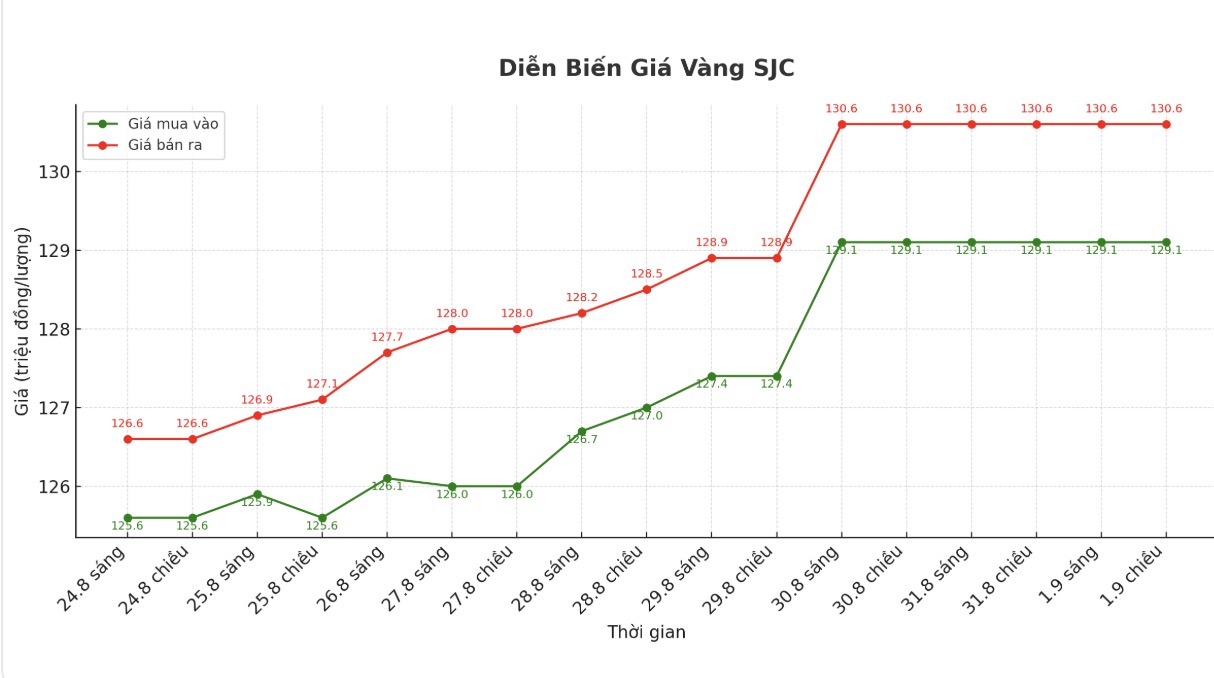

SJC gold bar price

As of 6:00 a.m. on September 2, the price of SJC gold bars was listed by DOJI Group at 129.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 128.6-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 128.1-130.6 million VND/tael (buy in - sell out). The difference between buying and selling prices is at 2.5 million VND/tael.

9999 gold ring price

As of 6:00 a.m. on September 2, DOJI Group listed the price of gold rings at 122.5-125.5 million VND/tael (buy in - sell out). The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 122.8-125.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 122.8-125.8 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Currently, the difference between buying and selling gold rings is at a very high level, around 3 million VND/tael, posing a potential risk of loss for investors.

