Updated SJC gold price

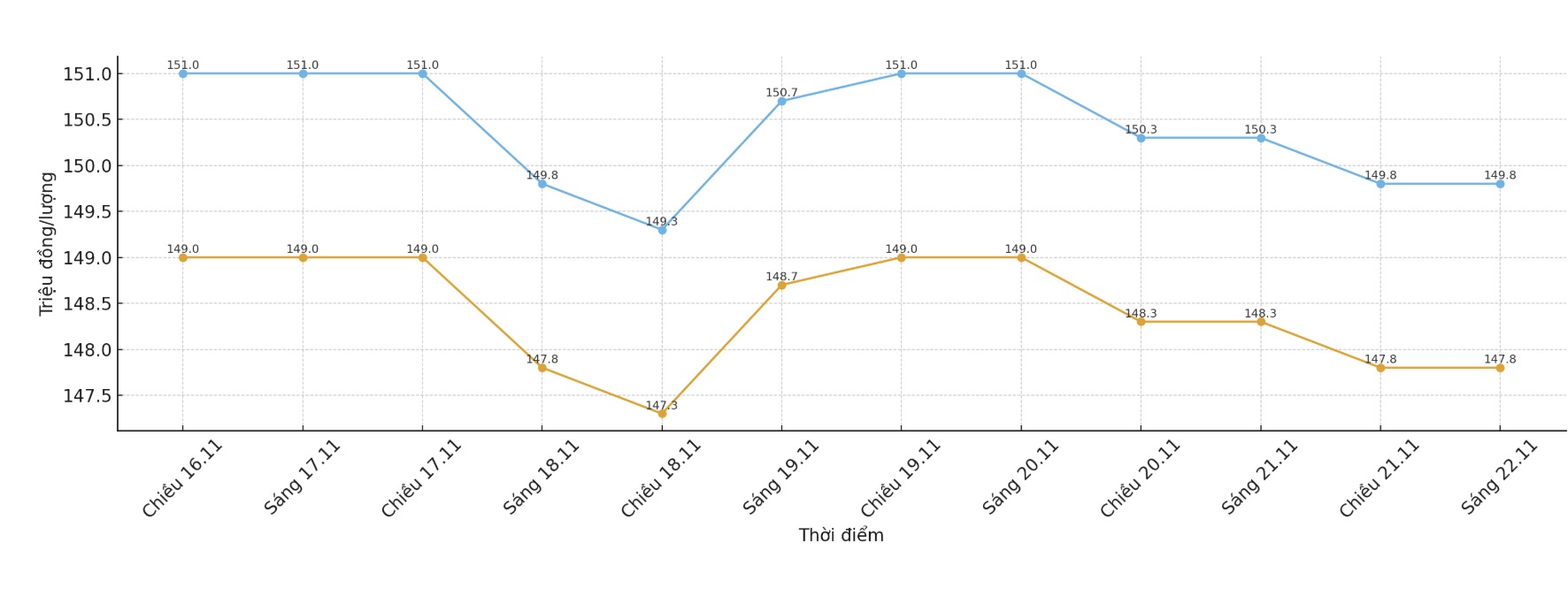

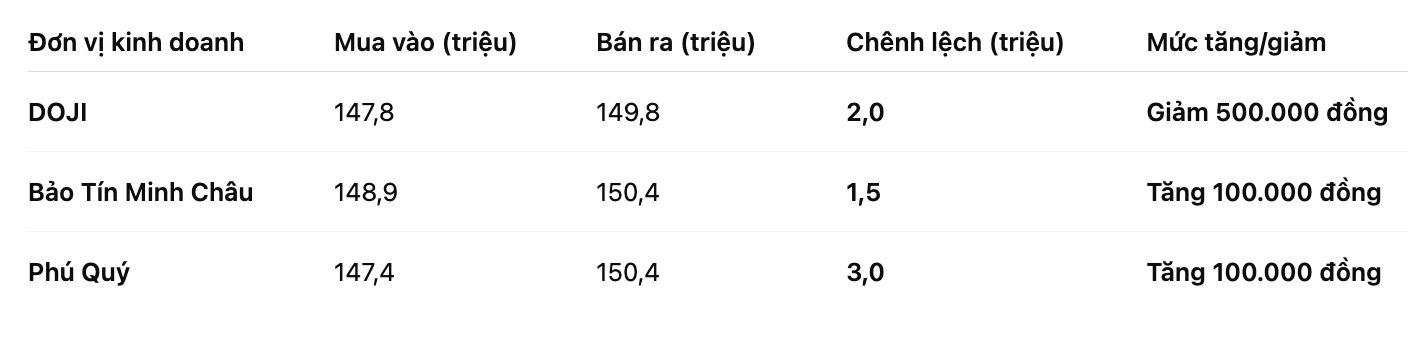

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at 147.8-149.8 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.9-150.4 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.4-150.4 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

