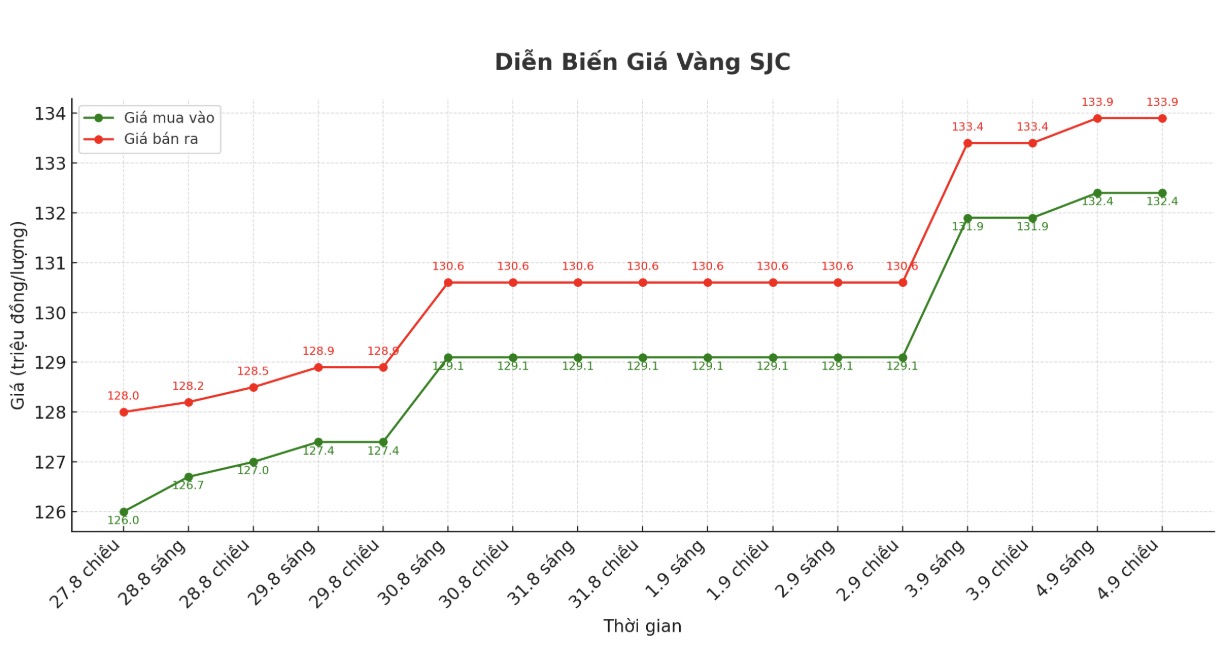

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at VND132.4-133.9 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 132.4-133.9 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 131.5-133.9 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.4 million VND/tael.

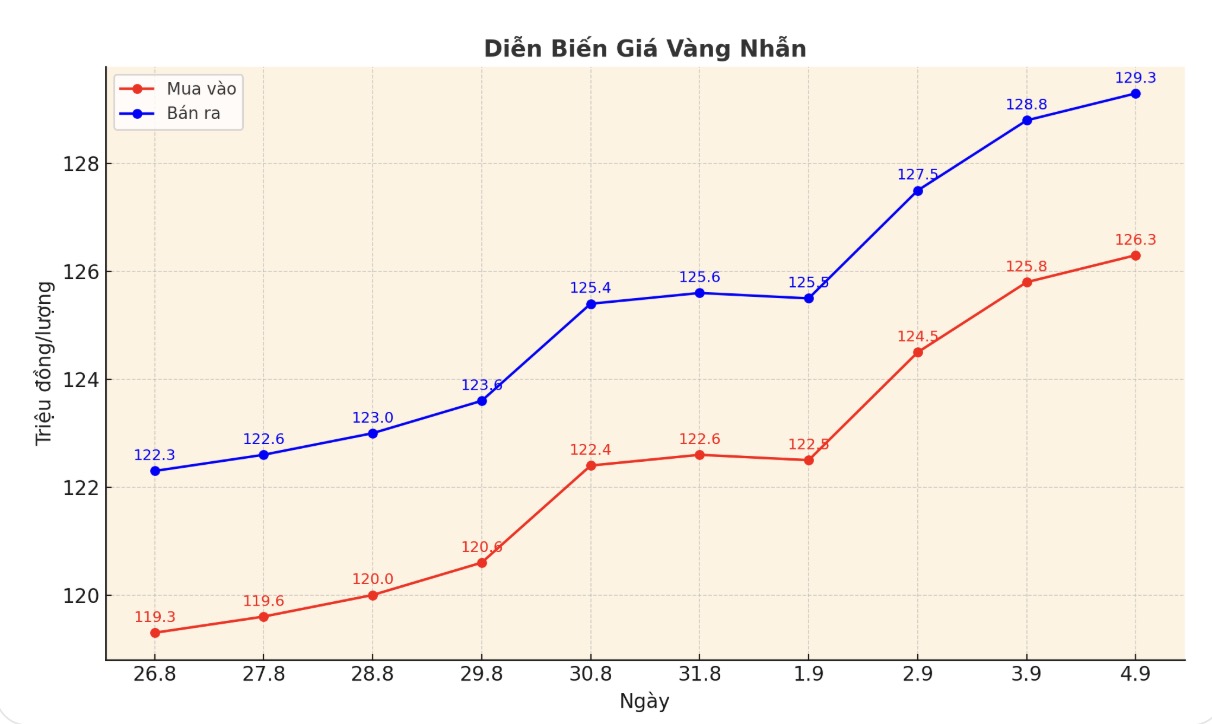

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 126.3-129.3 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 126.5-129.5 million VND/tael (buy - sell), an increase of 800,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 126.1-129.1 million VND/tael (buy in - sell out), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

