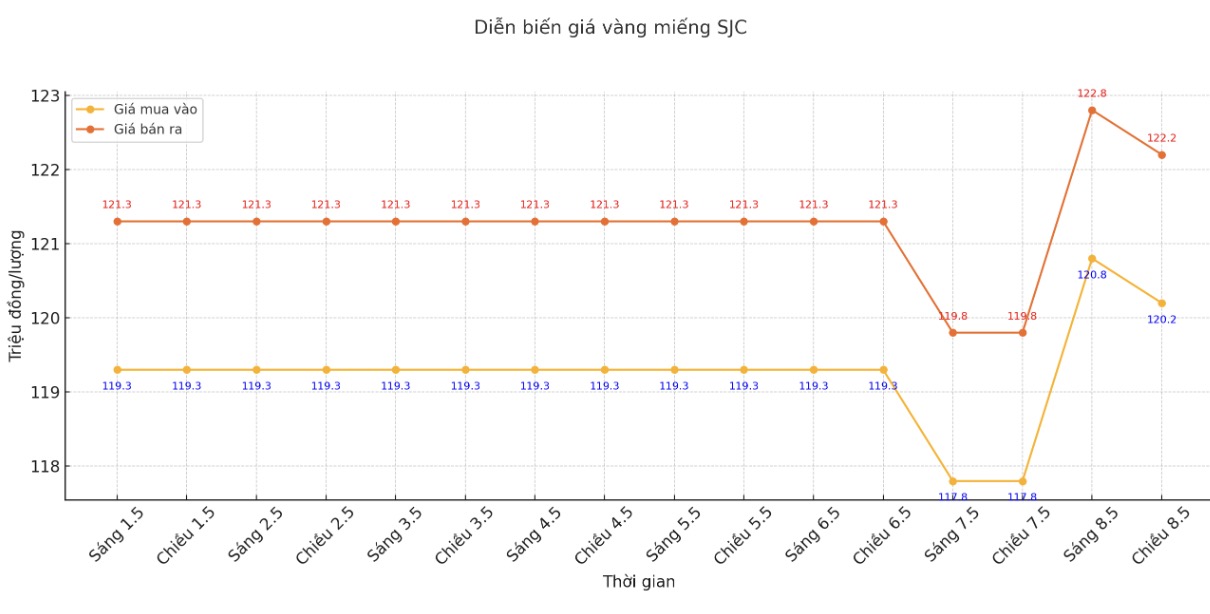

Updated SJC gold price

As of 6:00 a.m. on May 9, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), down VND 1.7 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy in - sell out), down 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.3-120.5 million VND/tael (buy - sell), down 1.9 million VND/tael for buying and down 1.7 million VND for selling. The difference between buying and selling prices is at 2.2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.5-120.5 million VND/tael (buy - sell), down 1.2 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

