Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND94.3-95.8 million/tael (buy in - sell out), an increase of VND200,000/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.3-95.8 million/tael (buy - sell), an increase of VND200,000/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.4-95.8 million/tael (buy - sell), an increase of VND1.4 million/tael for both buying and selling. The difference between buying and selling prices is at 1.4 million VND/tael.

9999 round gold ring price

As of 9:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND94.9-96.3 million/tael (buy - sell); increased by VND100,000/tael for buying and increased by VND200,000/tael for selling. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 94.95-96.5 million VND/tael (buy - sell); an increase of 1.55 million VND/tael for buying and an increase of 1.5 million VND/tael for selling. The difference between buying and selling is 1.55 million VND/tael.

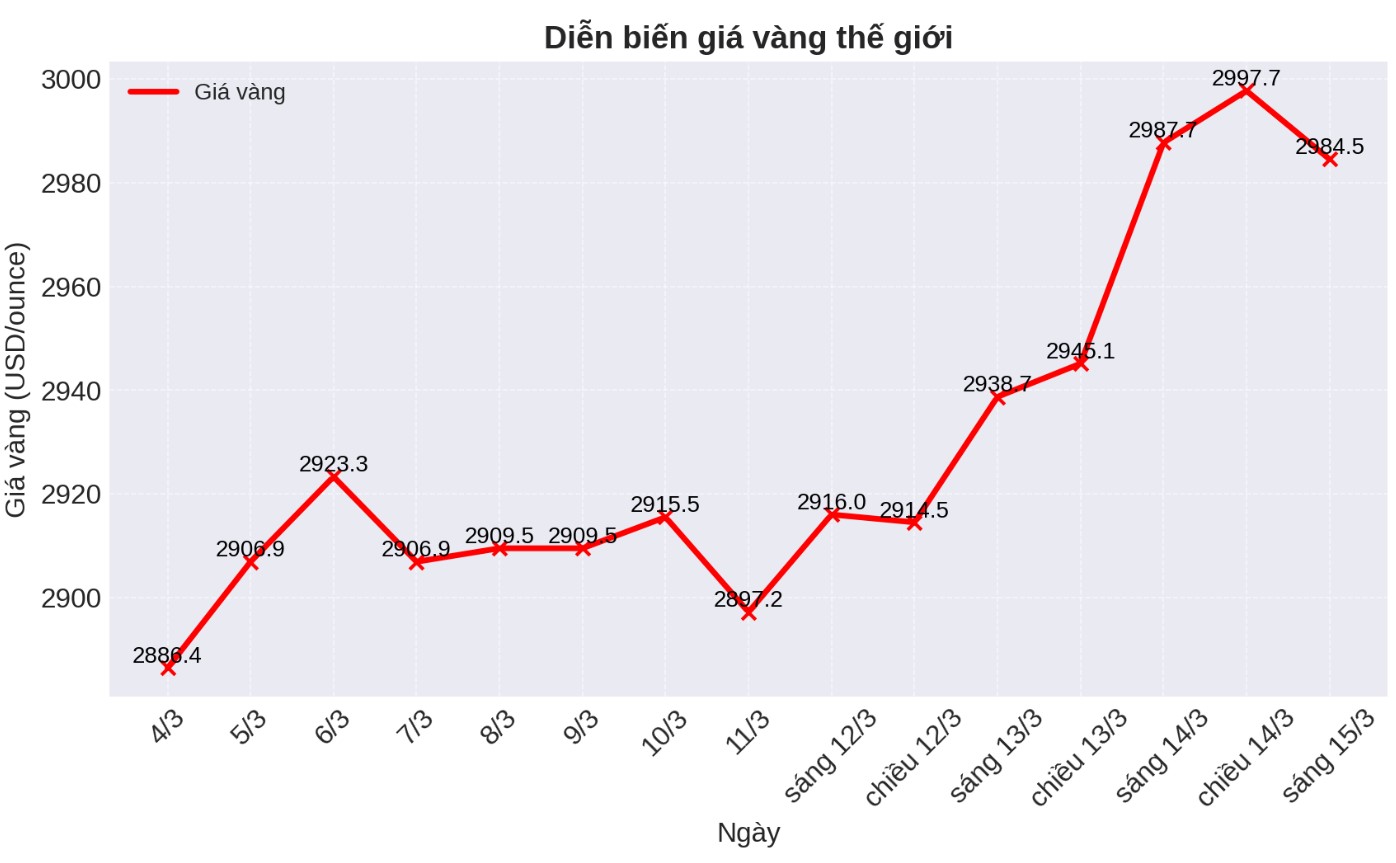

World gold price

As of 9:30 a.m. on March 15, the world gold price listed on Kitco was at 2,987.7 USD/ounce USD/ounce, up 49 USD/ounce compared to the same time in the previous session.

Gold price forecast

World gold prices increased in the context of the USD decreasing. Recorded at 9:30 a.m. on March 15, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.710 points (down 013%).

The gold market reached an important milestone on Friday morning when spot gold prices temporarily surpassed the $3,000/ounce mark, setting an all-time high of $3,005.04/ounce as many North American traders had just enjoyed a cup of morning coffee.

On Thursday, commodity analysts at Macquarie updated their gold price forecast, saying that gold prices will peak at $3,500/ounce in the third quarter of this year.

Many analysts said that global economic instability and geopolitical situations continue to support gold prices, even when gold prices are at their current highs.

