Updated SJC gold price

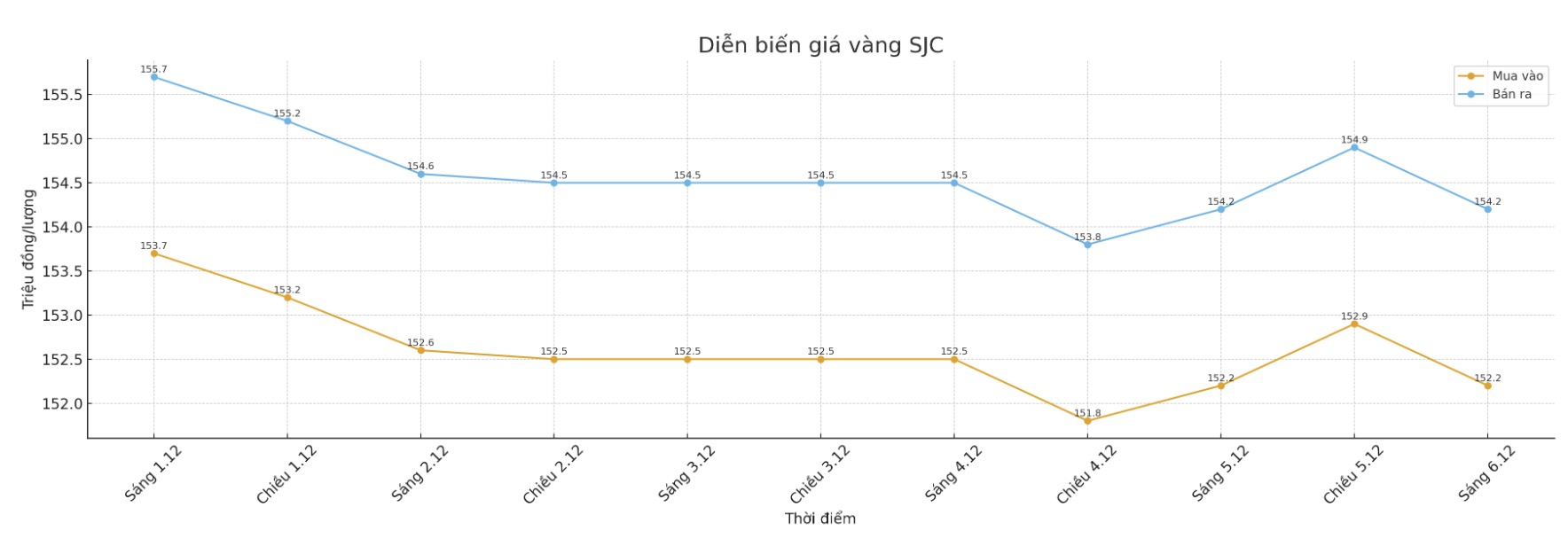

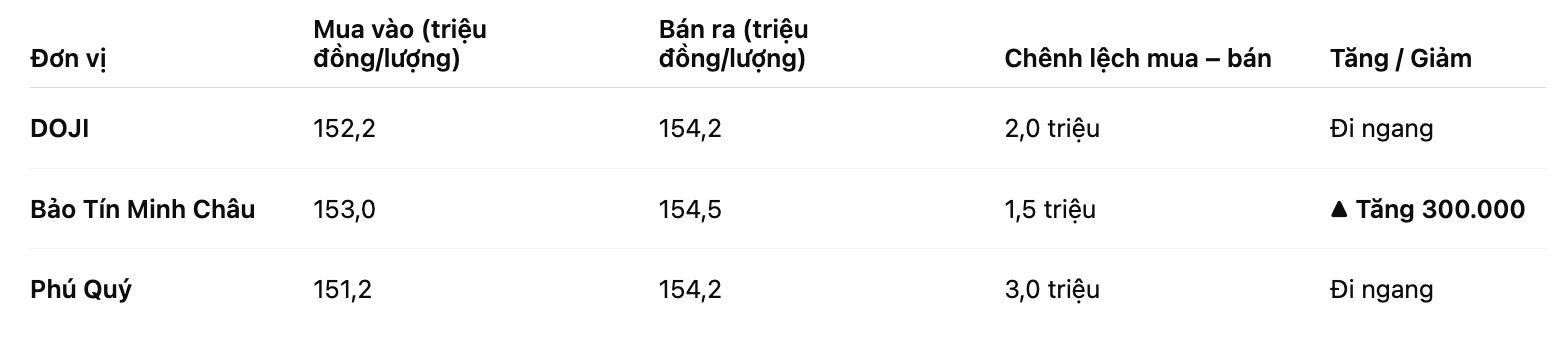

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 152.2-154.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.2-154.2 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

