Updated SJC gold price

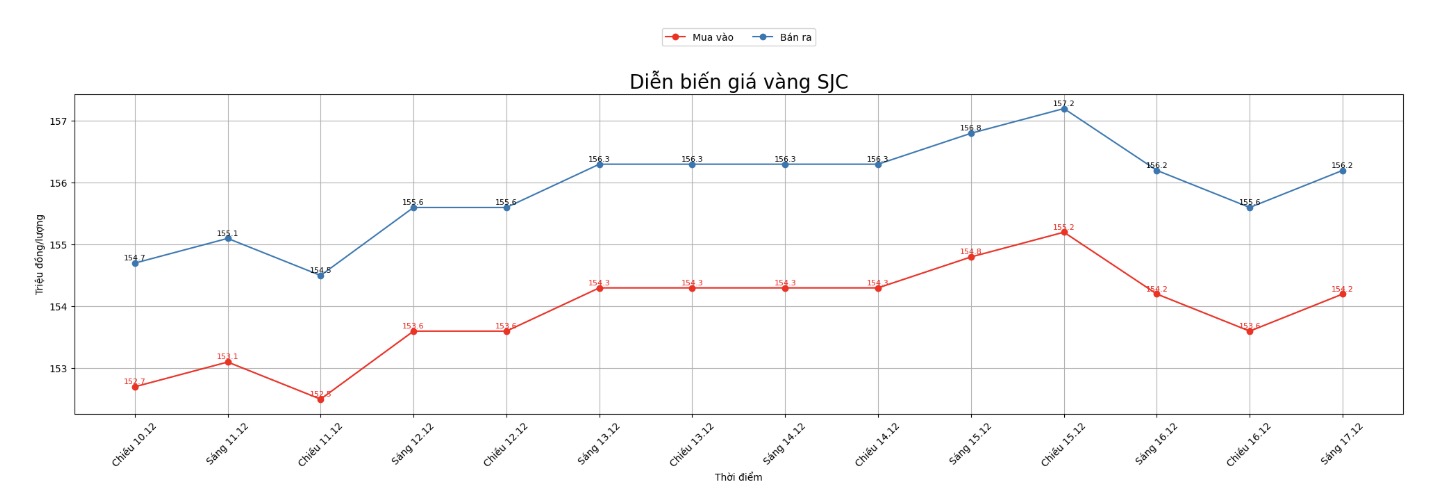

As of 9:05, the price of SJC gold bars was listed by DOJI Group at 154.2-156.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.2-156.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.2-156.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

