The precious metals market this week has not fared well, as both geopolitical tensions and expectations of the US Federal Reserve (FED) to loosen monetary policy have not been enough to create momentum to help prices maintain their upward momentum.

Gold futures fell about $15 (-0.38% on Friday and lost a total of about $24 (-0.59% for the whole week.

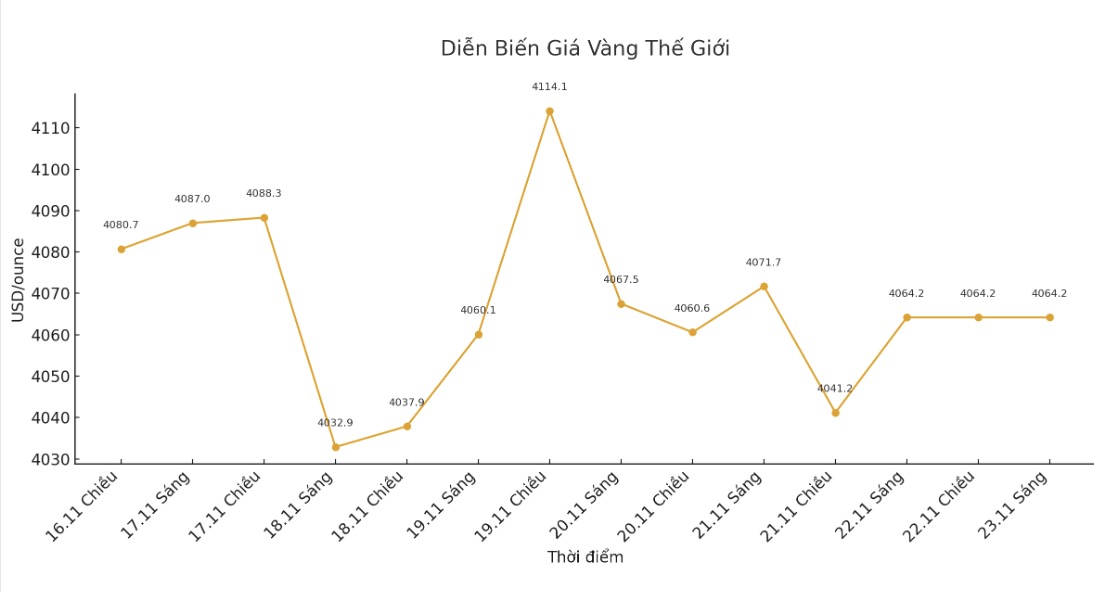

Gold moved within a $100 range throughout the five trading days, creating a support zone at $4,000 and resistance at $4,100/ounce. The lowest level of the week appeared on Tuesday when prices fell below the threshold of 4,000 USD/ounce, reaching 3,997 USD/ounce.

On Wednesday, gold futures surged to a weekly peak of $4,134 an ounce before giving up much of the increase, leaving a long ball of candlelight on the daytime chart.

US employment data changes expectations of FED interest rate cuts

The US Bureau of Labor Statistics (BLS) released its first report on Thursday after the government reopened. October employment data showed a stronger-than-expected increase in the number of jobs, with 144,000 new positions, far exceeding the consensus forecast by about 50,000. However, the unemployment rate continues to trend upward, approaching the highest level in four years at 4.4%.

The September employment report, due out on October 3, is the first major economic index to be delayed due to government shutdowns. Since the BLS completed data collection before the suspension of operations on October 1, this report became one of the first to be published after the government resumed operations.

The BLS said on Wednesday that the October jobs report, due out on November 7, will not be released individually. Instead, these figures will be combined with the November report due on December 16, which is after the Federal Reserve's next policy meeting.

Responding to this information, the market has raised expectations for an interest rate cut at the upcoming meeting of the Federal Open Market Committee, as reflected in significant fluctuations in the CME FedWatch tool.

Geopolitical developments

According to reports, US officials have pressured the Ukrainian leadership to accept a peace deal that would require territory ceded to Russia.

According to Reuters, Ukrainian President Volodymyr Zelensky may be being pushed to consider a 28-point proposal from Washington ahead of schedule on Thursday. Some analysts said that security support could be adjusted depending on the progress of the discussion.

Both Ukraine and Moscow have denied being notified or approved of the plan. Some Western media sources said the proposal was built between US negotiator Steve Witkoff and Kremlin official Kirill Dmitriev without the participation of Europe or Ukraine, and the terms were almost consistent with current Russian demands.

Silver for inspecting important technical assistance areas

Silver prices ended the week below $50/ounce, marking the first close below this important threshold since November 7. The metal fell $1.77 (1.5%) to $49.91/ounce. Despite losing the key support zone, silver has recovered strongly from its session low of $48/ounce, equivalent to a bounce of $1.86 in trading hours in New York.

Notably, the lowest level of the session coincided with the 50-day moving average - a technical indicator that has played a supporting role for silver prices over the past four months (129 days), only briefly penetrated once in August. This technical convergence may have created attractive order points for traders holding buying positions.