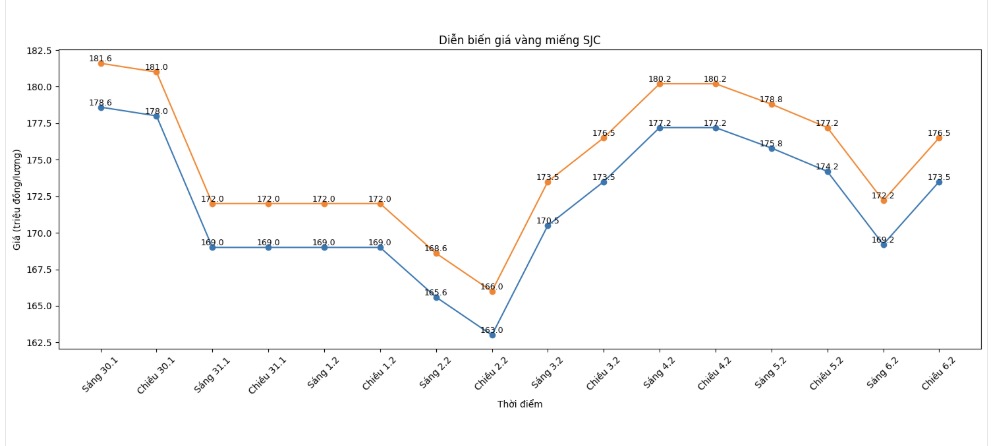

SJC gold bar price

As of 8:00 PM, SJC gold bar prices were listed by DOJI Group at 173.5-176.5 million VND/tael (buying - selling); down 700,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 173.5-176.5 million VND/tael (buying - selling); down 700,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 173.5-176.5 million VND/tael (buying - selling); down 700,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

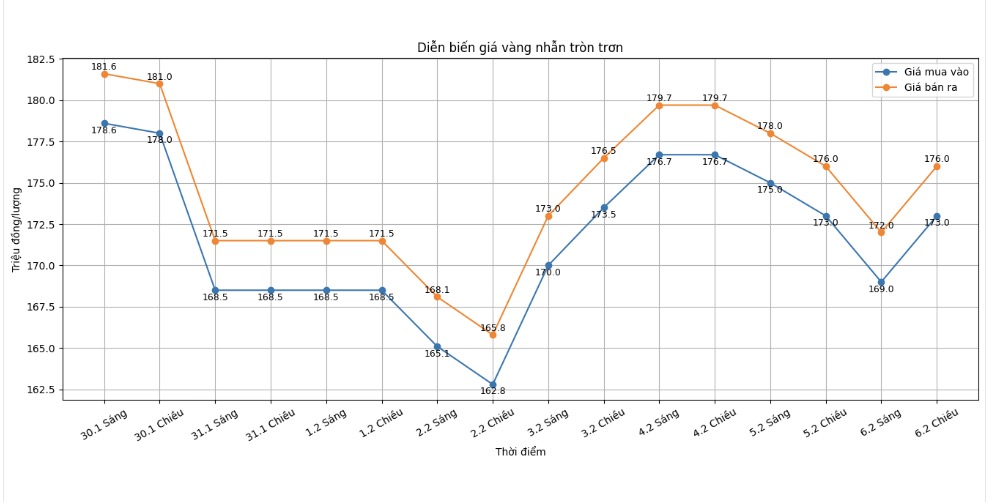

9999 gold ring price

As of 8:00 PM, DOJI Group listed the price of gold rings at the threshold of 173-176 million VND/tael (buying - selling); keeping both directions unchanged. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 173.5-176.5 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Jewelry Group listed the price of gold rings at 173-176 million VND/tael (buying - selling), down 700,000 VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

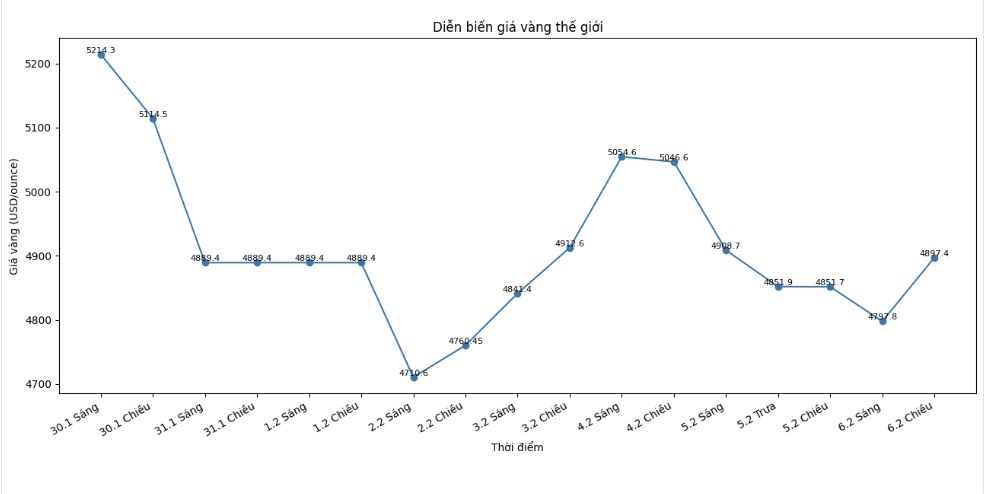

World gold price

At 8:00 PM, world gold prices were listed around 4,897.4 USD/ounce; up 45.7 USD compared to the previous day.

Gold price forecast

Despite strong corrections and rapid fluctuations in the precious metals market, many international financial institutions still maintain a positive view of gold price prospects in the medium and long term.

In the latest updated report, commodity analysts at the Bank of Canada CIBC believe that the recent sharp decline is mainly technical, while the fundamental factors supporting gold prices have not yet weakened. According to CIBC, the average gold price in 2026 may reach about 6,000 USD/ounce, significantly higher than previously forecast, and the upward trend is likely to extend into the following years.

CIBC assesses that the complex geopolitical context along with increased uncertainty in global monetary policy continues to drive demand for safe-haven assets. Notably, the weakening trend of the USD is seen as one of the key drivers supporting gold prices. According to this bank, the fact that central banks and international investors are gradually reducing their holdings of US Treasury bonds may create additional downward pressure on the greenback.

The process of weakening the USD is likely to continue as central banks seek to diversify reserves, in the context of falling confidence in assets considered ‘non-risk’," CIBC experts said. At the same time, they believe that US monetary policy is unlikely to avoid a more loose trend next year, regardless of personnel changes at the US Federal Reserve (Fed).

In the opposite direction, the short-term gold market still faces strong volatility risks. The fact that CME Group continuously adjusted to increase margin levels for gold and silver futures contracts shows that market regulators are assessing price risks at a high level. This move may cause speculation to shrink, thereby creating strong fluctuations in the short term.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...