Neils Christensen - an analyst at Kitco News - said that recent gold and silver price movements are making many investors feel uneasy, considering any historical norms. Daily fluctuations that were once thought to be unlikely to happen with precious metals have now become familiar, challenging the long-standing view that gold is a stable asset in uncertain periods.

However, beneath that layer of fierce fluctuations, many analysts believe that the market is not "broken" but is in the process of self-adjustment.

Daily trading bands have expanded to rare levels, except during times of crisis, while strong increases and decreases in silver further increase the sense of chaos in the market.

However, it should be recognized that this disruption occurred after a particularly strong price increase. Gold prices have set more than a dozen new records in just a few weeks, while silver has skyrocketed to levels that make the market overbought and crowded.

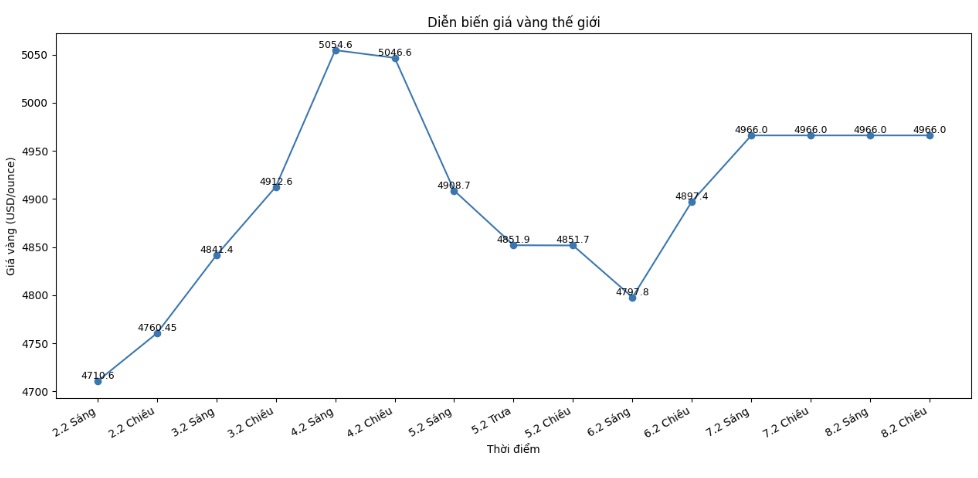

From that perspective, the current adjustment and accumulation phase is not only predictable but also necessary. Although the price has retreated compared to the historical peaks of the previous week, gold seems to be gradually stabilizing in the trading range from 4,500 - 5,000 USD/ounce. Despite large fluctuations, gold still recorded an increase of about 1% in the week.

Analysts emphasize that the recent sell-off does not reflect a structural change in the long-term outlook for gold. Instead, this is the market's process of unleashing excessive speculation after a rapid increase. Notably, prices have recovered significantly from the bottom, showing that the foundational demand is still solid even when leverage positions are eliminated.

This demand mainly does not come from short-term investors. Central banks continue to buy gold on a large scale in the historical context, while physical demand - especially in key markets such as India and China - still maintains sustainability despite strong price fluctuations.

At the same time, the proportion of gold allocation in the investment portfolio is still relatively low, leaving room for institutional capital to join if macroeconomic instability persists.

This explains why optimistic forecasts did not disappear along with the stagnant increase. Many large banks still expect gold prices to approach the $6,000/ounce mark by the end of the year.

These forecasts are not based much on short-term fluctuations, but mainly stem from long-term structural factors such as increased public debt, fiscal imbalances, geopolitical risks and the trend of gradual dedollarization.

In that context, volatility can be understood as part of a correction process, rather than a warning signal. Gold is revaluing risks in real time, and this process rarely goes smoothly. The current instability, although annoying, may be laying the foundation for a more sustainable growth cycle - based on broader investor participation rather than just speculative momentum.

Gold may no longer be a "peaceful" asset as before, but for many long-term investors, the core argument remains unchanged. This period of adjustment and accumulation is increasingly seen as an opportunity to buy in.

See more news related to gold prices HERE...