According to avi Gilburt - a veteran technical analyst and founder of ElliottWaveTrader, the increase in gold and silver starting from the bottom of 2015 - 2016 is entering the final stage.

Although prices may continue to rise in the short term, he warned investors to prepare early for a multi-year adjustment period, which could start as early as 2026.

Gilburt believes the current rally is not the start of a new cycle, but rather the end of a cycle that has lasted for nearly a decade.

He emphasized that this cycle formed after the post- 2015 restructuring period, when the precious metals market was under great pressure from the sell-off of ETF funds and a sharp decline in investor interest.

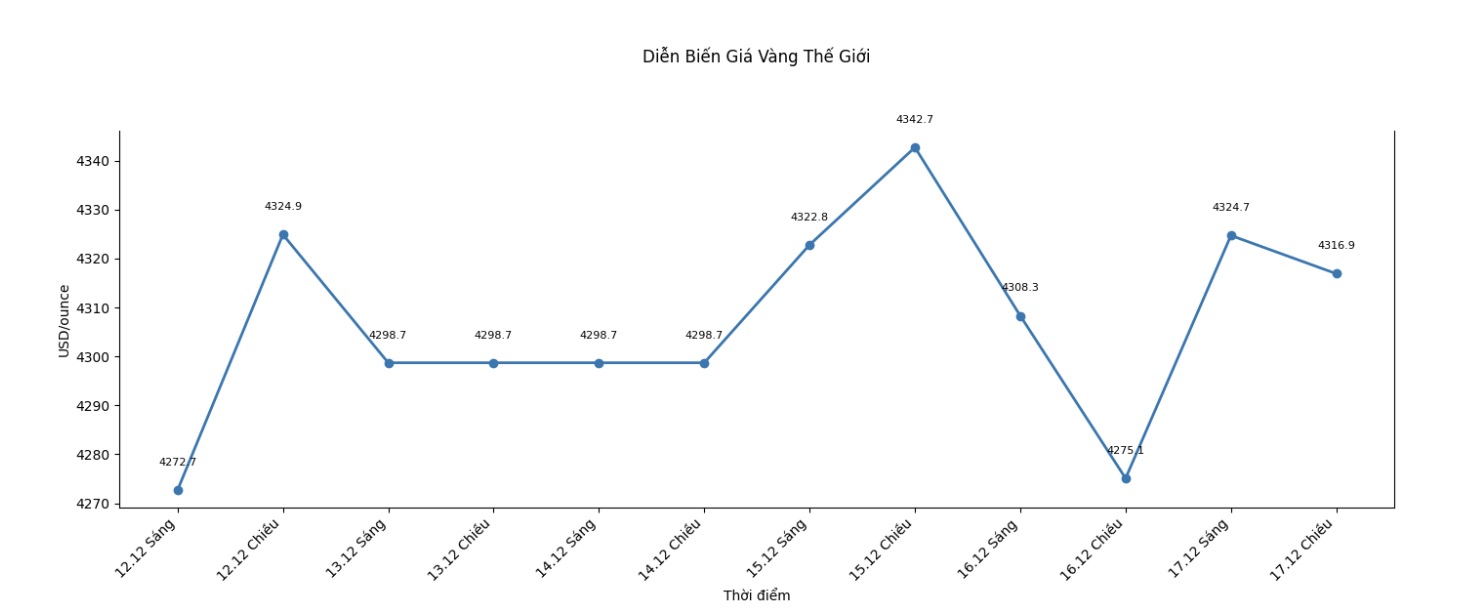

With gold prices currently trading above the support zone around $4,300/ounce, Gilburt said upcoming developments will depend on the ability to overcome the important resistance level at $4,383/ounce. If it cannot break out, gold could face a deep correction, even returning to the $3,800/ounce zone.

However, according to him, such a decline does not mean that the up cycle has ended, but on the contrary, it could open up attractive buying opportunities before the market enters the final big increase.

In a more positive scenario, if gold breaks the resistance zone, prices could approach the psychological mark of 5,000 USD/ounce, although the possibility of reaching this threshold is still open.

Regardless of the scenario, Gilburt believes that the final rally will be followed by a prolonged correction period, which could send gold prices back to around $2,000/ounce in the following years.

Gilburt's optimistic view on the medium and long term goes against many other analysts, who believe that gold and silver will continue to have a sustainable uptrend until 2026 thanks to favorable fundamentals.

However, Gilburt has flatly denied the role of these factors, saying they are often coincistent and not the main driver of the market.

He cited the period after 2011, when gold entered the market with prolonged price declines, although arguments about supply - demand and loose monetary policy were still very positive. Even in the 2008 financial crisis, gold did not show its absolute shelter when it lost more than 30% of its value while the stock market plummeted.

According to Gilburt, gold and silver move in their own cycles, and ignoring the cyclical factor could cause investors to be on the wrong side of the market. Not only for precious metals, he warned of the great risks accumulating throughout the entire financial system.

Gilburt believes that the long-term bond market has reached a peak and yields may increase sharply in the last years of this decade, even accompanied by a major collapse of the stock market.

In that context, Gilburt said he had raised his cash ratio to a career high, prioritizing short-term Treasury bonds and completely avoiding long-term bonds.

He also warned about the risks in the banking system, stressing that modern currency, which is mainly created through credit, could be rapidly destroyed during recession and deflation periods.

However, Gilburt believes that gold and silver still play a certain role in currency thinning scenarios, as investors seek to protect assets and purchasing power. He emphasized that the core message is not to give up precious metals, but to clearly understand their position in the current cycle.

He said the coming months could provide a final chance to join the rally, especially for silver. However, by 2026, the risk- profit balance may change significantly.

If history repeats itself, the most dangerous time for precious metals investors could come when confidence is at its peak, right before the reversal cycle. And if Gilburt is right, 2026 could mark a profound and prolonged correction in the gold and silver markets.

See more news related to gold prices HERE...