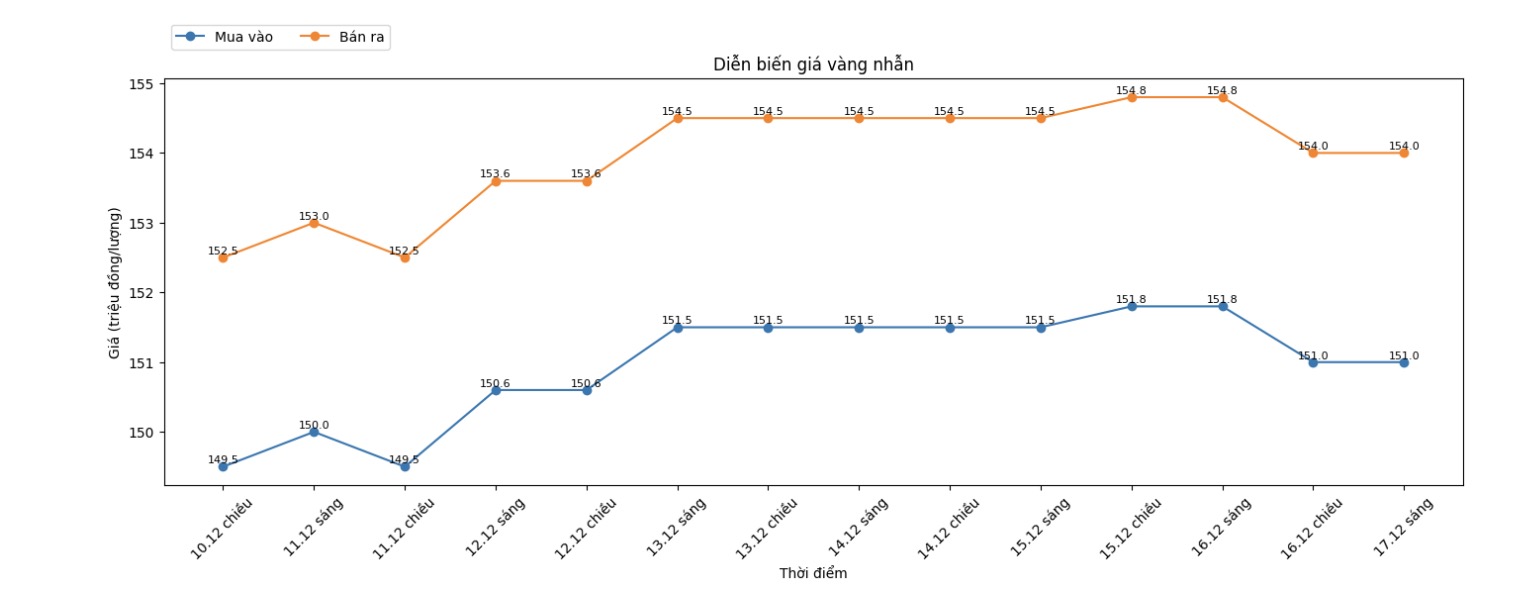

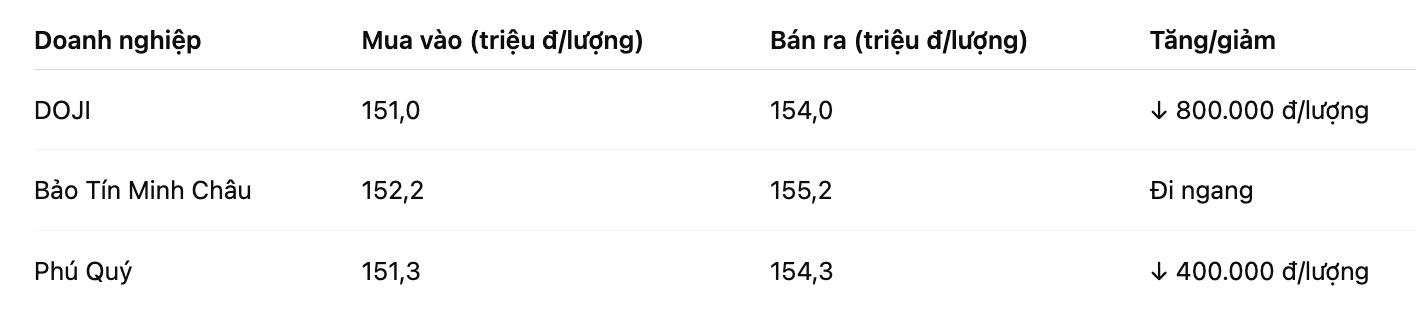

As of 9:05, DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy - sell), down 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.3-154.3 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

