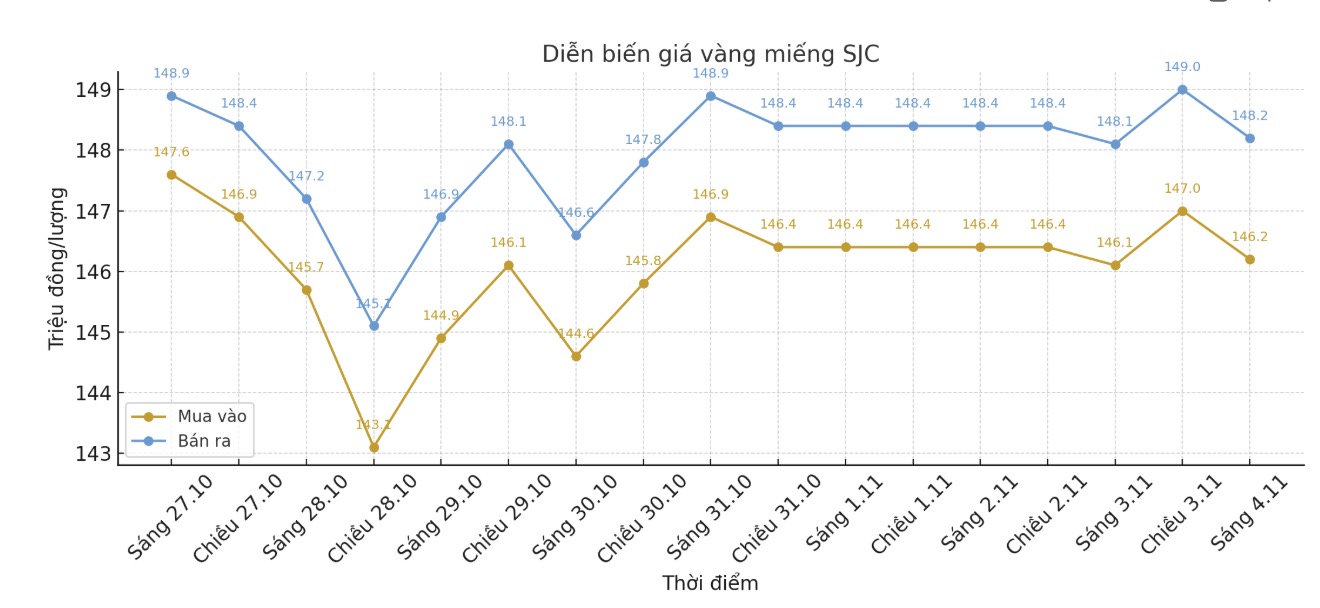

Updated SJC gold price

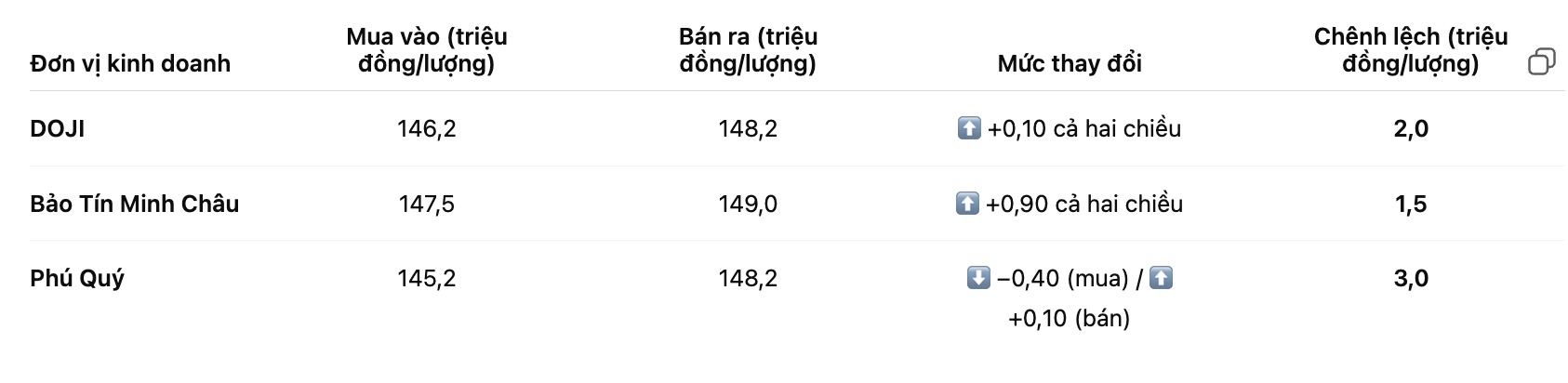

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 146.2-148.2 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.5-149 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of SJC gold bars at 145.2-148.2 million VND/tael (buy - sell), down 400,000 VND/tael for buying and up 100,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

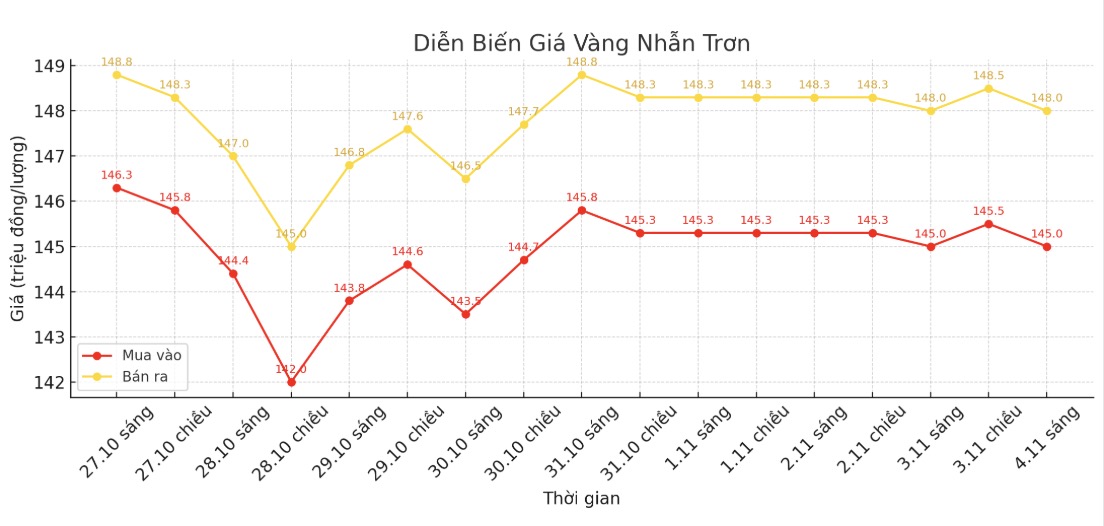

9999 round gold ring price

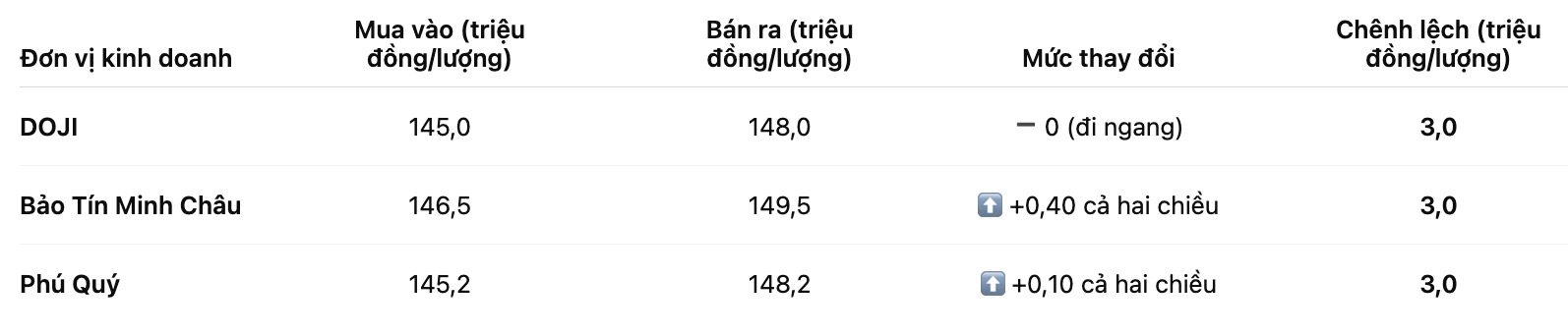

As of 9:00 a.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.2-148.2 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

