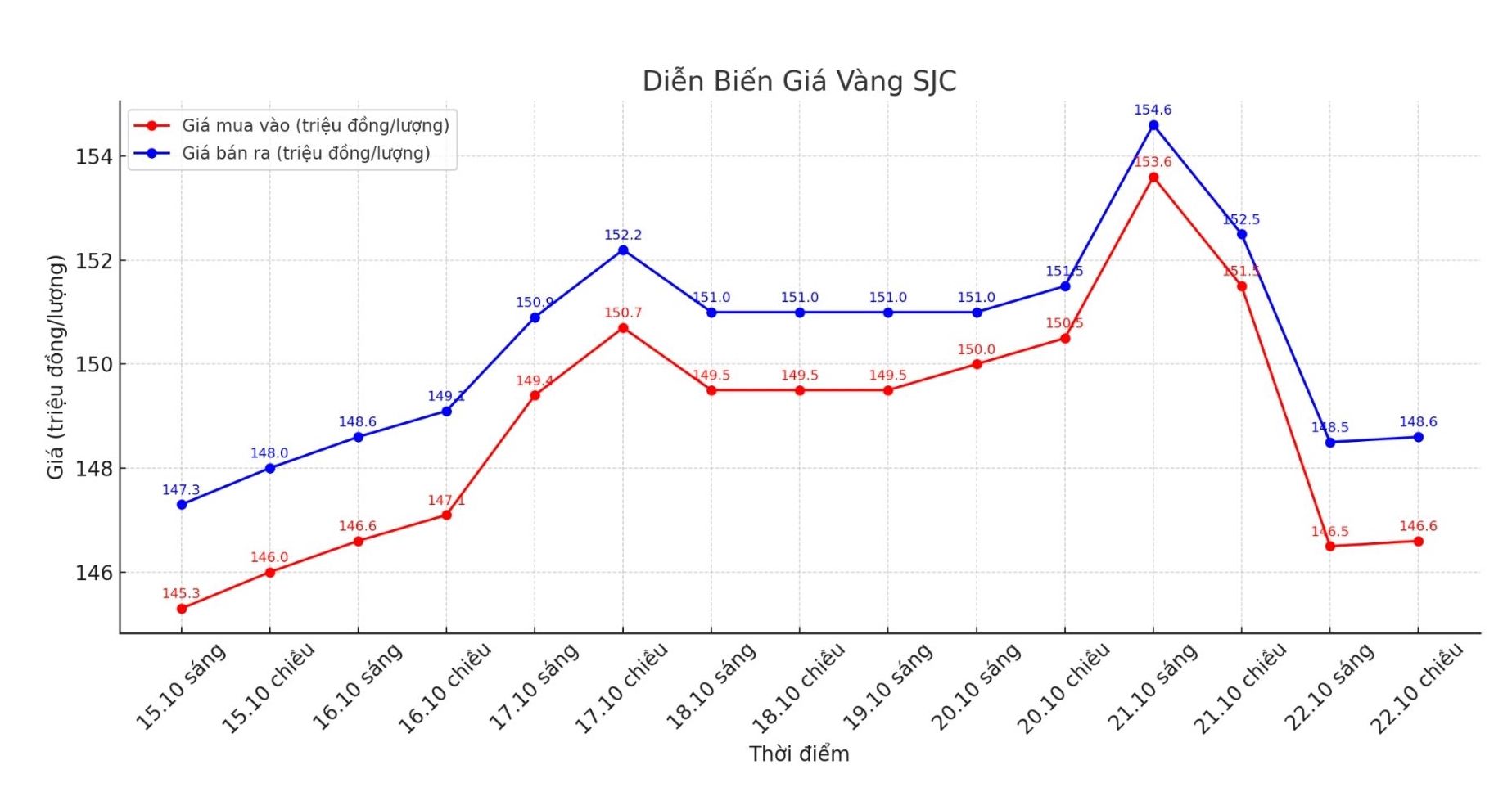

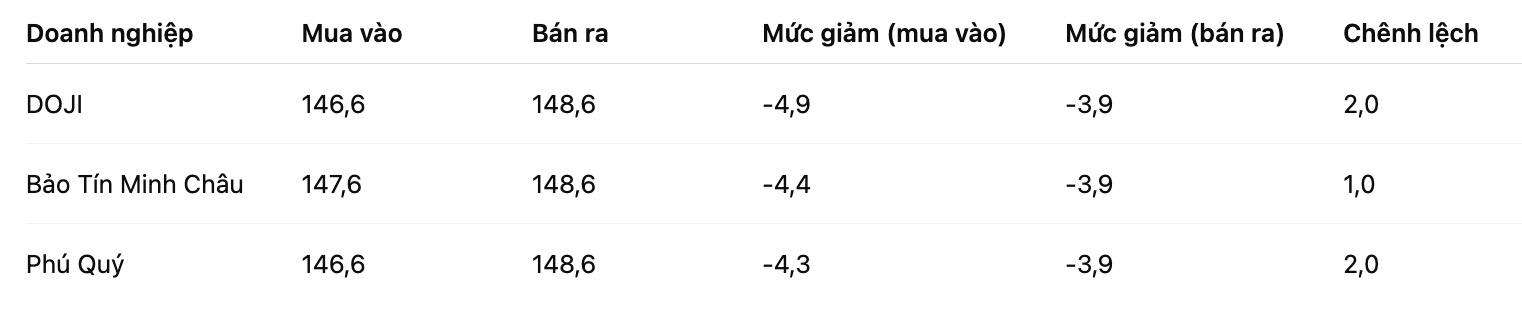

SJC gold bar price

As of 6:00 a.m. on October 23, the price of SJC gold bars was listed by DOJI Group at VND 146.6 - 148.6 million/tael (buy - sell), down VND 4.9 million/tael for buying and down VND 3.9 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.6 - 148.6 million VND/tael (buy - sell), down 4.4 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146.6 - 148.6 million VND/tael (buy - sell), down 4.3 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

