The gold and silver futures contract market recorded a wave of liquidation of buying positions, as many short-term traders - those who took advantage of bottom-fishing at the beginning of the week - are accepting losses as the market quickly reverses direction.

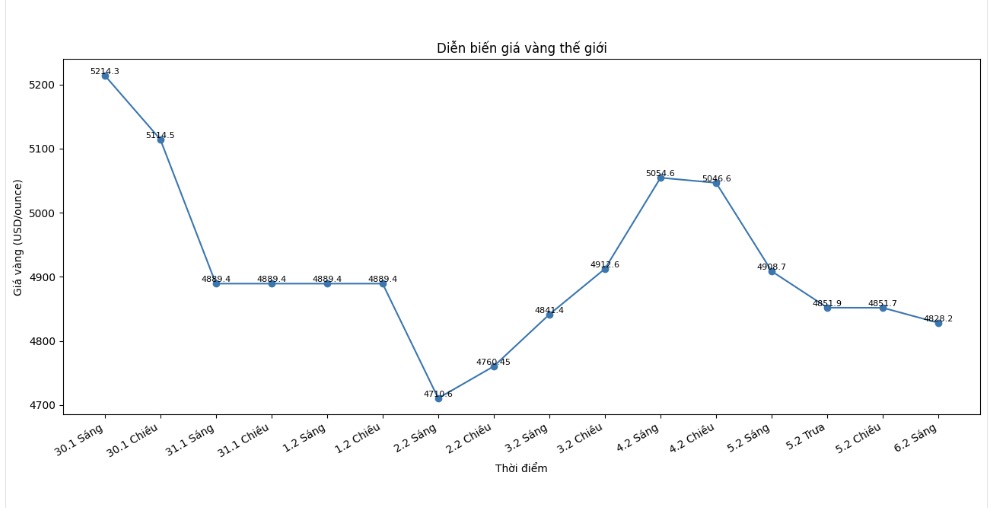

The upward momentum of the USD index along with the sharp drop in crude oil prices in today's session continued to create more pressure on the precious metal group. At the end of the session, gold futures for April fell 48 USD, to 4,803 USD/ounce. Meanwhile, silver futures for March plummeted to 8.29 USD, to 76.25 USD/ounce.

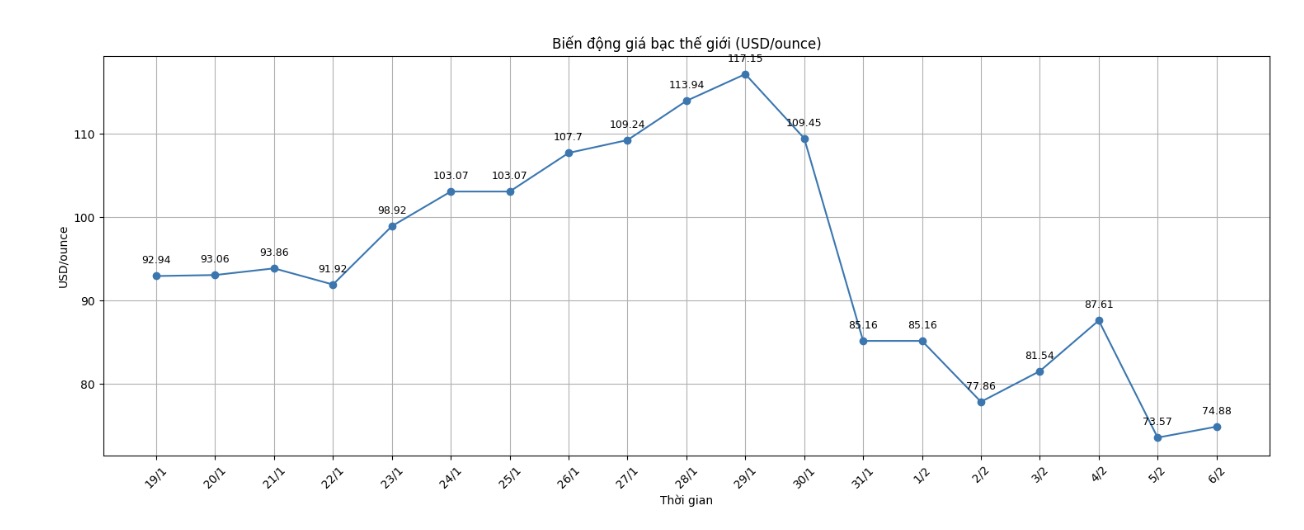

After an impressive recovery earlier this week, gold and silver quickly returned to a state of strong volatility. According to Bloomberg, spot silver prices "evaporated" by 17% in just one night, after jumping above 90 USD/ounce in the early trading session in Asia. The hot increase that took place too quickly and too strongly caused this metal to lose more than one-third of its value compared to the historical peak set on January 29.

The sudden drop in silver also negatively impacted the general sentiment in the basic metal market, when copper prices fell more than 1%, falling below the threshold of 13,000 USD/ton. Meanwhile, spot gold prices at times fell by up to 3.5% in a volatile trading session.

The USD index has risen to its highest level in two weeks, recovering strongly after hitting a four-year low at the end of January. The greenback was supported by a series of positive US economic data, along with information that US President Donald Trump nominated Mr. Kevin Warsh - who used to have a tough stance on monetary policy - for the next position of Chairman of the US Federal Reserve (Fed).

Technically, the April gold futures price has formed a strong reversal pattern of decline on the daily chart last week - a sign that the market may have created a short-term peak.

The nearest resistance level for gold is determined around the 5,000 USD/ounce mark, while the important support zone is in the 4,700 USD/ounce area. The market ranking according to Wyckoff is currently at 6,0, reflecting that the advantage is still slightly leaning towards buyers but the risk of correction is increasing.

On the daily chart, the silver futures price for March is forming a "bearish pennant" pattern, showing that the risk of correction is still present after a period of strong fluctuations.

On the upside, the next price target of the buying side is to close above the strong technical resistance zone at the peak of this week, around 92.015 USD/ounce. Conversely, the selling side is aiming to pull the price down below the important support level of 70 USD/ounce.

In the short term, the nearest resistance zone is determined at 80 USD/ounce, followed by 82.50 USD/ounce. On the support side, the first support level is at the bottom of this week, around 71.20 USD/ounce, before retreating to the psychological level of 70 USD/ounce.

According to Wyckoff's assessment, the market ranking of silver is currently at 5.0, reflecting a relative balance between buying and selling forces, but the short-term trend still contains many fluctuations.

In the energy market, crude oil prices turned down for the first time after three consecutive rising sessions, after Iran confirmed it would hold talks with the US, easing concerns about the risk of military conflict. Brent oil prices retreated to around 68 USD/barrel, while WTI oil traded nearly 64 USD/barrel.