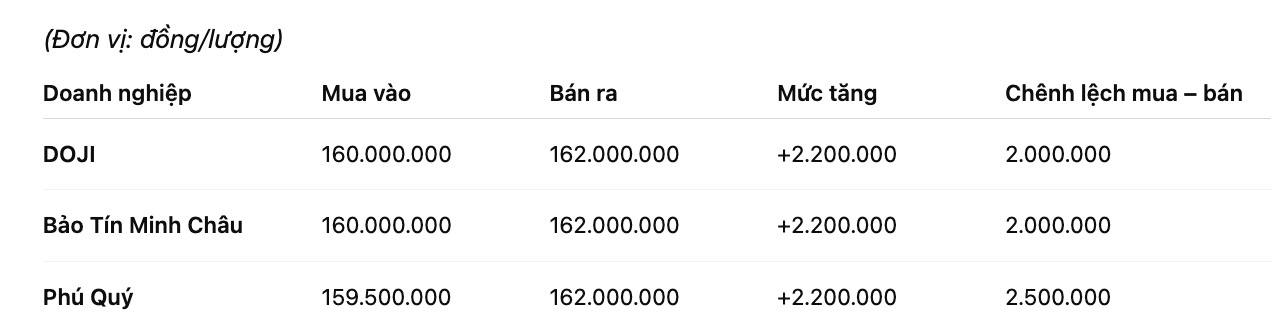

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 160-162 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 160-162 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 159.5-162 million VND/tael (buying - selling), an increase of 2.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

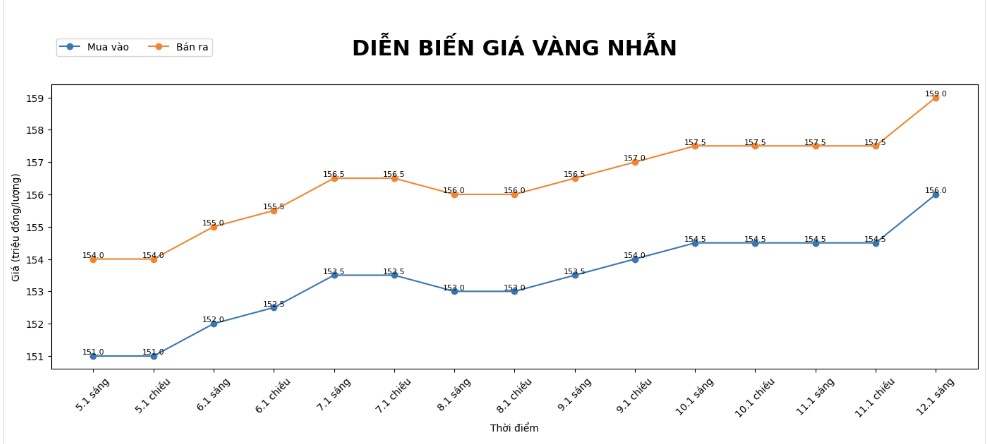

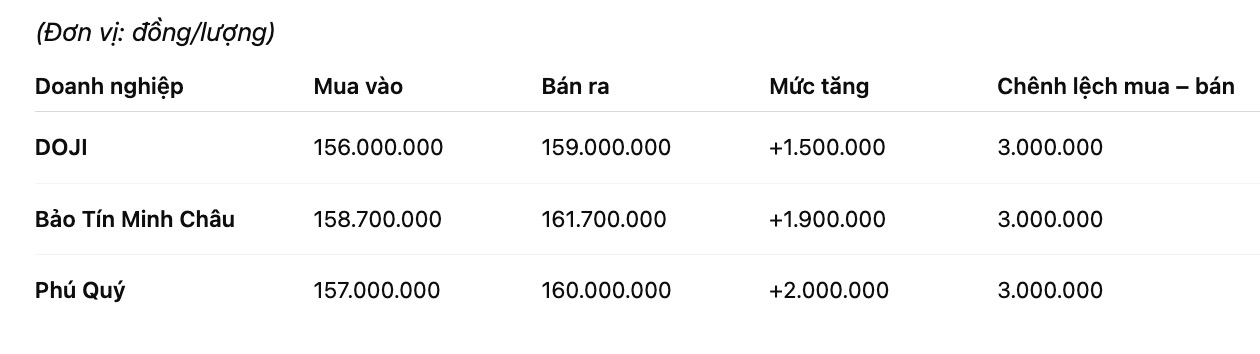

9999 gold ring price

As of 9:15 am, DOJI Group listed the price of gold rings at the threshold of 156-159 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 158.7-161.7 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 157-160 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

