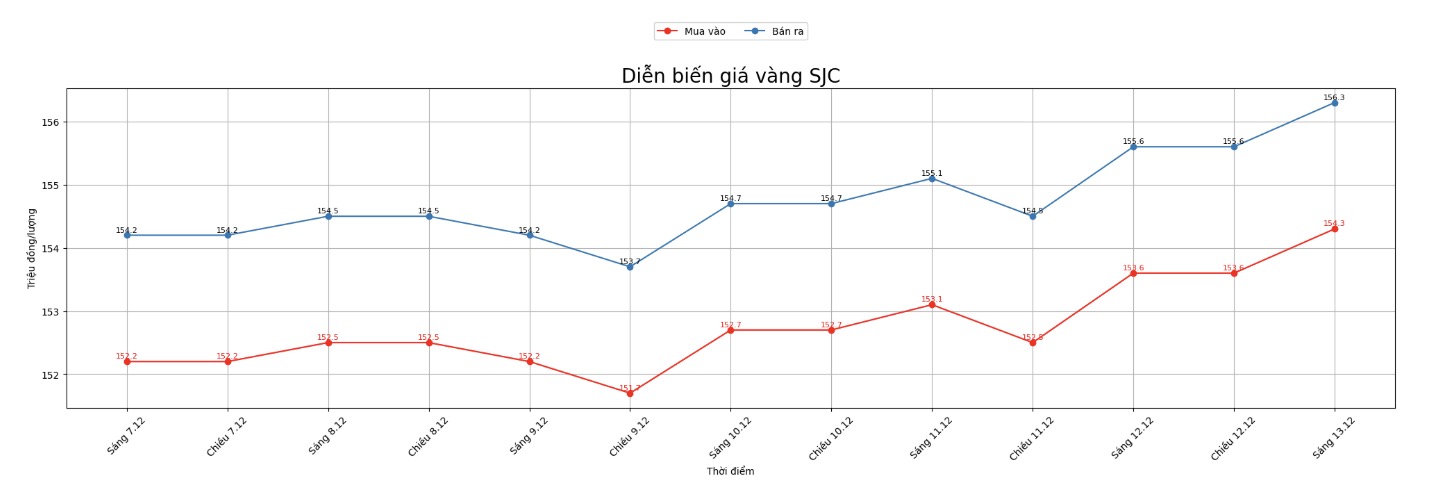

Updated SJC gold price

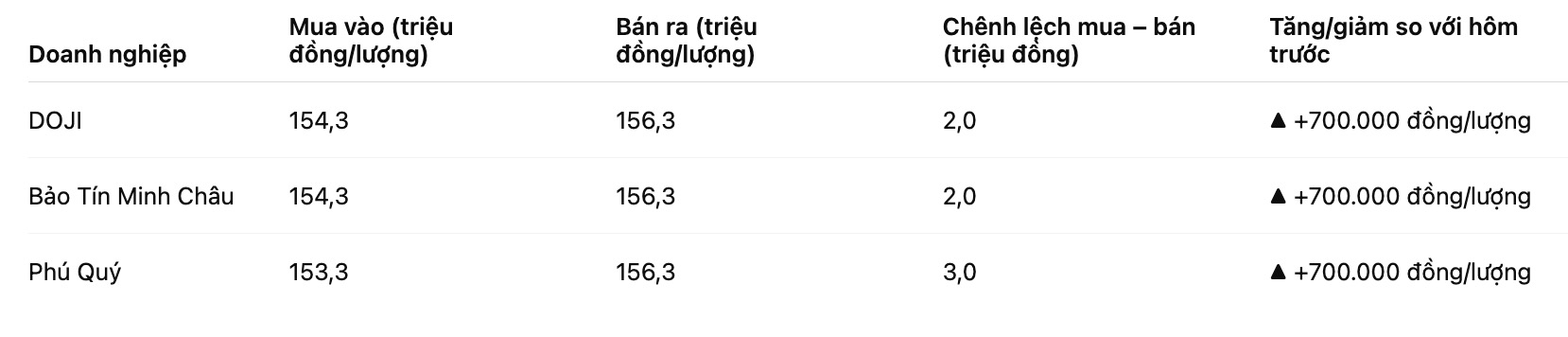

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at VND154.3-156.3 million/tael (buy in - sell out), an increase of VND700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.3-156.3 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.3-156.3 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