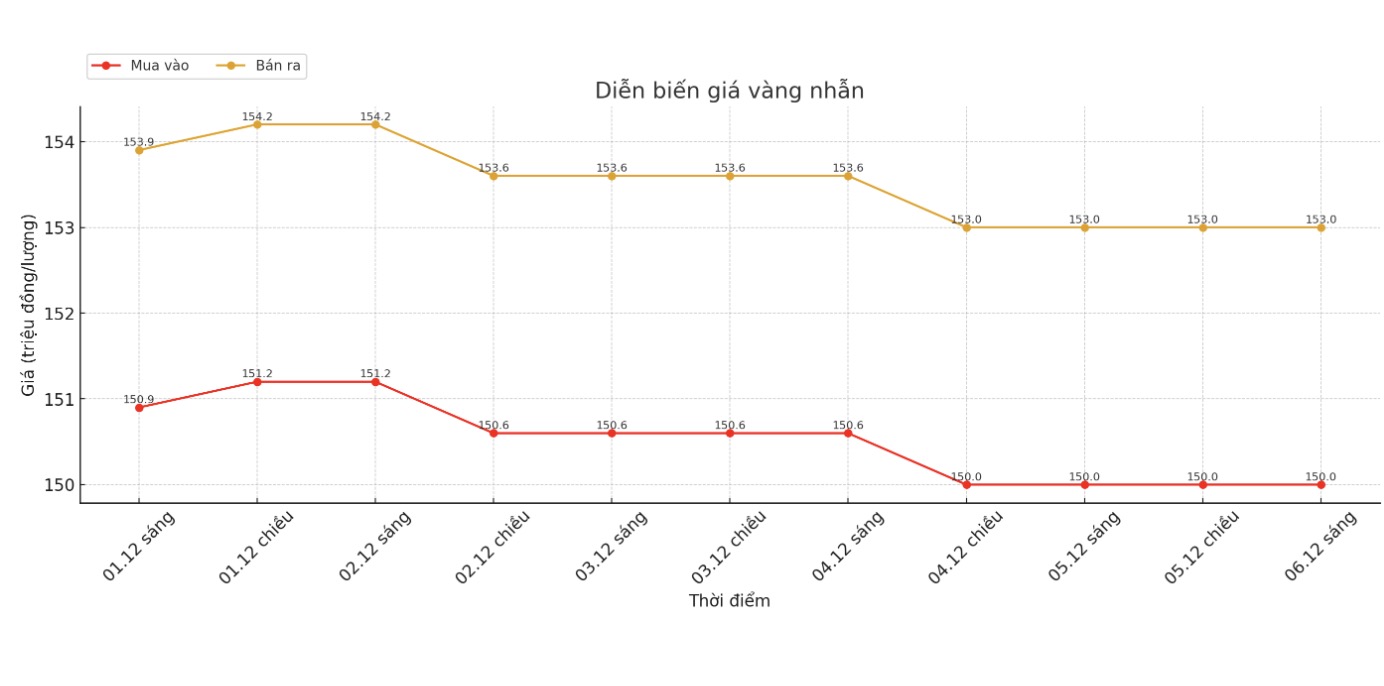

As of 9:00 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151-154 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

