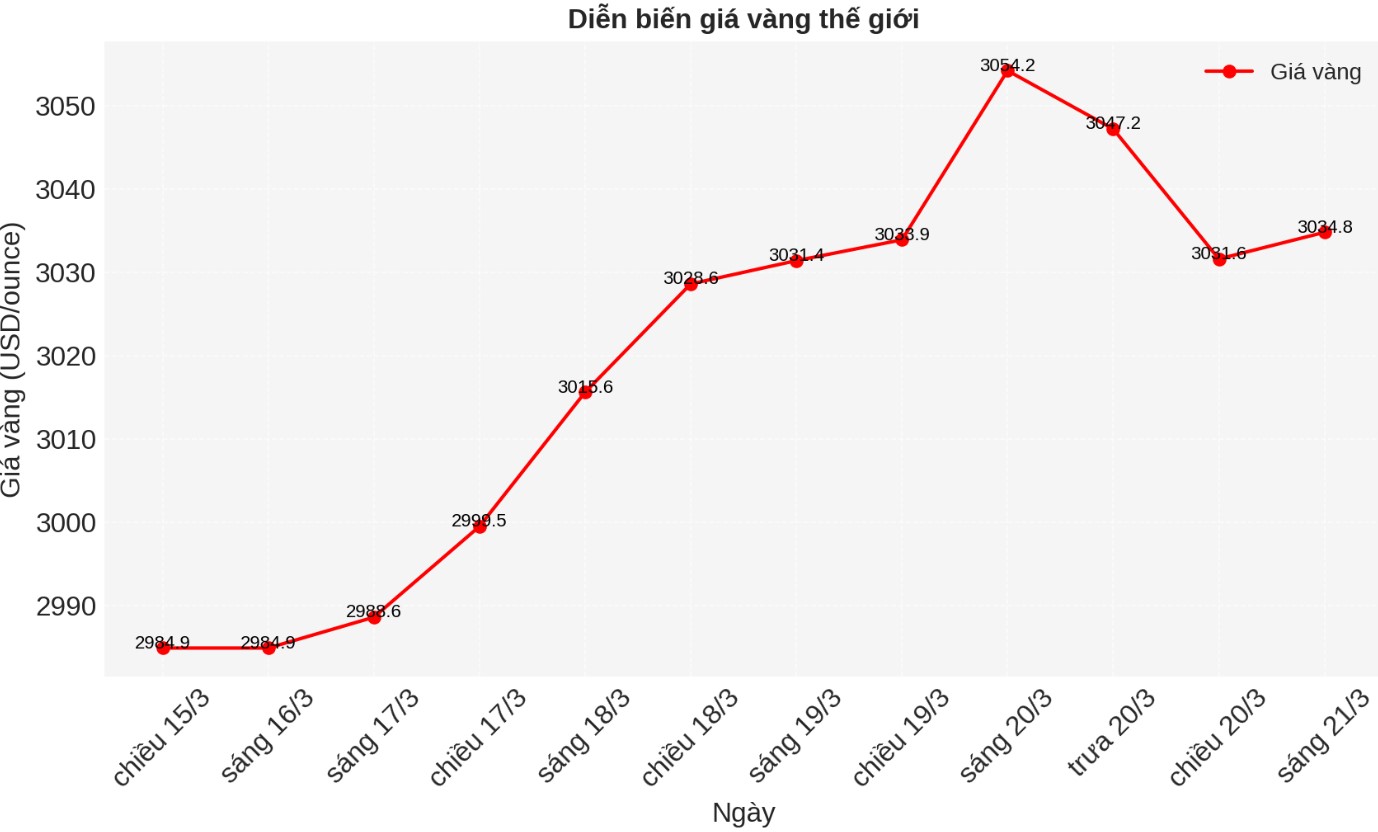

Gold futures have experienced a volatile trading session, first increasing sharply to a record high, but then decreasing when traders take profits, only to recover most of the losses before the end of the trading session.

The April gold contract opened at $3,058/ounce and quickly soared to $3,065.2/ounce within an hour of trading, setting an all-time high. However, the precious metal's rally quickly reversed as traders took advantage of the rally to make a profit.

Over the next six hours, prices fell steadily, hitting a daily low of $3,032.8/ounce, before recovering to $3,043.8/ounce, recording a slight increase of $2.60/ounce for the trading session.

Speculators are trying to take advantage of the market and make a profit, explains Alex Ebkarian, CEO of allegiance Gold.

Ebkarian also said that gold prices have not fully played a safe asset role: "Every time gold prices reach highs, we will see some resistance. Gold is not really a safe haven asset for retail investors because technically, we are not in recession. However, the slowdown in the economy could cause greater uncertainty and increase demand for safe-haven assets.

The move comes just a day after the Federal Reserve (FED) ended its Open Market Committee meeting in March, in which members voted unanimously to keep interest rates at the current rate of 4.25% to 4.50%.

In a press conference after the meeting, Fed Chairman Jerome Powell mentioned concerns about the government's current trade policies, saying they may have contributed to slowing US economic growth while increasing inflationary pressures.

In the official announcement, FED officials forecast slowing economic growth along with rising inflation, especially concerns about US trade policy. They described these policies as "ambitious and often unstable," concluding that they have put increasing pressure on both the economy and the Fed's ability to maintain stability.

A few hours after the Fed's decision, President Donald Trump criticized the central bank on the social network Truth Social, writing: "The Fed would be much better off cutting interest rates as US tariffs begin to transition (less) into the economy," adding: "Doing the right thing."

This quick response shows that the US President is ready to put pressure on the Fed, despite a long tradition of central banks being independent of political influence.

Investors have now shifted their attention from monetary policy to US trade measures and their potential impacts.

With import tariffs from Canada and Mexico at 25% and tariffs of 20% on imports from China, investors around the world are preparing for the inevitable impact of rising prices due to these tariffs and retaliatory measures that other countries may take.

See more news related to gold prices HERE...