Mr. Paul Williams - CEO of Solomon Global, a certified gold and silver supplier, told Kitco News: "Gold surpassing $3,000/ounce is a direct response to escalating trade tensions and economic instability that this brings.

The new tariff threat from US President Donald Trump, a tax of up to 200% on imported alcohol from the European Union, has caused a strong fluctuation in the global market, increasing demand for safe-haven assets.

This is not just a quick response to individual policies; it is investors looking to protect themselves from systemic risks. With the current growth momentum, gold prices could reach $3,500/ounce in the summer and $4,500/ounce next year, which is entirely possible," he said.

In a comment to Kitco News, Mr. Stuart O'Reilly - Market Analysis Manager at The Royal mint, said that many investors are turning to gold as a safe haven.

"Although the stock market has been shaken in recent weeks, safe-haven assets such as gold are rising strongly. This not only helped gold prices set a record but also broke the threshold of 3,000 USD/ounce.

Thanks to the prospect of continued global trade tensions, along with the continued purchase of gold by central banks, according to British sources, gold has increased by more than 9% since the beginning of this year when it entered the bull market," he said.

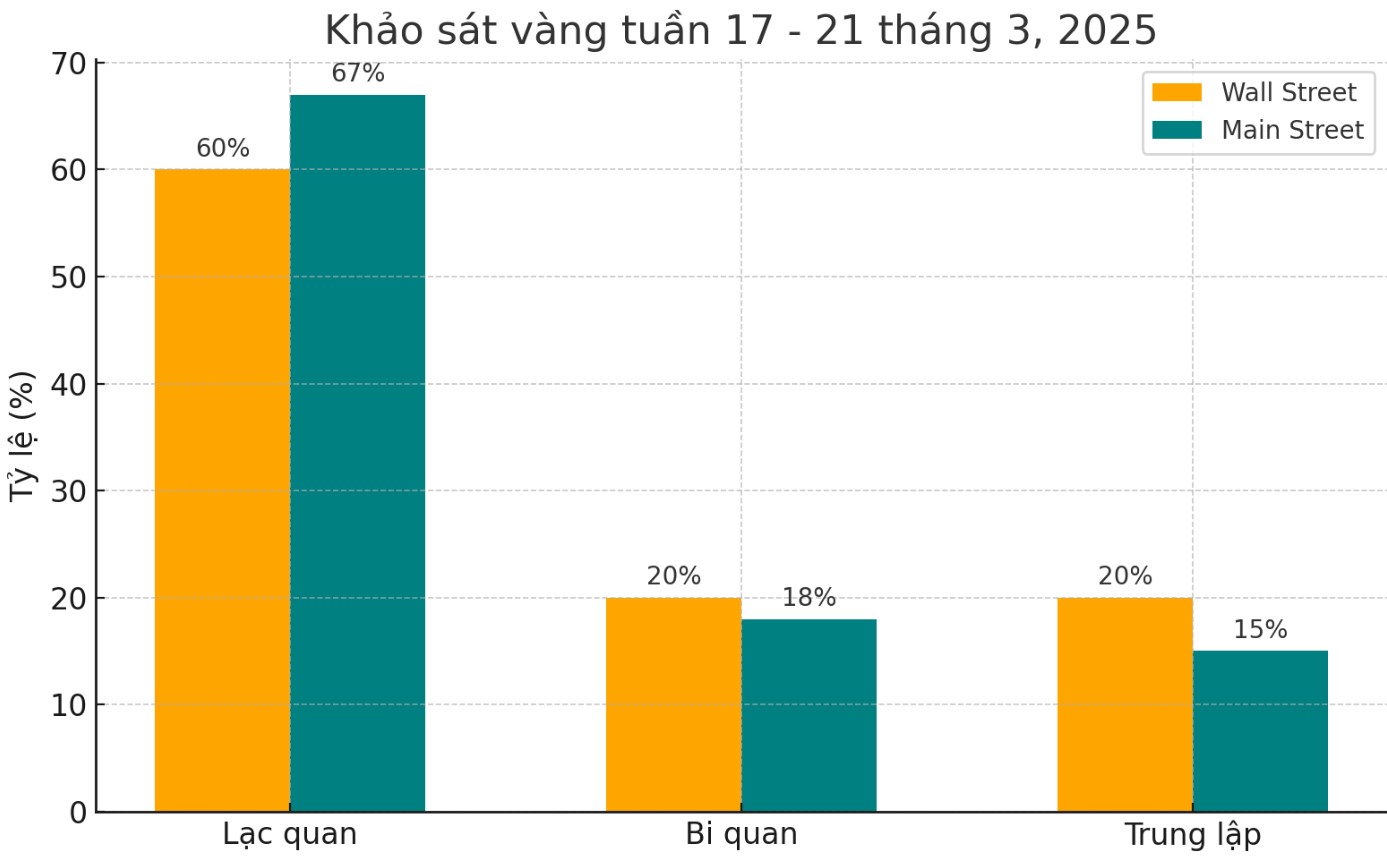

This week, 15 analysts participated in the Kitco News gold survey. Nine experts, or 60%, predict gold prices will continue to rise next week, while three analysts, or 20%, predict gold prices will fall, and the remaining three experts believe gold prices will move sideways.

Meanwhile, 262 votes were cast in Kitco's online survey the strongest participation in 2025 with retail investors' sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week, while another 47 - 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

See more news related to gold prices HERE...