Mr. Pham Van Binh (character's name has been changed) said that he is a male, born in 1965, who used to work in a state agency with a period of compulsory social insurance (SI) payment according to the rank of 27.5 years.

After that, he transferred to work at a joint stock company and paid social insurance according to the contract salary for 5 years. Due to poor health, he resigned and switched to voluntary social insurance contributions for more than 2.5 years to complete a total of 35 years of social insurance contributions.

Mr. Binh expressed his desire to know how to calculate the pension regime for his case and whether by 2026, when he is old enough to retire, he can enjoy the pension regime or not. At the same time, he also asked whether there was any need to carry out any additional procedures or supplements before receiving the pension.

Regarding his reflection and recommendation, the Ministry of Home Affairs has responded on the Electronic Information Portal.

According to the Ministry of Home Affairs, the pension regime for those who have both paid compulsory social insurance and voluntary social insurance is stipulated in Article 111 of the Social Insurance Law No. 41/2025/QH15 and detailed in Article 11 of Decree No. 159/2025/ND-CP dated June 25, 2025, detailing and guiding the implementation of a number of articles of the Social Insurance Law on voluntary social insurance.

Accordingly, Article 11 of Decree No. 159/2025 clearly states: For those who have paid compulsory social insurance and voluntary social insurance, the period to calculate pension benefits is the total period of compulsory social insurance and voluntary social insurance contributions.

- In case the voluntary social insurance participant has paid compulsory social insurance for 15 years or more, the pension age requirement shall be implemented according to the provisions of Article 64 of the Social Insurance Law, except for the cases specified in Point b and Point c of this Clause.

- In case the voluntary social insurance participant has paid compulsory social insurance for 20 years or more and has a reduced working capacity of 61% or more, the pension age requirement is implemented according to the provisions of Article 65 of the Social Insurance Law.

- In case the voluntary social insurance participant before January 1, 2021 and has paid voluntary social insurance for 20 years or more, will receive pension when reaching the age of 60 for men and 55 for women.

The monthly pension is calculated by multiplying the monthly pension rate by the average monthly salary and income for social insurance contributions as prescribed in Clause 4 of this Article.

In case a person who has both paid compulsory social insurance and paid voluntary social insurance has participated in social insurance according to the subjects prescribed in Points a, b, c, d, dd, g and i, Clause 1, Article 2 of the Social Insurance Law before July 1, 2025 and has paid compulsory social insurance according to these subjects for 20 years or more when calculating the monthly pension lower than the reference level, it will be calculated at the reference level.

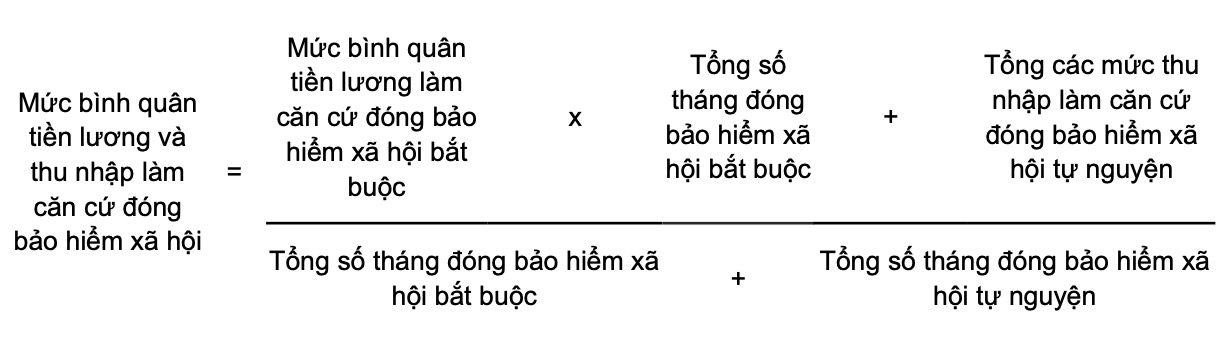

The average salary and income used as the basis for social insurance contributions is calculated according to the following formula:

The Ministry of Home Affairs recommends that you study the above regulations to review and apply them appropriately to your case.