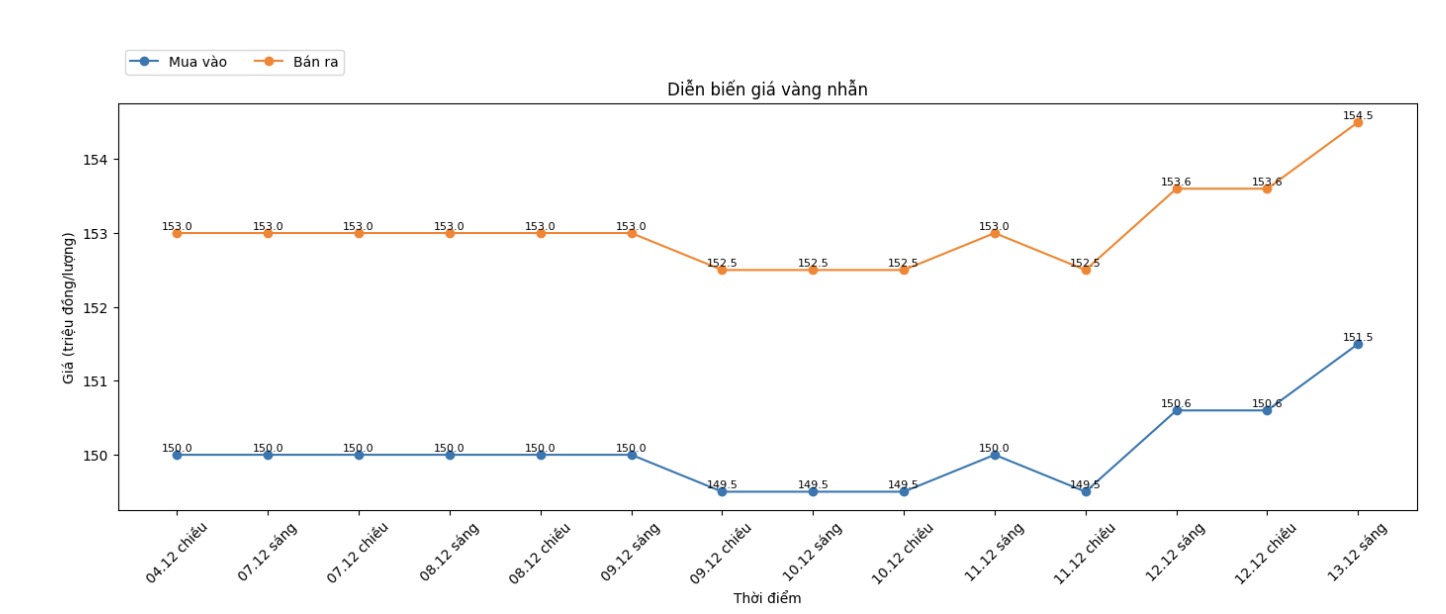

9999 round gold ring price

As of 9:45 a.m., DOJI Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.5-155.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.5-154.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

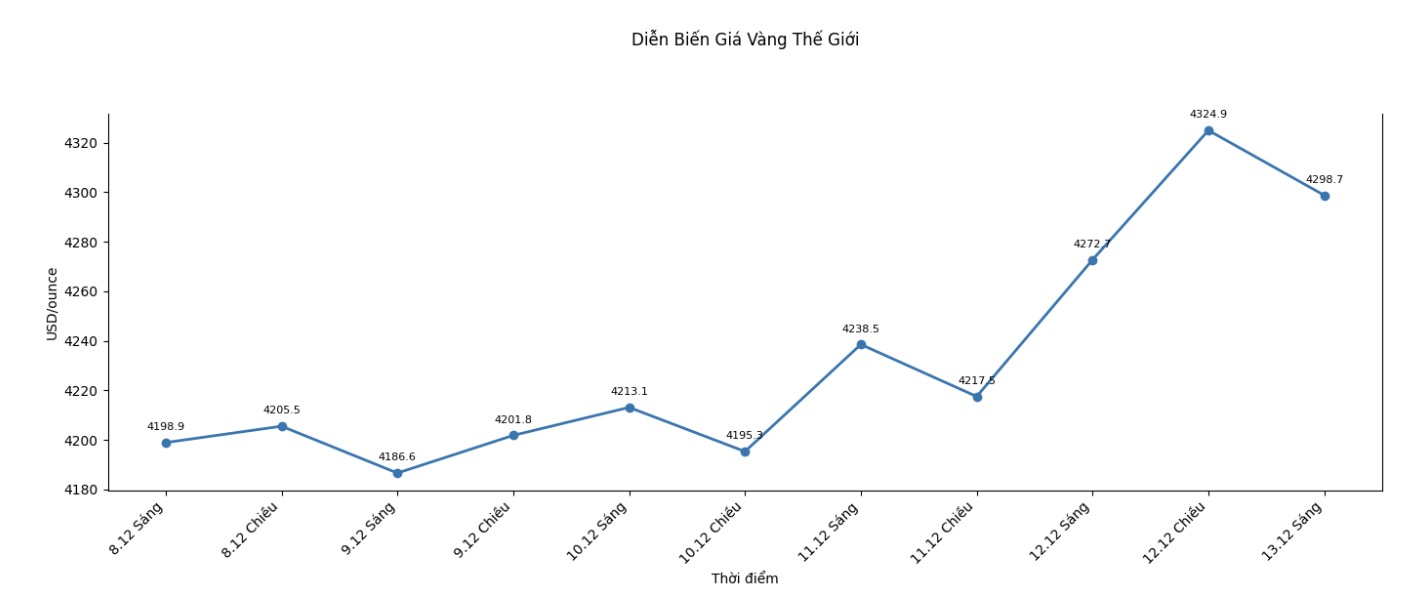

World gold price

At 9:50 a.m., the world gold price was listed around 4,298.7 USD/ounce, up 26 USD compared to a day ago.

Gold price forecast

Gold and silver prices rose steadily and hit a seven-week high in the early trading session in the US on Friday. Silver prices also increased and set a new record of $64.955 an ounce in the overnight trading session, calculated according to the March silver futures contract on the Comex exchange.

The two precious metals are witnessing strong technical buying power and are supported by the unexpected loose stance of the US Federal Reserve (Fed), along with the weakening of the USD index.

Notably, other major economies such as Australia, Canada and Europe are seeing expectations adjusted to tighten, continuing to put downward pressure on the USD. The greenback is expected to weaken against most major currencies this week, with the strongest decline coming against the euro.

On geopolitics, US President Donald Trump said the US is ready to support Ukraine within the framework of a security deal to end the conflict with Russia. Mr. Trump expressed his disappointment at the slow progress of negotiations.

Technically, buyers for February gold futures are aiming for the next upside target of closing above the strong resistance zone at $4,433/ounce, which is also a record high for the contract. On the other hand, the short-term bearish target for the bears is to push prices below the important technical support zone at $4,200/ounce.

The nearest resistance zone was determined at 4,400 USD/ounce, followed by 4,433 USD/ounce. The support levels were at 4,300 USD/ounce and the bottom recorded in the overnight trading session was 4,295.5 USD/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...