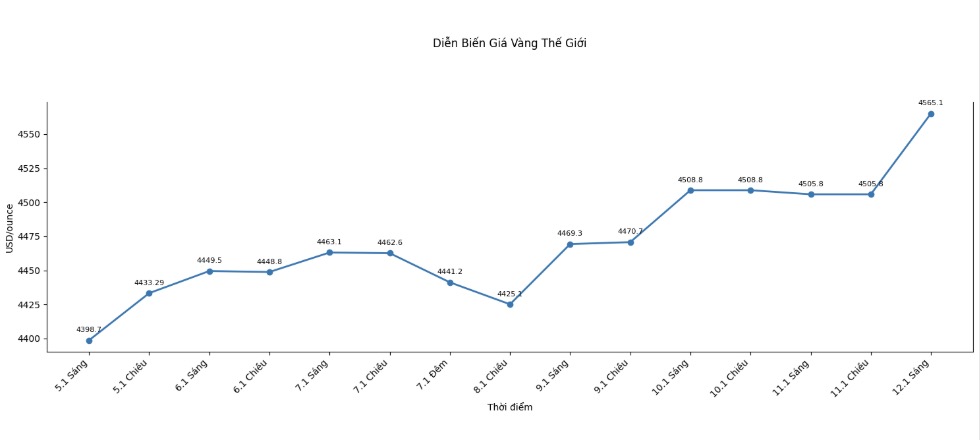

World gold price

At 9:17 am, world gold prices were listed around the threshold of 4,565.1 USD/ounce, up 56.3 USD compared to the previous day.

Gold price forecast

Analysts believe that factors supporting gold prices in the short term are still dominant. Mr. Sean Lusk - co-director of risk hedging at Walsh Trading, said that safe haven demand is still maintained at a high level in the context of global geopolitical and economic risk information appearing densely on news reports. According to him, even when the USD has recovered, demand for precious metals is still strong enough to keep gold prices high.

Mr. Lusk also said that the seasonal factor is supporting the market, as the period from the end of the year to after the New Year is usually the time when physical gold and investment demand increases. In addition, the expectation that the US Federal Reserve will shift to a softer stance in the coming months continues to be an important driving force, helping gold maintain its upward trend. According to this expert, gold prices may still have room to increase in the first quarter, before the market enters the stage of re-evaluating macroeconomic prospects in the following quarters.

UBS Bank has just attracted attention by strongly adjusting its gold price target for 2026. According to the Swiss bank's strategist group, gold could reach the 5,000 USD/ounce mark in the third quarter of 2026 and even reach 5,400 USD/ounce if political or fiscal risks in the US escalate. UBS believes that the low real interest rate environment, along with prolonged instability surrounding US domestic policy and global economic prospects, will continue to promote cash flow to turn to gold as a safe haven.

Sharing the same view, Societe Generale said they still hold a 10% proportion of gold in their multi-asset portfolio and expect the price of this precious metal to reach 5,000 USD/ounce by the end of 2026. According to the French bank, capital flows from individual investors and central banks continue to flow strongly into gold, in the context that many countries want to reduce dependence on USD-denominated assets.

From a short-term perspective, the gold market is still strongly influenced by US monetary policy. Recent job data shows that the US labor market is showing signs of cooling down, raising expectations that the US Federal Reserve (Fed) will soon ease its policy.

Mr. Bart Melek - Head of Global Commodity Strategy at TD Securities said that the weakening of the labor market, combined with inflation and high energy prices, is creating a very favorable environment for precious metals.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...