumer's starting point and mainstay product line is spices. Up to now, this enterprise has participated in 8 main consumer goods industries in Vietnam and owns 5 brands with annual revenue of 150-250 million USD. These are consumer brands that have become familiar to millions of Vietnamese people such as CHIN-SU, Nam Ngu, Omachi, Kokomi and Wake-up. It is known that these 5 "Big Brands" account for about 80% of Masan Consumer's revenue in the Vietnamese market.

According to Kantar, more than 98% of Vietnamese households own at least one Masan Consumer product. Of which, CHIN-SU and Nam Ngu are the most chosen brands in urban areas; meanwhile, in rural areas, there are 4 brands: Nam Ngu, CHIN-SU, KOKOMI and Tam Thai Tu (According to a report by HSC Securities Company). In both rural and urban areas, Masan Consumer has a loyal customer base, ready to experience new products and help increase product sales in many different categories.

According to the company's latest report, Masan Consumer continues to extend its record growth momentum in 2023 with positive business results recorded in the second quarter of 2024. Masan Consumer's revenue recorded a growth rate of 14% and continued to maintain a high gross profit margin of 46.3%. In the second quarter of 2024, the Convenience Food, Beverages and Coffee industries led the growth "race", recording increases of 20.7%, 17.6% and 16% respectively over the same period.

In addition, the company's Go Global strategy also achieved positive numbers with export revenue continuing to grow, reaching a 17% increase over the same period last year.

Boost from market upgrade

On September 18, the Ministry of Finance officially approved Circular 68/2024/TT-BTC. The new Circular has notable content related to foreign institutional investors being able to trade and buy shares without requiring sufficient funds (non-pre-funding) and the roadmap for information disclosure in English, effective from November 2, 2024.

This is a step closer for the Vietnamese stock market to meet the requirements for an upgrade to emerging market status by FTSE Russell.

SSI Research predicts that Vietnam will be upgraded in the September 2025 review. With the upgrade to emerging market status, according to preliminary estimates, capital flows into the Vietnamese market from ETFs could reach up to 1.7 billion USD, not including capital flows from active funds (FTSE Russell estimates total assets from active funds are 5 times higher than ETFs). This is also a positive catalyst for businesses planning to IPO in 2025 such as Masan Consumer.

Foreign capital flows wishing to learn about the story of the FMCG industry, invest long-term in businesses with a stable business history with high growth, and pay "huge" dividends, then MCH stock of Masan Consumer will be one of the potential options.

With its outstanding growth rate, Masan Consumer has attracted the attention of many large domestic and foreign investors. Recently, the Board of Directors Resolution of Masan Consumer revealed a series of large investment funds holding shares in the company. Of which, Albizia Asean Tenggara Fund owns 3,891,258 MCH shares; Vietcap Securities JSC owns 2,700,800 MCH shares; Bill & Melinda Gates Foundation Trust owns 1,041,100 MCH shares.

In 2024, Masan Consumer aims to continue double-digit revenue and profit growth. Net revenue is expected to reach between VND32,500 billion and VND36,000 billion. The focus of the company's plan is to own 6 billion-dollar brands and achieve 10-20% of revenue from the global market, premiumize products and expand product ranges for each brand, increasing the accessible market from 100 million consumers in Vietnam to 8 billion people globally.