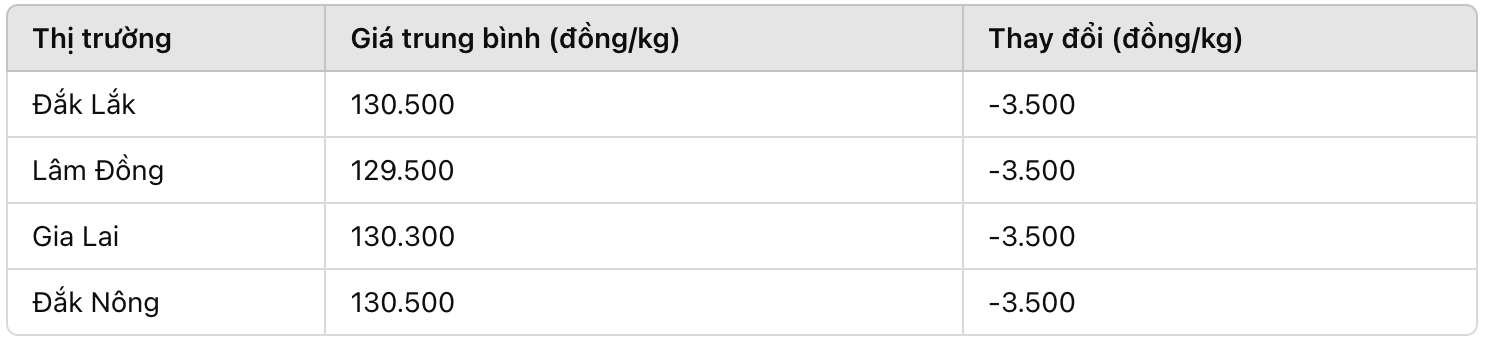

Domestic coffee prices lose 3,500 VND/kg

The domestic coffee market continued to decline sharply, recording a decrease of 3,500 VND/kg compared to yesterday. Currently, coffee prices in key localities such as Dak Lak, Gia Lai, Dak Nong fluctuate around 130,500 VND/kg. Lam Dong is still the area with the lowest price, at 129,500 VND/kg.

This is the strongest decrease in the past week, marking a downward adjustment trend after many previous hot increases.

World coffee prices plummet

On the London Stock Exchange, Robusta coffee prices fell across the board by more than 3.8%.

The May contract decreased by 216 USD/ton, to 5,427 USD/ton.

The July contract lost 217 USD/ton, down to 5,386 USD/ton.

The New York Stock Exchange also saw Arabica lose more than 5% of its value.

The May contract decreased by 22.80 cents/lb, to 387.15 cents/lb.

The July contract lost 22 cents/lb, down to 377.55 cents/lb.

The market is under strong selling pressure

According to analysis from the International Coffee Organization (ICO), coffee prices have fallen sharply due to the impact of abundant supply and profit-taking by investors.

Brazil is boosting exports as the Real is weakening, causing farmers to sell more. Meanwhile, Vietnam is entering the peak of the late harvest season, with abundant goods, increasing pressure on prices. Although ICE-supervised Robusta inventories have fallen to a two-month low, the decline is not enough to create a driver for coffee prices.

In addition, hedge funds have also stepped up their selling. According to data from the US Commodity Exchange (CSTC), investment funds have sharply reduced their net buying positions due to concerns that high USD interest rates could affect global coffee consumption demand.

Not only that, Arabica inventories are also at a high level. The ICE report shows that Arabica coffee in stock at US ports has increased to a 9-month high, adding pressure on prices to continue to fall.

Coffee price forecast

According to the forecast from the National Coffee Council of Brazil (CNC), coffee prices may continue to decrease slightly in the next few sessions if selling pressure continues. However, some experts believe that prices will recover at the end of March when Brazil begins a low delivery period, reducing supply pressure.