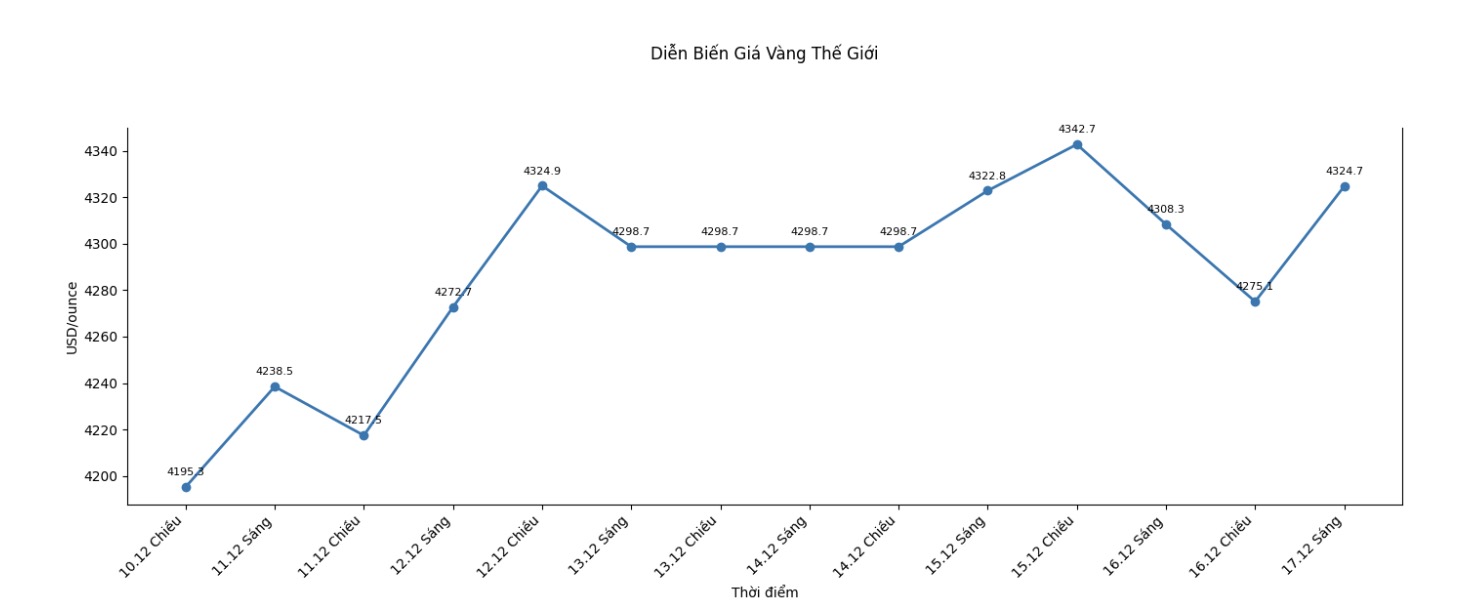

At 9:05, the world gold price was listed around 4,324.7 USD/ounce, up 16.4 USD compared to a day ago.

Gold price forecast

Gold and silver prices increased after a series of economic data showing that the US economy is not too hot but has not cooled down too quickly. Gold and silver prices had weakened overnight and before the US economic reports were released. However, after the figures were released, both precious metals were eased and edged up slightly.

The report showed that US non-farm payrolls increased by 64,000 in November, after falling by 105,000 in October, reflecting the fluctuations in the US labor market in recent months. The overall unemployment rate rose to 4.6%, higher than the 4.5% expected by the market, continuing the upward trend as many unemployed Americans had difficulty finding new jobs.

Another report released on Tuesday said US retail sales were largely unchanged in October, as sales at dealers fell and gasoline revenue weakened, offsetting stronger spending in other product groups. In addition, data from S&P Global shows that US business activity in December grew at the slowest pace in six months, while the input price index soared to its highest level in more than three years.

Morgan Stanley (a US multinational financial services and investment banking corporation headquartered in New York) said on Tuesday that gold prices are likely to increase more slowly in 2026, as central banks and exchange-traded funds (ETFs) slow down their buying pace.

However, interest rate cuts along with a weakening USD are expected to continue to support the upward trend of this precious metal.

The bank expects gold prices to reach $4,800/ounce in the fourth quarter, with supporting factors including strong retail demand in China, increased central bank buying and concerns about global economic growth.

Technically, buyers for February gold contracts are aiming for the next target of closing above the strong resistance zone at the contract's record peak of $4,433/ounce. Meanwhile, the sellers have a short-term goal of pushing prices below the important technical support zone at 4,200 USD/ounce.

The first resistance level recorded at the highest level of the day was 4,367.9 USD, followed by the high of the previous week at 4,387.8 USD/ounce. The first support level was at the bottom of the night at $4,297.4/ounce, followed by $4,250/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot market. Second is the futures contract market, which sets prices for future deliveries.

See more news related to gold prices HERE...