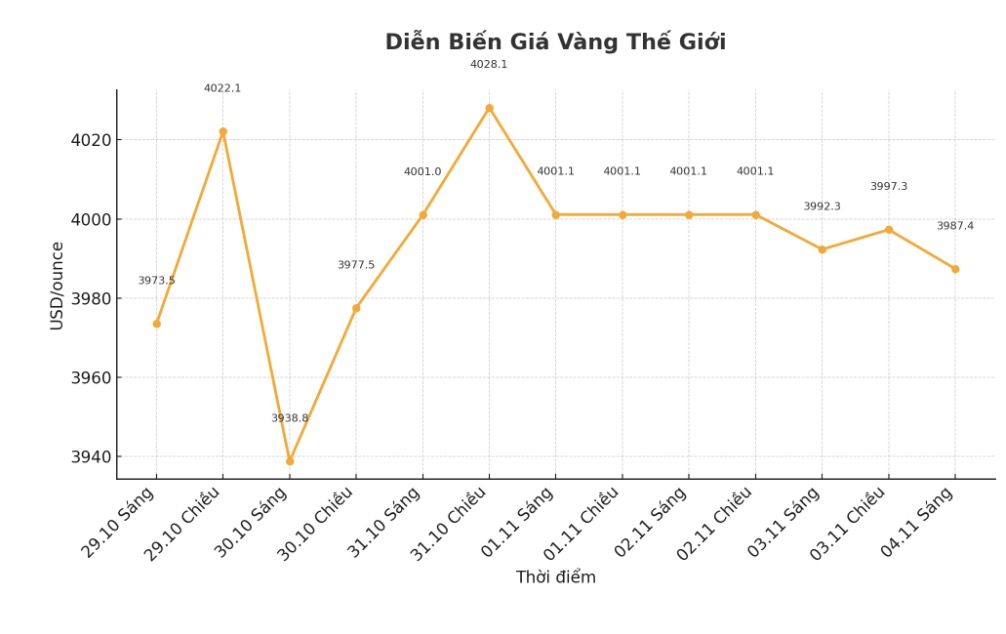

World gold price

At 8:53, the world gold price was listed around 3,987.4 USD/ounce, down 4.9 USD compared to a day ago.

Gold price forecast

The precious metal is under pressure from a strong US dollar as investors reduce expectations of the US Federal Reserve (FED) continuing to cut interest rates in the short term, while the US-China trade tensions are also cooling down demand for gold.

Golds upward momentum is lacking due to a number of technical factors, while the US dollar remains quite strong, which has a negative impact on gold, said Kelvin Wong, senior market analyst at OANDA.

Despite the decline in gold prices, UBS (one of the world's largest financial groups, headquartered in Switzerland) said that the current market correction is only temporary. The group said that gold prices are still on track to reach $4,200/ounce, with a higher increase scenario of up to $4,700/ounce if geopolitical or financial risks escalate.

The long-awaited correction has been suspended, UBS said in its research report released on Monday. Other than technical factors, we do not see any fundamental reasons for this sell-off."

In the international market, notable information comes from China when the country decided to end its long-standing tax incentives for gold. Accordingly, retailers will no longer be entitled to deduct value-added tax (VAT) when selling gold.

This new regulation applies to both investment products such as gold bars and gold bars with high purity, as well as non-investment products such as jewelry and industrial materials. Analysts say this move will help the Chinese government increase budget revenue, but at the same time increase the cost of buying gold for domestic consumers.

Technically, gold investors are aiming to close above a solid resistance zone at $4,100/ounce to confirm a new uptrend. On the contrary, the seller will try to push the price below the strong support zone at 3,800 USD/ounce.

The most recent resistance level was recorded at the peak of last night's session at 4,043.1 USD/ounce and the high of the previous Friday session at 4,059.9 USD/ounce. Meanwhile, the support zone is at the bottom of today's session at 3,971.3 USD/ounce and next at 3,950 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...