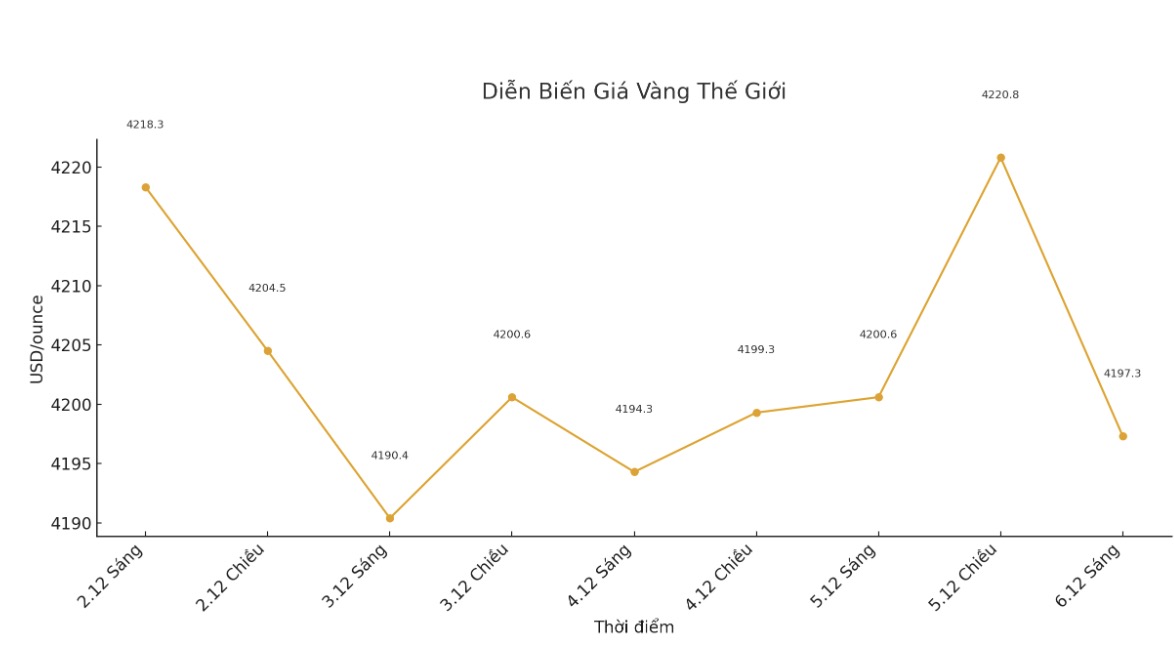

At 8:55 a.m., the world gold price was listed around 4,197.3 USD/ounce, down 3.3 USD compared to a day ago.

Gold price forecast

Mr. David Morrison - senior market analyst at Trade Nation - said that although gold's rally is slowing as prices are stopped at 4,200 USD/ounce, any correction next week should be considered a buying opportunity.

Gold prices may need another decline to screen weak investors, dragging the MACD index into the negative zone and raising concerns that gold's rally is over.

Of course, this is just a hypothetical. But if that happens, gold could return to the $3,800-3,600/ounce zone, creating a sense of panic in the market. And that will be the ideal time to gather and prepare for a strong price increase to new records, said Mr. Morrison.

Mr. Alex Ebkarian - Executive Director (COO) of allegiance Gold - said that gold prices are forecast to fluctuate between 4,200-4,500 USD/ounce this year and 4,500-5,000 USD/ounce next year, depending on the decisions of the US Federal Reserve (Fed).

The market is increasingly confident that the central bank will cut interest rates. Reacting to that, the US dollar has weakened slightly and this supports gold prices," said Bart Melek, global commodity strategist at TD Securities.

Technically, the bulls on the February gold contract are aiming for their next target of closing above the strong resistance zone at the contract peak/record of $4,433/ounce. Meanwhile, the bears' next short-term bearish target is to push prices below the important technical support zone at 4,100 USD/ounce.

The immediate resistance level is at 4,273.3 USD/ounce, then 4,300 USD/ounce. The first support level was the bottom overnight at 4,224.6 USD/ounce, followed by 4,200 USD/ounce.

In addition to the Fed's policy meeting, the Reserve Bank of Australia (RBA), the Bank of Canada (BoC) and the Swiss National Bank (SNB) will also announce interest rate decisions. The market is now expecting all three central banks to keep interest rates unchanged.

Notable economic data next week

Monday: RBA monetary policy decision (CBP).

Tuesday: US job openings (JOLTS).

Wednesday: BoC interest rate decision, Fed monetary policy decision.

Thursday: SNB interest rate decision, US weekly jobless claims.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...