Updated SJC gold price

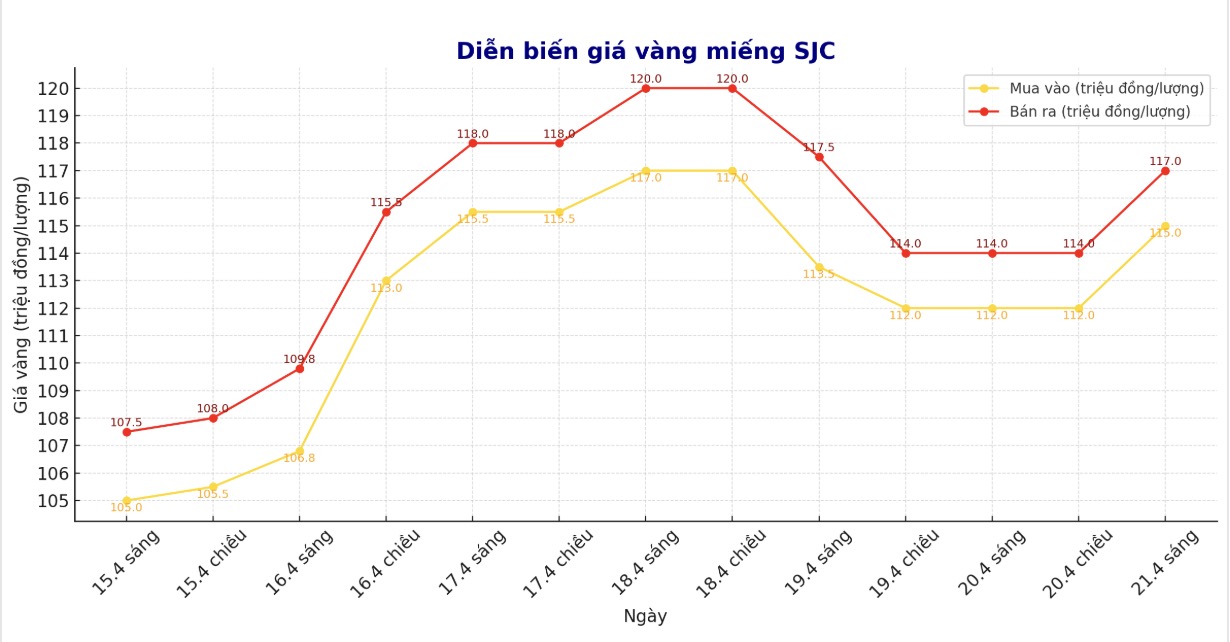

As of 9:15 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND115-117 million/tael (buy in - sell out), an increase of VND3 million/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 115-117 million VND/tael (buy - sell), an increase of 3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 115-117 million VND/tael (buy - sell), an increase of 3 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

9999 round gold ring price

As of 9:15 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-116 million VND/tael (buy - sell), an increase of 3 million VND/tael for buying and an increase of 2.5 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113-117 million VND/tael (buy - sell), an increase of 1.8 million VND/tael for buying and an increase of 3 million VND/tael for selling. The difference between buying and selling is 4 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 8:50 a.m., the world gold price listed on Kitco was around 3,374.3 USD/ounce, up sharply to 47.3 USD.

Gold price forecast

Navneet Damani - Senior Vice President in charge of commodity and currency research at Motilal Oswal Financial Services (a diversified financial services company based in Mumbai, India) commented: "In the context of a world full of policy instability, high inflation and geopolitical tensions, gold is still a safe haven.

As central banks increase reserves and investors seek safety, gold will continue to be a popular asset. Unless there is a major breakthrough in global trade negotiations, we still maintain a buying position when prices adjust in the medium and long term.

Meanwhile, Jim Wyckoff - an expert at Kitco, said that there is no factor hindering the current uptrend, as the technical graph maintains a positive signal and the demand for gold as a safe haven is still very strong.

Sean Lusk, co-head of commercial hedging at Walsh Trading, said the market is still in a state of running away for shelter, and gold is benefiting from that fear.

On Thursday, investors take a little profit, thats normal before the long weekend, but well have to see what they do after this slight decline, he said.

Lusk said there is currently a lot of money flowing into gold. Speculators are buying, TV experts are also recommending buying, and central banks continue to hoard gold, he said. We have achieved a 25% increase for the year at $3,301/ounce. The next target is around $3,434/ounce.

Economic data to watch

Wednesday: Preliminary manufacturing and services PMI, new home sales in the US.

Thursday: Long-term goods orders, weekly jobless claims, US home sales.

See more news related to gold prices HERE...