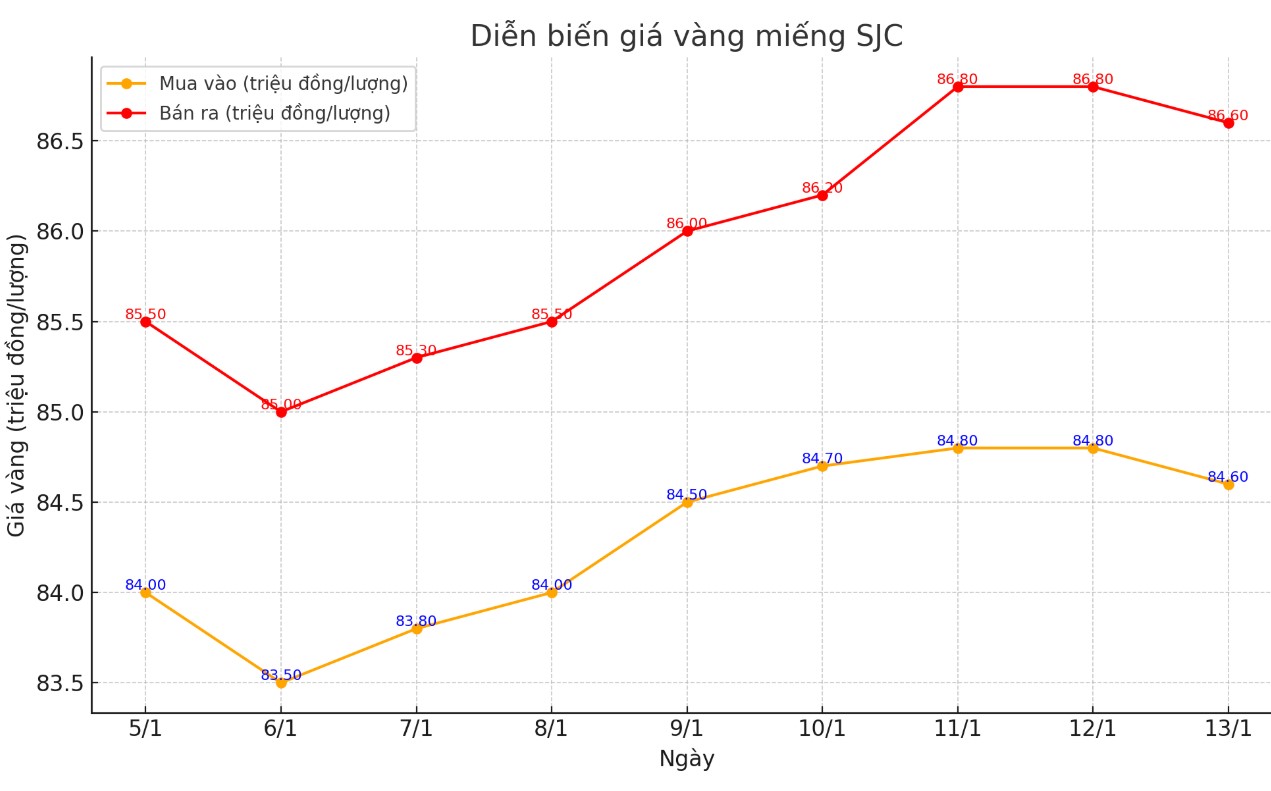

Update SJC gold price

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.8-86.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.8-86.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.8 million VND/tael (buy - sell).

