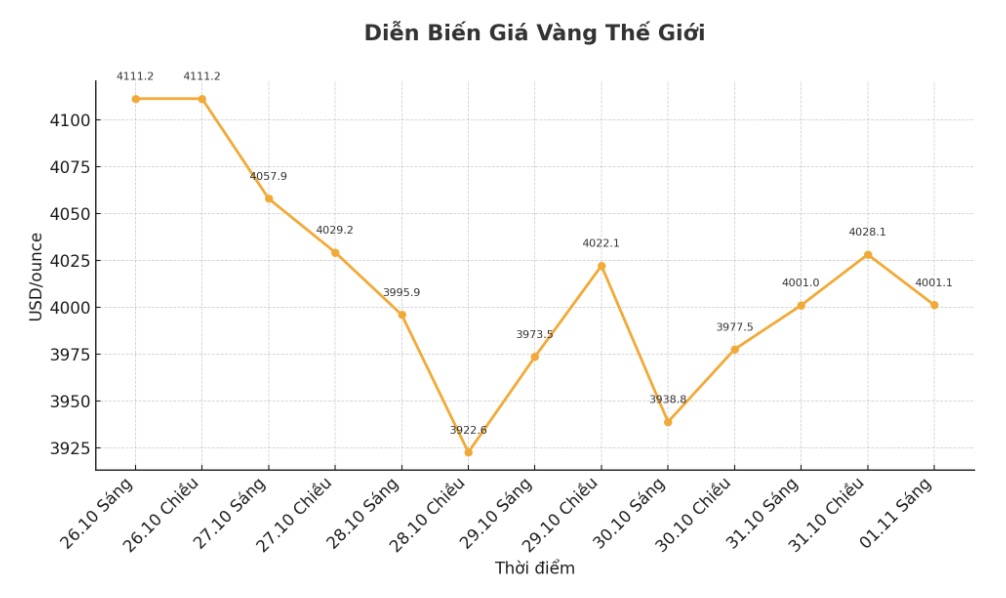

After the initial correction, gold prices have fallen about 11% compared to last week's peak. Although the possibility of further declines still exists, the market in general still remains stable in this high price range.

However, the current adjustment does not reduce long-term optimism. At the Global Gold and Silver Market Association (LBMA) Gold Market Conference, delegates predicted that gold prices will test resistance at nearly 5,000 USD/ounce at this time next year - an increase of about 25% compared to present. This is the most optimistic outlook in many years, after two consecutive years of underestimating gold's upward momentum.

Major banks such as HSBC, Bank of America and Societe Generale also have similar forecasts, all of which predict gold will reach the 5,000 USD/ounce mark by 2026. British research firm Metals Focus also believes that gold could reach 5,000 USD and silver could reach 60 USD in the coming year.

Despite recent strong fluctuations in prices, analysts believe that gold is still well supported by the tense geopolitical situation and expectations that the US Federal Reserve (FED) will loosen monetary policy, leading to a weakening of the USD.

However, not everyone is "super optimistic". The World Bank forecasts gold prices to increase by only about 5% next year, while Natixis believes that the average price in 2026 will be around 3,800 USD/ounce. However, even these cautious forecasts are not negative.

Although the rally is expected to slow, gold prices will still be 180% above the average of 2015-2019 in 2026, the World Bank report stated.

It can be difficult to be optimistic as central banks continue to hoard gold to diversify foreign exchange reserves. According to the World Gold Council (WGC), in the third quarter, central banks bought about 200 tons of gold and could reach a total of 750-900 tons for the whole year.

Even after purchasing more than 3,000 tons in the past three years, demand is still very strong. At the LBMA meeting, Mr. Heung-Soon Jung of the Bank of Korea said that the agency is considering buying more gold in the medium and long term - the first time since 2013.

In the short term, gold prices may continue to move sideways, but many experts say this is a good opportunity to accumulate strategic position, preparing for the next strong increase.

See more news related to gold prices HERE...