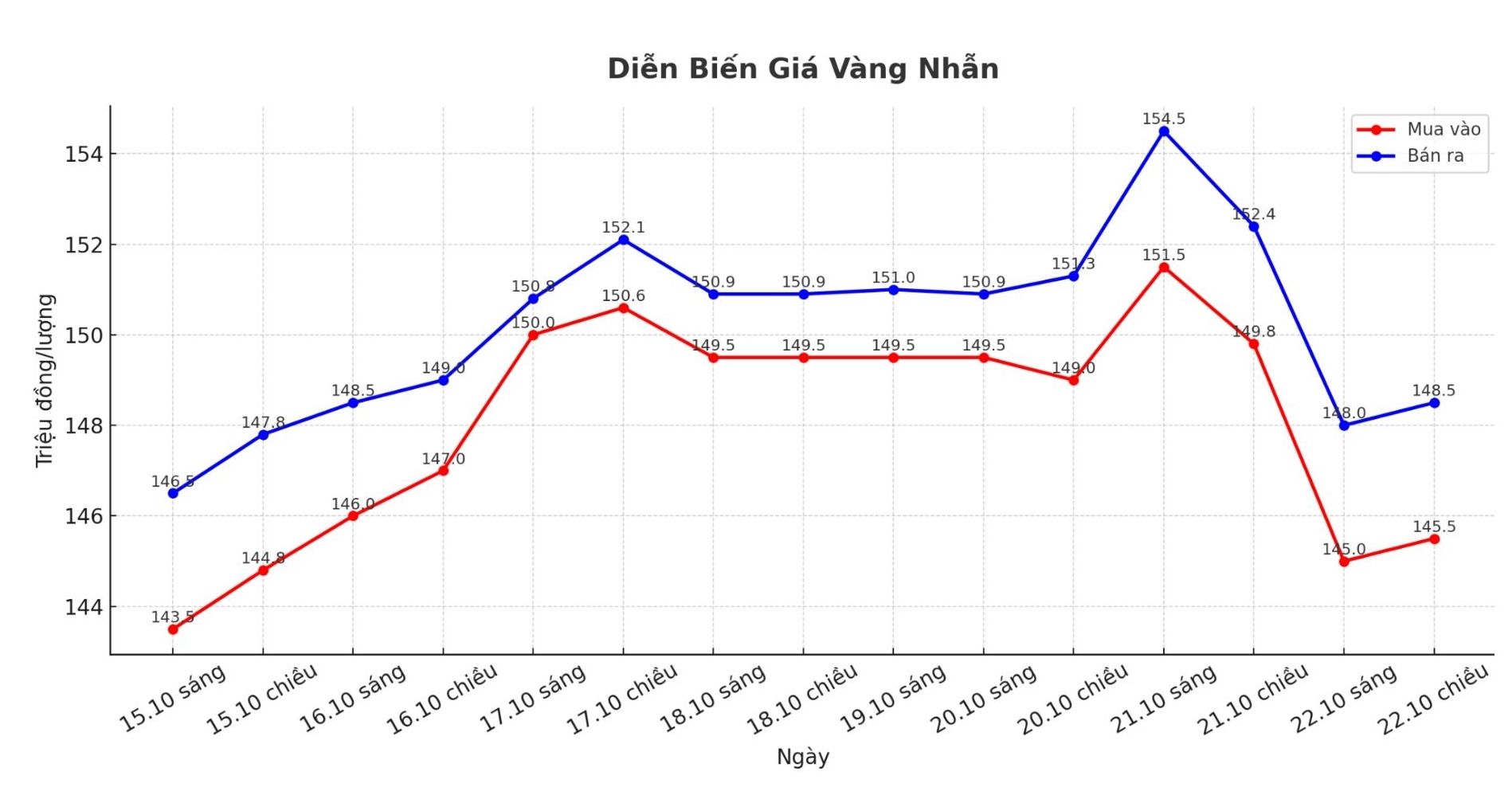

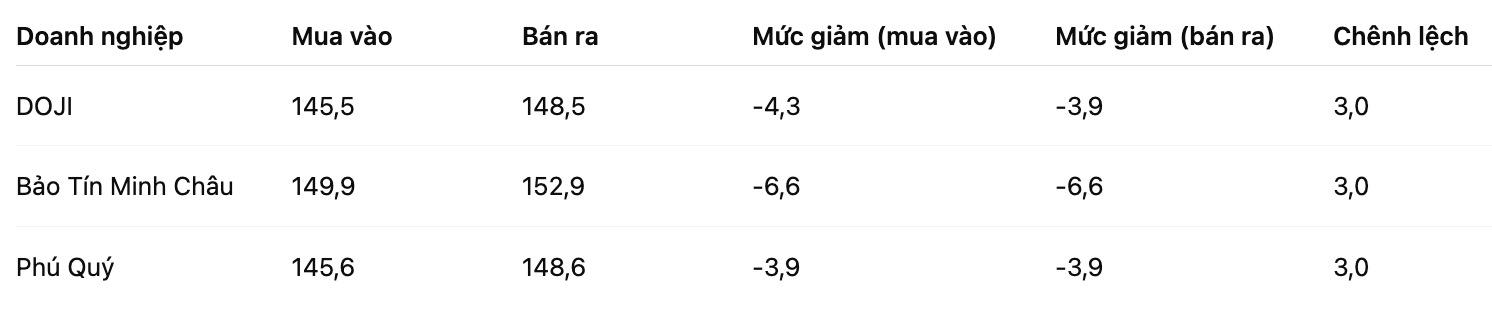

9999 gold ring price

As of 6:20 p.m. on October 22, DOJI Group listed the price of gold rings at 145.5 - 148.5 million VND/tael (buy - sell), down 4.3 million VND/tael for buying and down 3.9 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.9 - 152.9 million VND/tael (buy - sell), down 6.6 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.6 - 148.6 million VND/tael (buy - sell), down 3.9 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