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

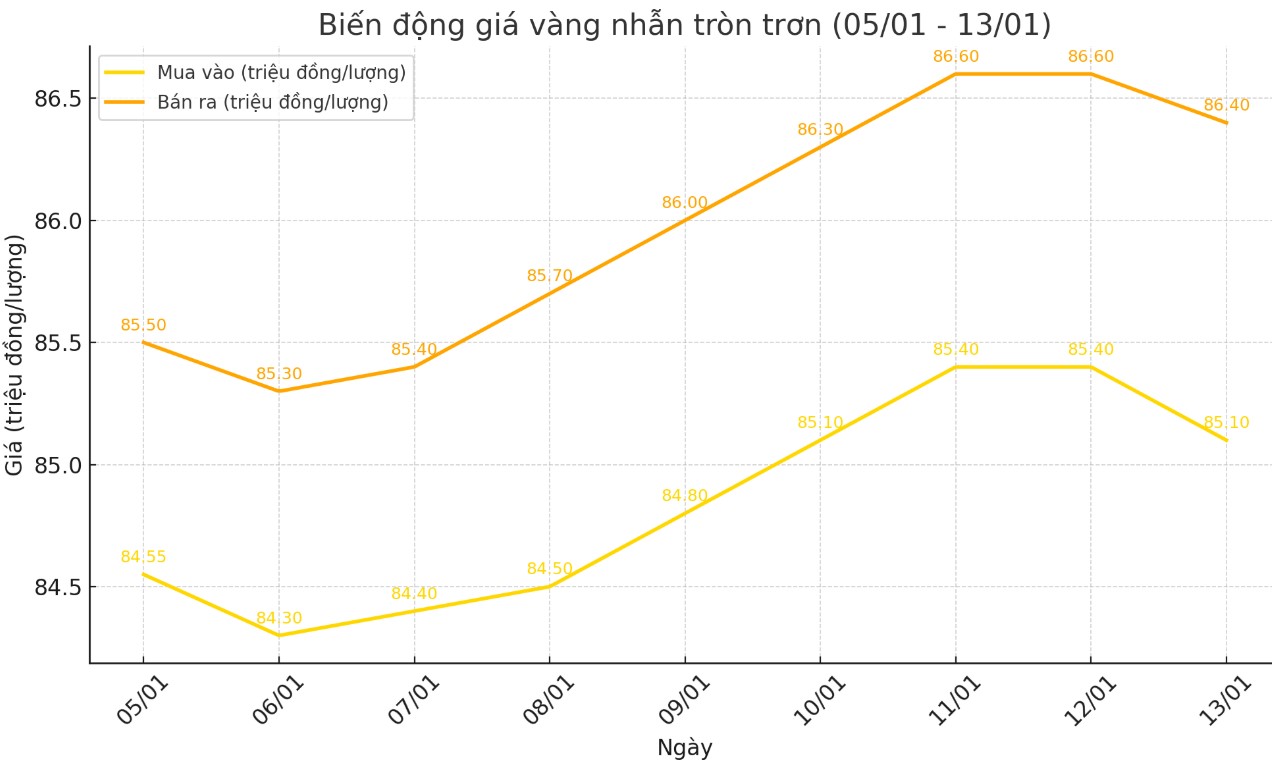

Price of round gold ring 9999

As of 7:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.1-86.4 million VND/tael (buy - sell); down 300,000 VND/tael for buying and down 200,000 VND/tael for selling compared to the closing price of yesterday afternoon's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.2-86.6 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling compared to the closing price of yesterday afternoon's trading session.

World gold price

As of 6:20 p.m., the world gold price listed on Kitco was at 2,679.2 USD/ounce, down 10.1 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices fell amid a sharp increase in the USD index. Recorded at 6:20 p.m. on January 13, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109.920 points (up 0.40%).

Despite reacting rather late, the gold market is under pressure from the optimistic US employment report, released on Friday (10.1). The report shows that the US economy is recovering well and is consistent with the US Federal Reserve's (FED) cautious policy easing stance; especially when US President-elect Donald Trump pledged to sharply increase tariffs on imported goods, which could increase inflation.

The market is focusing on the US monthly inflation data released later this week, as well as speeches by several Fed officials, to predict the direction of gold prices in the coming time.

Traders expect the Fed to keep interest rates unchanged at its meeting in late January 2025 and the agency to cut interest rates only once this year in June 2025.Gold is used as a hedge against inflation, although rising interest rates reduce the appeal of this non-yielding asset.

Despite the slight decline in gold prices, many experts are still positive. Kitco News' 2025 Gold Price Survey shows that retail traders still believe in gold's ability to outperform in an uncertain world.

51% expect gold to lead all other metals this year. 36% predict silver will be the biggest gainer in 2025. Only 8% expect copper to be the strongest performer. The rest expect platinum and palladium to outperform other metals in 2025.

Gold prices continue to be supported by stronger-than-expected demand from central banks, according to the World Gold Council (WGC) Gold Outlook 2025 report.

See more news related to gold prices HERE...