After a volatile 2025, but bringing a profit that is considered "generational", the metal market enters 2026 with great expectations but also many controversies.

The latest survey results from Kitco News show that the majority of retail investors believe that silver will continue to be the metal with the strongest price increase. Meanwhile, many financial institutions and experts believe that platinum - an outstanding representative of the platinum metal group (PGM) - is a strong candidate for the leading position.

Silver leads in 2025, retail investors continue to "choose to deposit gold"

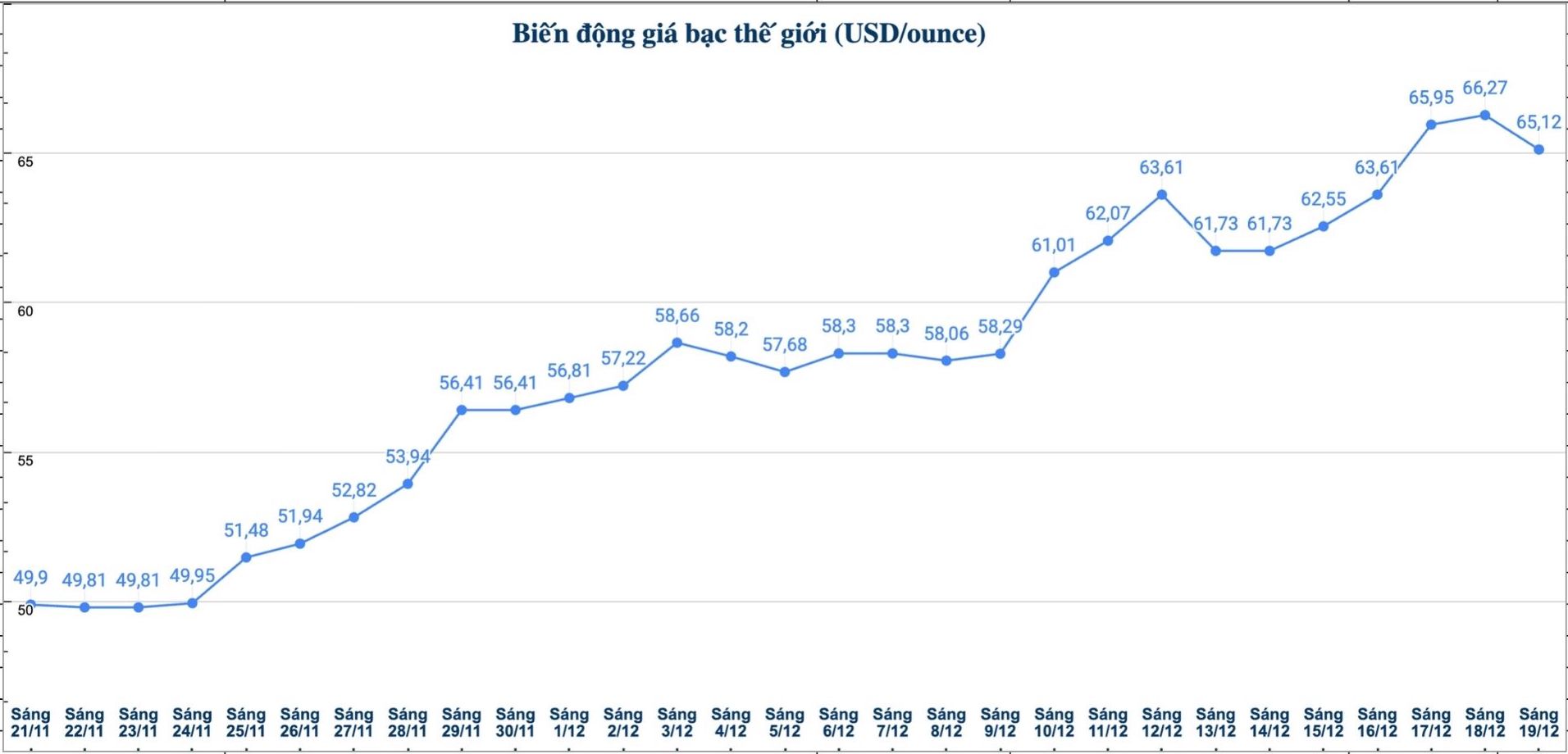

According to statistics from Kitco News, 2025 recorded an impressive increase across the board of major metals. Silver became the focus when it increased by more than 127%, far surpassing other metals.

platinum followed closely the increase of about 120%, gold continued to consolidate the increase trend for many years with an increase of about 65%, while copper also brought a yield of about 35% to investors.

Kitco News' Top Metals 2026 survey with the participation of 352 retail investors, with up to 178 people, equivalent to 51%, predicts that silver will continue to lead in 2026. About 29% of participants expected gold to be the metal to increase the most, 10% chose platinum and the remaining 11% had expectations for copper.

This result clearly reflects the sentiment of individual investors, who have benefited greatly from the increase in silver over the past year and continue to believe in this trend.

Wall Street cautious with silver, shifting to PGM

In contrast to the optimism of retail investors, the views of financial institutions and analysts have become more clearly differentiated.

In its 2026 commodity outlook report, TD Securities believes that the lower interest rate environment, currency depreciation, supply-demand factors and portfolio diversification demand will continue to support gold, bringing the metal price to a new high of over $4,400/ounce in the first half of 2026.

However, TD Securities believes that silver will hardly repeat the strong increase in 2025. According to analysts, the silver market has shifted from a "silver squeeze" state - tightening supply - to a "silver flood" as the free silver in the warehouse of the London Metallurgy Association (LBMA) increased sharply.

The return of more than 212 million ounces of silver to the market is expected to be enough to offset nearly two years of global deficits, thereby reducing upward pressure on prices.

Therefore, TD Securities forecasts that silver prices may weaken in early 2026 and it is difficult to return to recent peaks, with a forecast around the mid-40 USD/ounce range.

On the contrary, this organization highly appreciates the prospects of platinum and palladium, considering these two top options in the commodity group in 2026, with the target price about 20% higher than the general forecast level of the market.

Heraeus warns of the risk of adjustment at the beginning of the year

While TD Securities highlighted PGM's potential, Heraeus - one of the largest precious metals corporations - gave a more cautious view.

In the 2026 precious metals outlook report, Heraeus said that the strong increase in gold, silver and PGM in 2025 has pushed prices up too quickly, causing the market to enter an adjustment or accumulation phase in the first months of next year.

According to Heraeus, gold is still the metal with the most solid foundation thanks to central bank buying demand and the possibility of real interest rates falling if the US Federal Reserve continues to loosen monetary policy. However, after a period of strong increases, gold prices are likely to move sideways before establishing a new trend.

For silver, Heraeus noted that high prices are putting pressure on demand in many fields, from industry to jewelry. In particular, demand for silver in the solar energy sector is forecast to slow down, while consumers in major markets such as India have to tighten spending due to high prices.

platinum: Potential but many challenges

As for platinum, Heraeus admitted that the market became tight in the first half of 2025, when supply was less optimistic while demand and hoarding activities increased, pushing prices to their highest level since 2013. However, in 2026, supply is forecast to improve while demand tends to decrease, causing the deficit to narrow.

However, Heraeus believes that the platinum market can still maintain a state of shortage, with metal lending rates at a high level. After the correction period, platinum prices are expected to have room to increase again, with a forecast range of around 1,300 - 1,800 USD/ounce in 2026.