Gold and silver prices simultaneously increased sharply right in the first trading sessions of 2026, extending the most impressive increase since 1979.

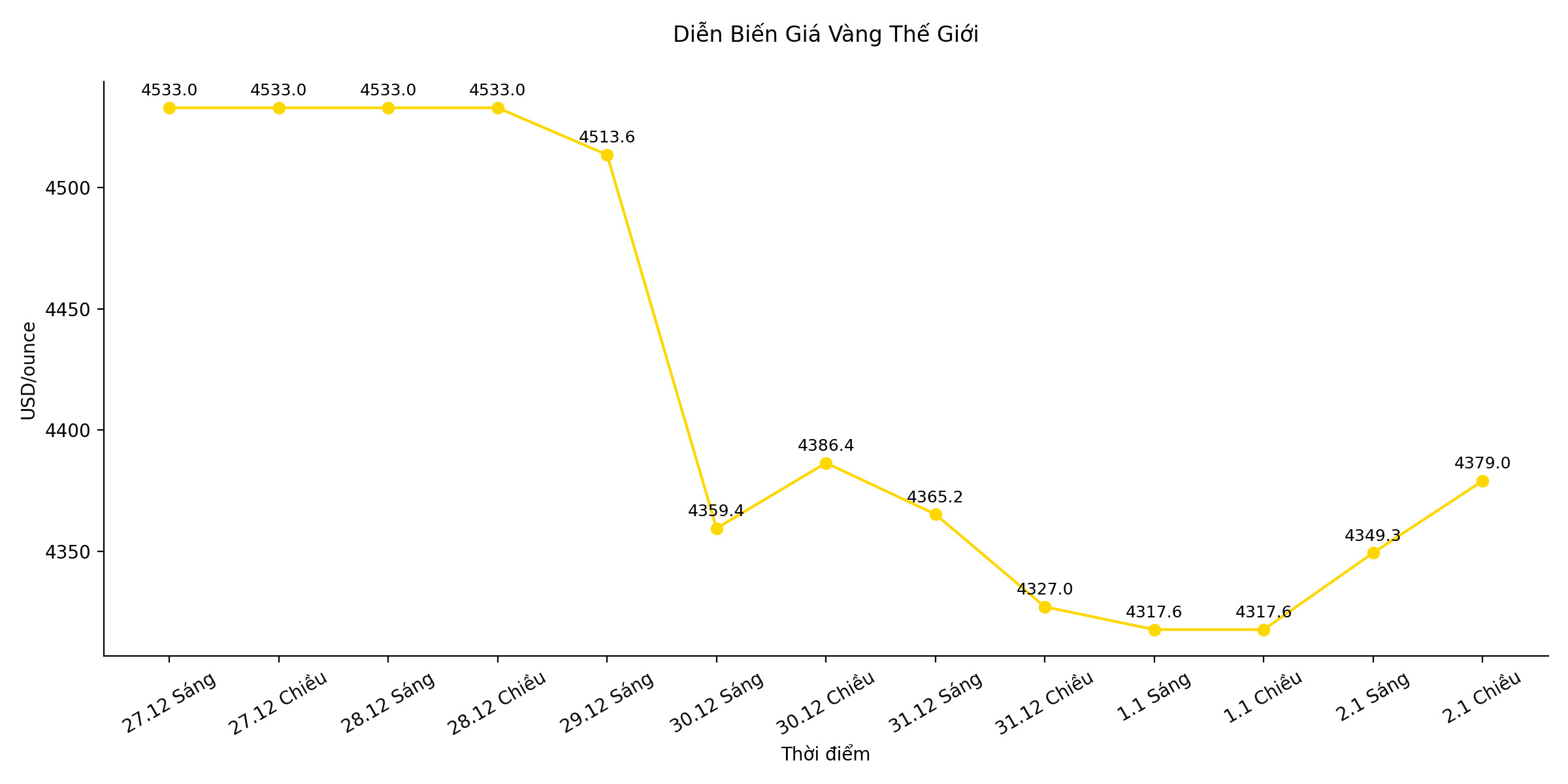

During the session, spot gold prices approached the threshold of 4,379 USD/ounce, while silver jumped more than 2%. Investors expect the precious metal to continue to benefit this year thanks to the prospect of the US Federal Reserve (Fed) cutting interest rates and the weakening USD. However, the market also has short-term concerns as portfolio restructuring activities of index funds may put pressure on price adjustments.

According to Mr. Daniel Ghali, senior commodity strategist at TD Securities, about 13% of the total number of contracts opened on the Comex silver market may be sold within the next two weeks to adjust the portfolio proportion.

This could lead to a significant price adjustment, especially in the context of still thin after-holiday liquidity" - he assessed.

2025 closed with one of the strongest increases in the history of precious metals, although the market once fluctuated at the end of the year when investors took profits and technical indicators fell into the overbought zone.

Gold prices continuously set new records thanks to strong buying power from central banks, expectations of the Fed easing monetary policy, along with the weakening USD. In addition, geopolitical tensions and trade conflicts led by the US also boost safe haven demand.

Silver even increased more strongly than gold in the past year, continuously exceeding price levels once considered "unbelievable". In addition to general supporting factors, this metal also benefits from concerns that the US may impose import tariffs on refined silver.

Among major financial institutions, many banks still maintain an optimistic view of gold in 2026. Goldman Sachs forecasts that gold prices could reach 4,900 USD/ounce, amid continued interest rate cuts by the Fed and the Donald Trump administration reshaping the role of the Federal Reserve.

As of this afternoon's trading session, gold prices increased by 1.3% to 4,375.15 USD/ounce. Bloomberg Dollar Spot index slightly decreased by 0.1%. Silver prices increased by 2.5% to 73.45 USD/ounce, while palladium and platinum also simultaneously went up.

Market liquidity is expected to remain low in the last session of the week as many major markets, including Japan and China, continue to have holidays.