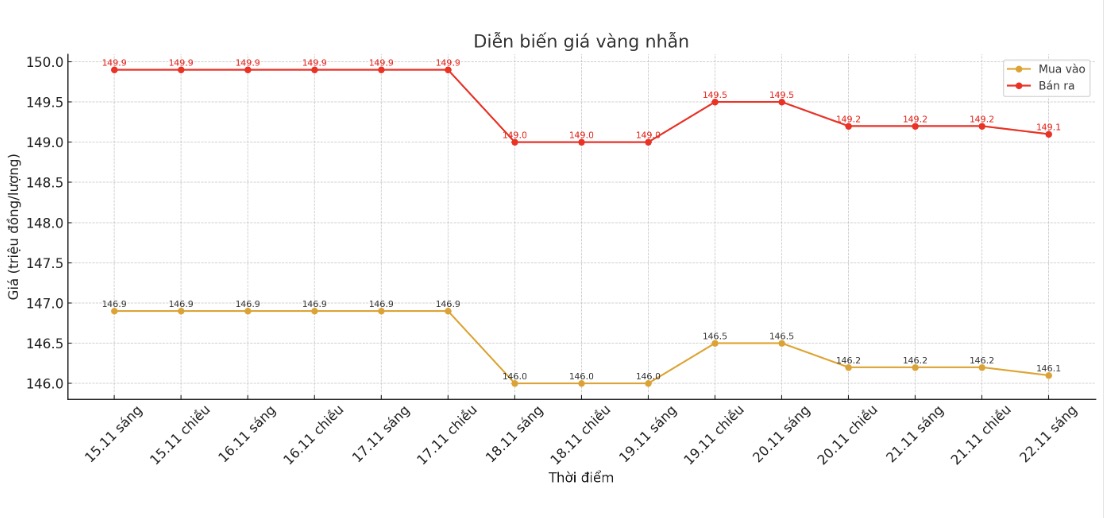

As of 9:15 a.m., DOJI Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.6-150.6 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147-150 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

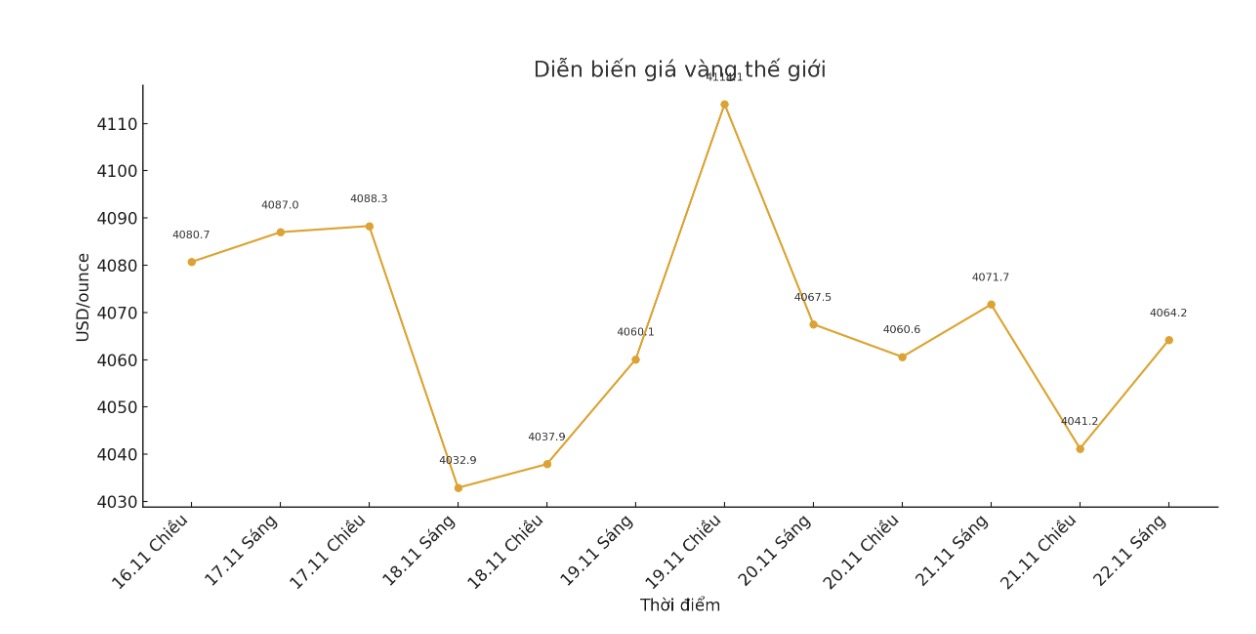

World gold price

At 9:18 a.m., the world gold price was listed around 4,064.2 USD/ounce, down 7.5 USD compared to a day ago.

Gold price forecast

The world gold market ended the trading week with many notable fluctuations when a series of important economic data in the US were released.

Despite still holding the support zone above $4,000/ounce, the precious metal is facing many mixed factors related to consumer sentiment, inflation and economic health.

Data from the University of Michigan shows that US consumer sentiment in November improved slightly after the federal government ended the closure. The consumer psychology index was at 51 points, higher than the forecast but still lower than last month.

Meanwhile, the market received new signals from S&P Global's PMI data. The preliminary tong thong PMI rose to 54.8, a four-month high, showing that US economic activity remains stable. The main driver came from the service sector with an increase of 55.0, exceeding the forecast. The manufacturing PMI decreased slightly but was still in the growth zone.

UBS (Switzerland's leading financial services group) has just raised its gold price target for mid-2026 to $4,500/ounce - from $4,200 before, based on expectations of the US Federal Reserve (FED) cutting interest rates, prolonged geopolitical risks, fiscal concerns and strong demand from central banks and ETF investors.

We expect gold demand to continue to increase in 2026, affected by the Feds forecast of rate cuts, real yield cuts, prolonged geopolitical uncertainties, and changes in the domestic policy environment in the US, UBS wrote in a report on Thursday.

The bank also raised its target price in the scenario of a sharp increase of 200 USD, to 4,900 USD/oz, in case of a political and financial risk outbreak, but still maintained the down scenario at 3,700 USD/ounce.

According to UBS analysts, the US's increasingly poor fiscal outlook could support central banks and investors' gold purchases. They also expect ETF demand to remain strong in 2026.

However, UBS warned that the potential "hawl" policy of the FED and the risk of central banks selling gold are still major challenges for the price increase prospect.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries. Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...