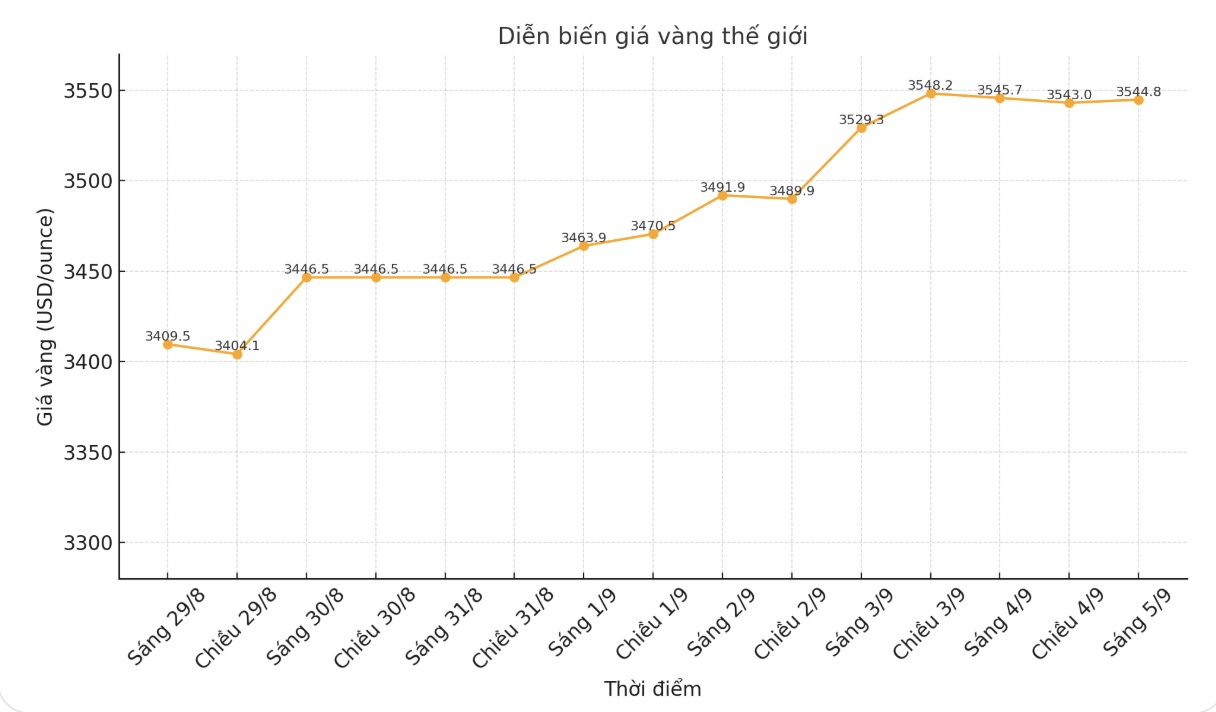

World gold price

The world gold price was listed at 2:00 a.m. at 3,544.8 USD/ounce, up 25.4 USD.

Gold price forecast

Gold's rally slowed as short-term futures traders took profits after gold set an all-time record and silver hit a 14-year high on Wednesday.

December gold contract decreased by 30.1 USD, to 3,605 USD/ounce. December delivery silver price decreased by 0.65 USD, to 41.405 USD/ounce.

After a series of US economic data released today but did not cause significant market fluctuations, the most important data of the month will come on Friday morning: the US Department of Labor's employment report.

Analysts predict that jobs will extend their weakest job growth streak since the pandemic, likely strengthening the Fed's interest rate cut.

Non-farm payrolls are expected to increase by 75,000 in August, marking the fourth consecutive month of increase below 100,000. The unemployment rate is expected to increase to 4.3%, the highest level since 2021.

Technically, bulls are still in a strong position in the short term with December gold delivery contracts. The next target for buyers is to close above the solid resistance level of 3,700 USD/ounce.

In contrast, the nearest target for the bears is to pull prices below the strong technical support zone at $3,500/ounce.

The first resistance level was at the above-night high of $3,621.6 an ounce, followed by a trading peak of $3,640.10 an ounce on Wednesday. First support was at the lowest level of the day at 3,573.70 USD/ounce, then 3,550 USD/ounce.

The outside market today recorded a slight increase in the USD index, crude oil prices decreased and traded around 63.50 USD/barrel. The yield on the 10-year US Treasury note is currently around 4.2%.

Notable US economic data this week

Thursday: ADP, unemployment claims, ISM services PMI.

Friday: Non-farm payrolls report.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...