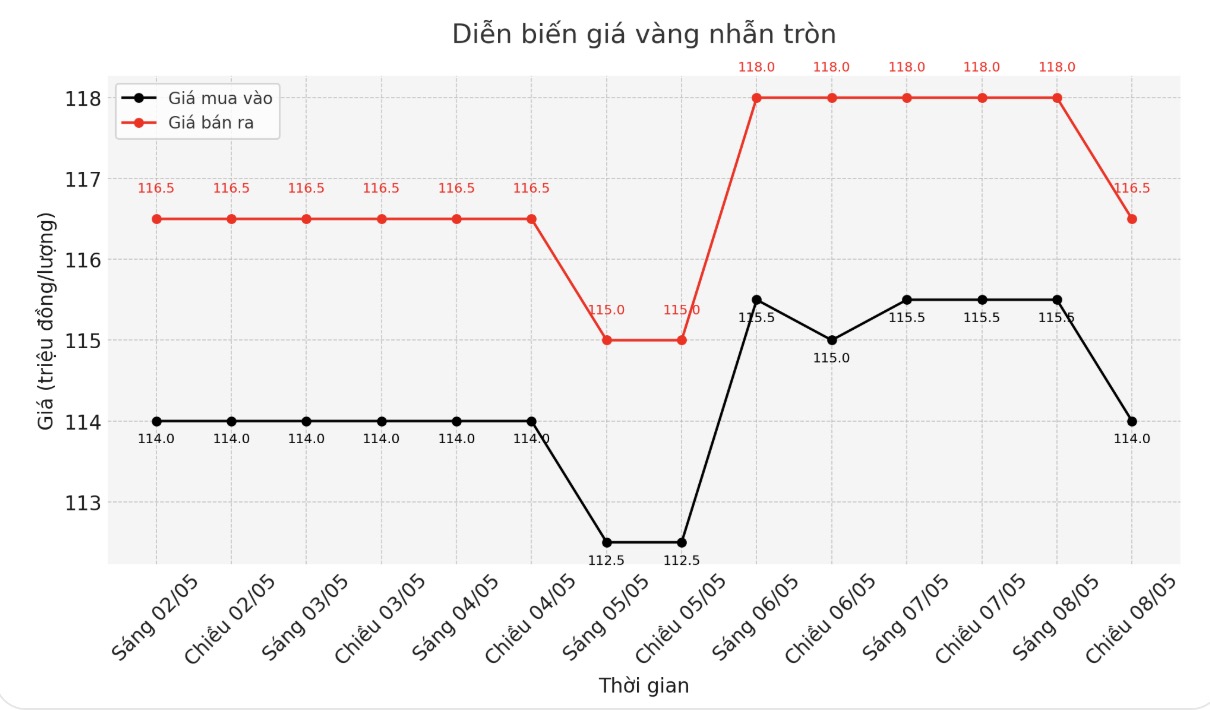

9999 round gold ring price

As of 6:00 a.m. on May 9, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114-116.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.5-1195 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.5-117.5 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

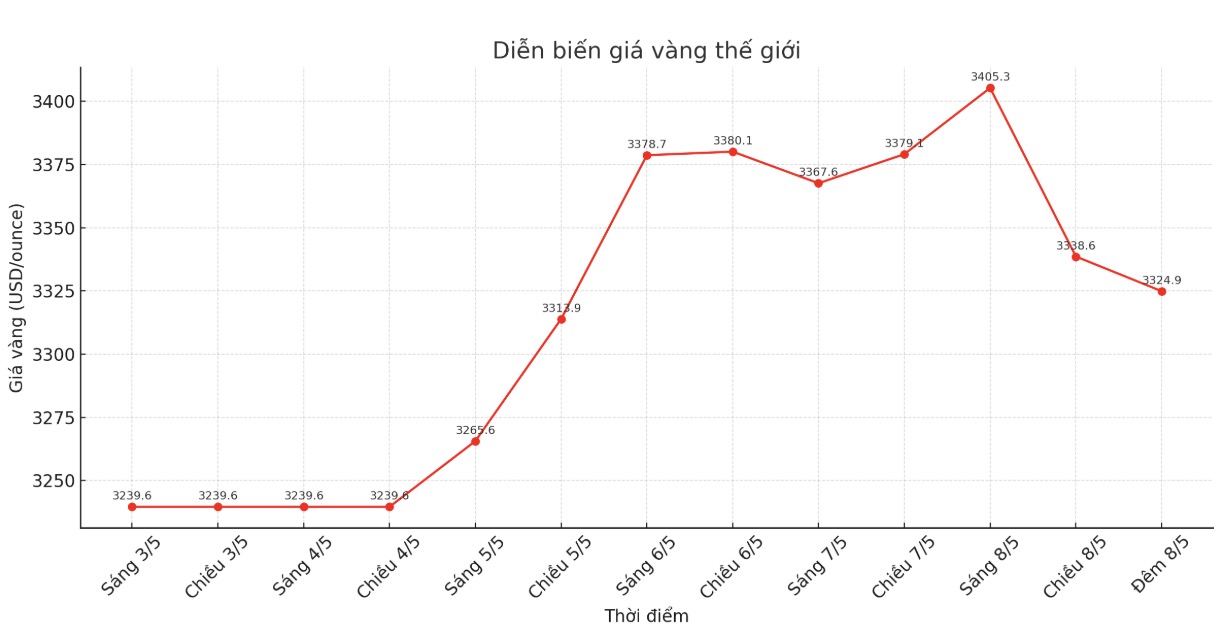

World gold price

At 23:00 on May 8, the world gold price listed on Kitco was around 3,324.9 USD/ounce, down 43 USD.

Gold price forecast

According to Kitco, world gold prices fell due to profit-taking after the previous increase. The increase in the USD index is also an unfavorable factor for gold and silver. Gold futures for June are currently down 40.4 USD, down to 3,351.5 USD/ounce. July gold futures fell $0.216 to $22.575 an ounce.

The Asian and European stock markets generally increased in the overnight session. US stock indexes are also expected to open up strongly.

Increased risk-off sentiment in the market has also put pressure on safe-haven metals. Investors' risk appetite improved after US President Donald Trump announced that he would hold a "big press conference" on Friday morning, with the content of a "big trade deal with the representative of a large and very dignified country" - said to be the UK.

Mr. Trump added that this will be the first of many deals. However, the specific details of the deal are still unclear and observers believe that this statement is in the context of many changes in the Trump administration's statements on trade.

At the same time, the US and China are also expected to resume trade talks in Switzerland this weekend.

In other developments, the Bank of England (BoE) has cut the key interest rate by 0.25 percentage points - in line with market expectations.

Technically, buyers still have the advantage in the short term. The next target for buyers is to close above the resistance level of 3,448.20 USD/ounce. Meanwhile, the sellers will try to pull the price below 3,209.40 USD/ounce.

The most recent resistance was $3,400/ounce, followed by $3,422/ounce. The most recent support is last night's bottom of $3,325.4 an ounce, then $3,300 an ounce.

In the outside market, the USD index increased, the US slightly sweet crude oil (WTI) price was trading around 59 USD/barrel. The yield on the 10-year US government bond is currently at 4.308%.

See more news related to gold prices HERE...