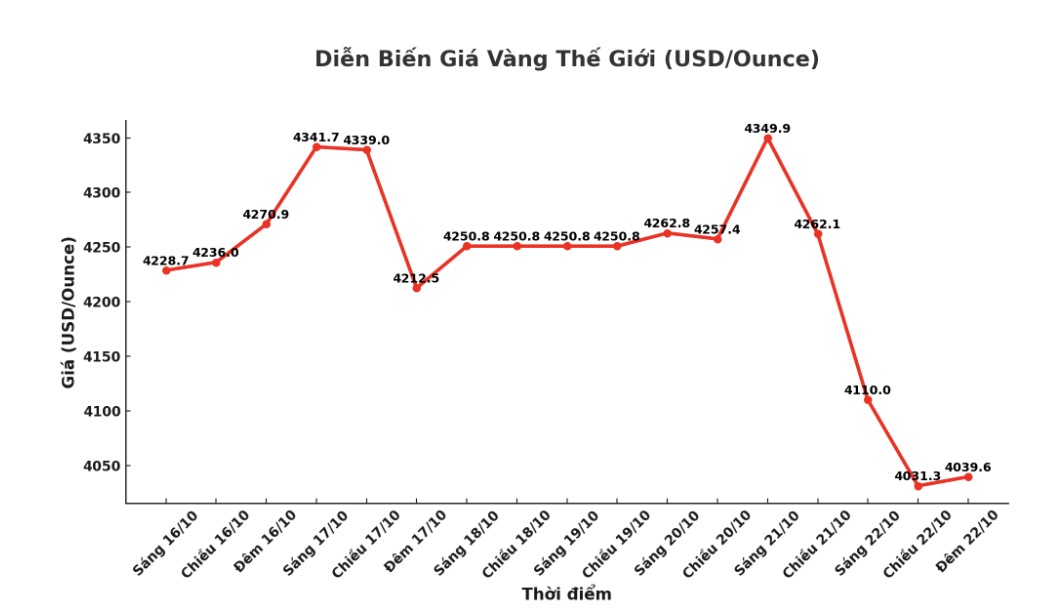

World gold price

Recorded at 22:55 on October 22, the world spot gold price was listed at 4,031.2 USD/ounce, down 92.6 USD.

Gold price forecast

Gold prices continued to fall in the trading session on Wednesday, just one day after spot gold recorded its strongest decline in more than 5 years. At the same time, US key stock indexes also fell across the board, with Netflix (NFLX.O) losing more than 9% due to unsatisfactory business prospects.

According to Jim Wyckoff - senior analyst at Kitco, the sharp declines in gold and silver are attracting special attention from the market. In last night's session, the two precious metals continued to fall sharply after recording their worst decline in many years on Tuesday, due to concerns that the increase had gone too far and too fast.

Mr. Tim Ghriskey - Senior portfolio strategist at Ingalls & Snyder, New York - commented: "The market is witnessing strong fluctuations in both directions, reflecting a clear psychological instability. The profit reporting season always has many potential risks. In addition, trade tensions and war in the Middle East are still factors that worry investors".

Investors have almost priced in the possibility of the Federal Reserve cutting by 0.25 percentage points at its meeting next week. However, the lack of economic data due to government shutdowns has caused policymakers to be "unable to inform" when making decisions.

Technically, the buying power of bulls in the December gold futures market is weakening rapidly. The next upside target for buyers is to close above the strong resistance zone of 4,200 USD/ounce. In contrast, the short-term target for the bears is to pull prices below the important technical support zone of $3,900/ounce.

The first resistance zone was at $4,100/ounce and then the night peak was $4,175/ounce. The nearest support zone is 4,021.2 USD/ounce and next is the psychological mark of 4,000 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...