Gold futures surpass $3,000/ounce

The gold breakout comes amid global trade tensions and escalating geopolitical uncertainty, creating what analysts call a "perfect storm" that pushes gold prices higher.

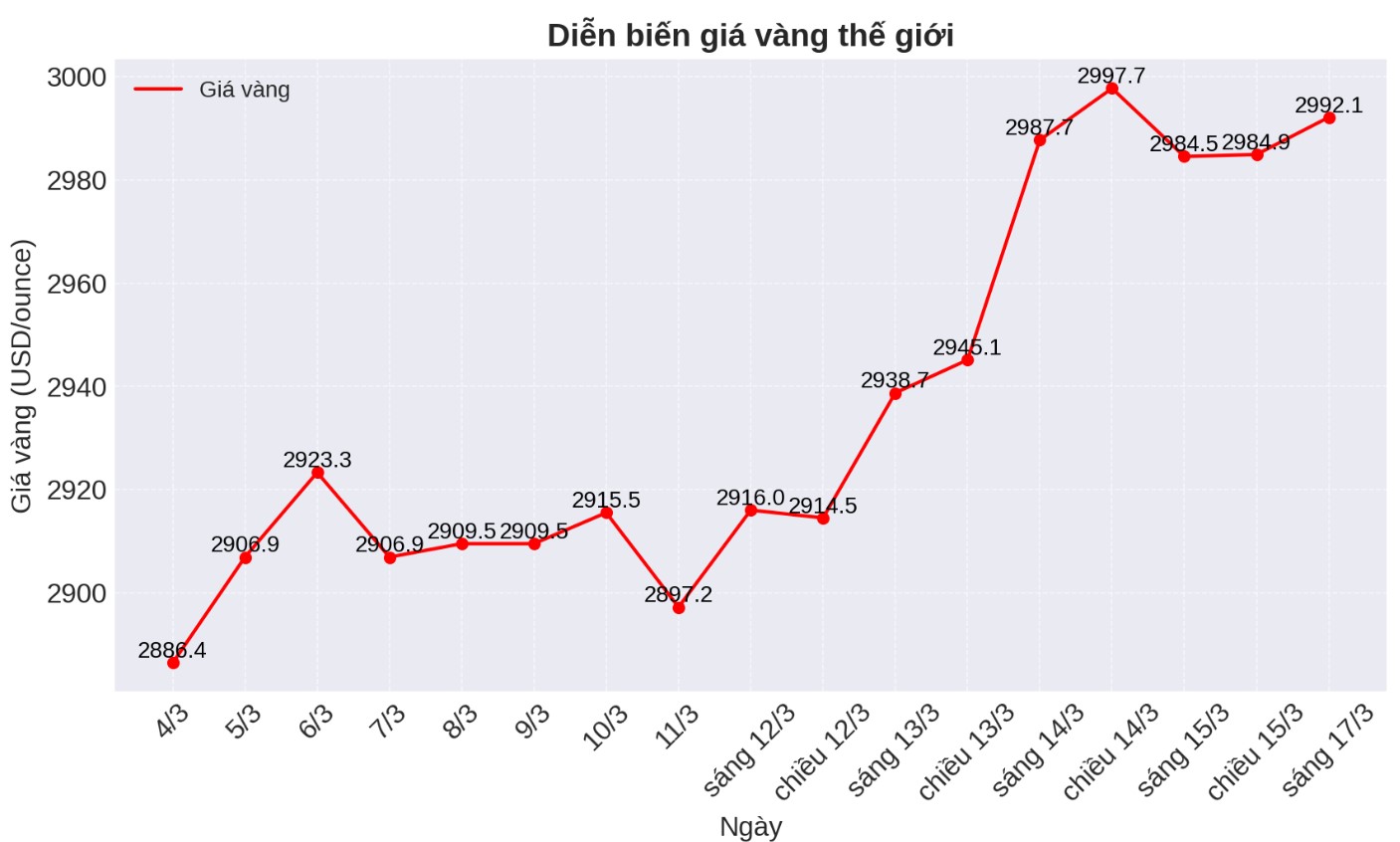

April gold futures closed at $3,001.10 an ounce at 7:05 p.m. EST, after a week of steady price increases.

Gold prices rose $21.50 to $2,920.9 an ounce on Tuesday, holding around $2,927 on Wednesday, then rebounded strongly to $44.5 on Thursday, closing at $2,991 an ounce.

Today's trading session opened at $3,001.4 an ounce, with a day's range of $2,988.6/ounce to $3,017.1/ounce, and ended the session with a net increase of $9.8.

Driving factors for gold prices

Gold prices increased sharply due to increased demand for safe havens in the face of US President Donald Trump's fierce trade policies. Investors are particularly concerned about tariffs on China, Canada, Mexico and recently the European Union.

Donald Trump said he would not make any transfers at the White House when asked about his tariff stance. When the reporter asked about the possibility of withdrawing the new series of taxes effective from April 2, he replied firmly: "No".

Market sentiment was further strained when Donald Trump announced plans to double Canada's metal import tax to 50%, effective from Wednesday. In addition, he also proposed a 200% tax on champagne and other alcoholic products from the European Union, signaling an expansion in protectionist trade policies.

According to MT Newswires: "The fact that the US President has continuously announced, although not certain to do so, import tariffs have increased geopolitical instability and boosted inflation expectations, thereby putting pressure on real interest rates in the short term and supporting gold prices even as the USD strengthens and the market has reduced expectations of the FED cutting interest rates".

In addition, conflicts in the Middle East and the war between Russia and Ukraine continue to push investors to seek gold as a safe haven. "escalating trade measures are raising real concerns about the risk of a US recession," experts said.

Gold price forecast

Analysts are increasingly optimistic about the outlook for gold prices. Macquarie Group has raised its forecast, saying gold will reach $3,150/ounce by the third quarter of 2025, significantly above the $2,650/ounce they had previously forecast.

Increased inflationary pressures from tariffs could force the Federal Reserve to reconsider its interest rate policy. Instead of continuing the interest rate normalization roadmap as planned, the FED may have to raise interest rates to control inflation, similar to what it did during the pandemic.

Based on current market developments and supporting factors, analysts predict that gold prices could range from 3,330 to 3,400 USD/ounce by the end of the fourth quarter of 2025.

The combination of trade tensions, geopolitical instability and expectations of monetary policy changes has created a strong momentum, continuing to push gold prices to new heights as investors seek safety in the context of many fluctuations.

See more news related to gold prices HERE...