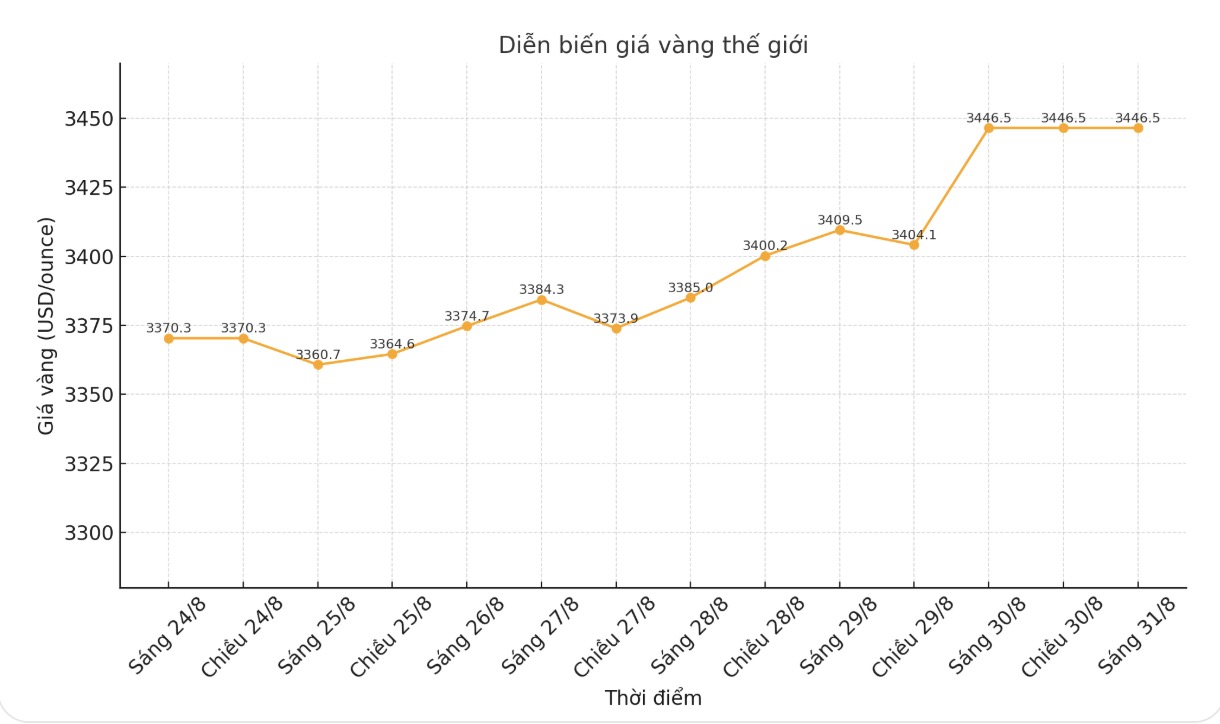

World gold price

The world gold price was listed at 9:00 p.m. at 3,475.9 USD/ounce, up 29.4 USD.

Gold price forecast

Gold prices are anchored high, around a four-month peak as investors are increasing their bet on the possibility of the US Federal Reserve (FED) cutting interest rates this month, increasing the appeal of the precious metal.

Matt Simpson, senior analyst at City Index, said: Motely comments from San Francisco branch Fed President Mary Daly have helped the market ignore the high PCE core inflation data on Friday and left open the possibility of the Fed cutting interest rates by 25 basis points this month.

A US appeal court has also ruled that most of the tariffs issued by US President Donald Trump are illegal, putting pressure on the USD and supporting gold prices. The data showed that the US PCE index increased by 0.2% monthly and 2.6% annually, as expected.

In a social media post on Friday, Daly stressed continuing to support interest rate cuts due to concerns about risks to the labor market. Gold is not profitable, so it often benefits in a low interest rate environment.

Regarding trade, US Trade Representative Jamieson Greer affirmed that the Trump administration continues to negotiate with partners even though the appellate court has ruled that most of the tariffs are illegal.

Tim Waterer - market analyst at KCM Trade - said: Spot silver prices increased by 2.2% to 40.56 USD/ounce, the highest level since September 2011.

US bank holidays reduce liquidity, contributing to the amplification of gold and silver fluctuations. Silver is rising thanks to expectations of a US interest rate cut, while the shortage of supply also maintains an upward trend.

Marc Chandler - CEO of Bannockburn Global Forex acknowledged: Attacks aimed at the independence of the Fed, combined with the ability to report on unsatisfactory jobs, will be a supporting factor for gold.

The precious metal had two strong rallies last week, surpassing $3,400 an ounce and then moving sideways before the weekend. The next target is the July peak around $3,439/ounce and then the June peak at $3,451/ounce.

Jim Wyckoff - senior analyst at Kitco predicted: "Technical charts are increasingly supporting the uptrend. US monetary policy is also gradually easing. I expect gold prices to continue to move up steadily next week.

Notable US economic data this week

Tuesday: ISM manufacturing PMI.

Wednesday: JOLTS employment data.

Thursday: ADP, unemployment claims, ISM services PMI.

Friday: Non-farm payrolls report.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...