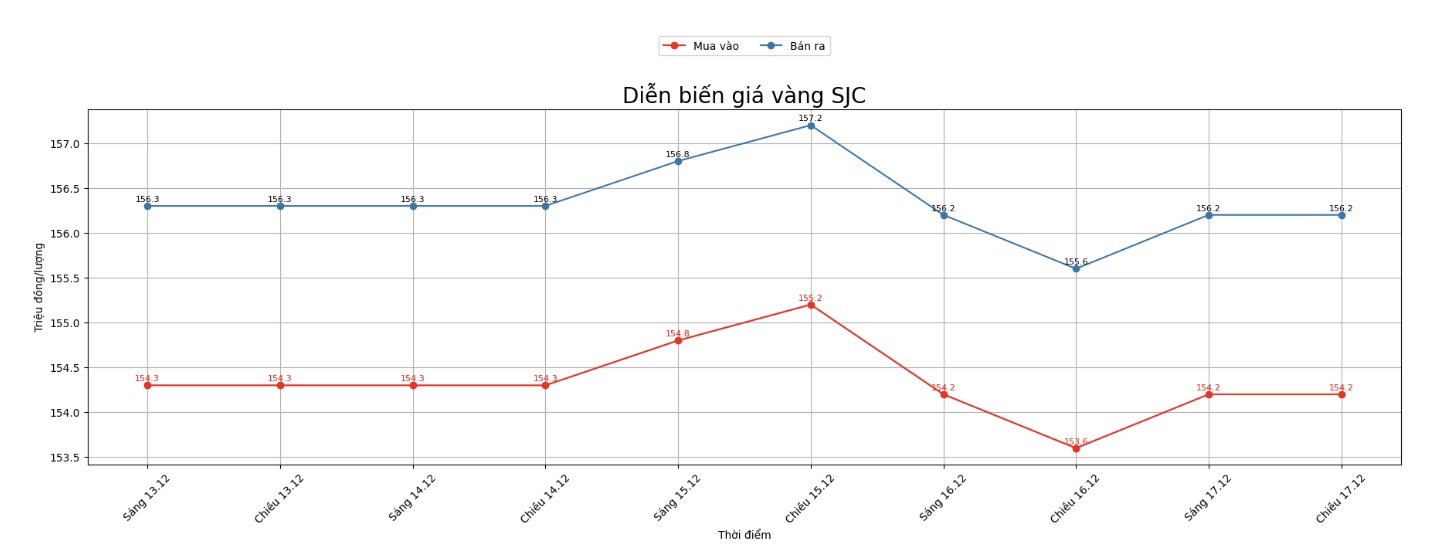

SJC gold bar price

As of 6:15 p.m., DOJI Group listed the price of SJC gold bars at VND154.2-156.2 million/tael (buy in - sell out), an increase of VND600,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 154.2-156.2 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 153.2-156.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

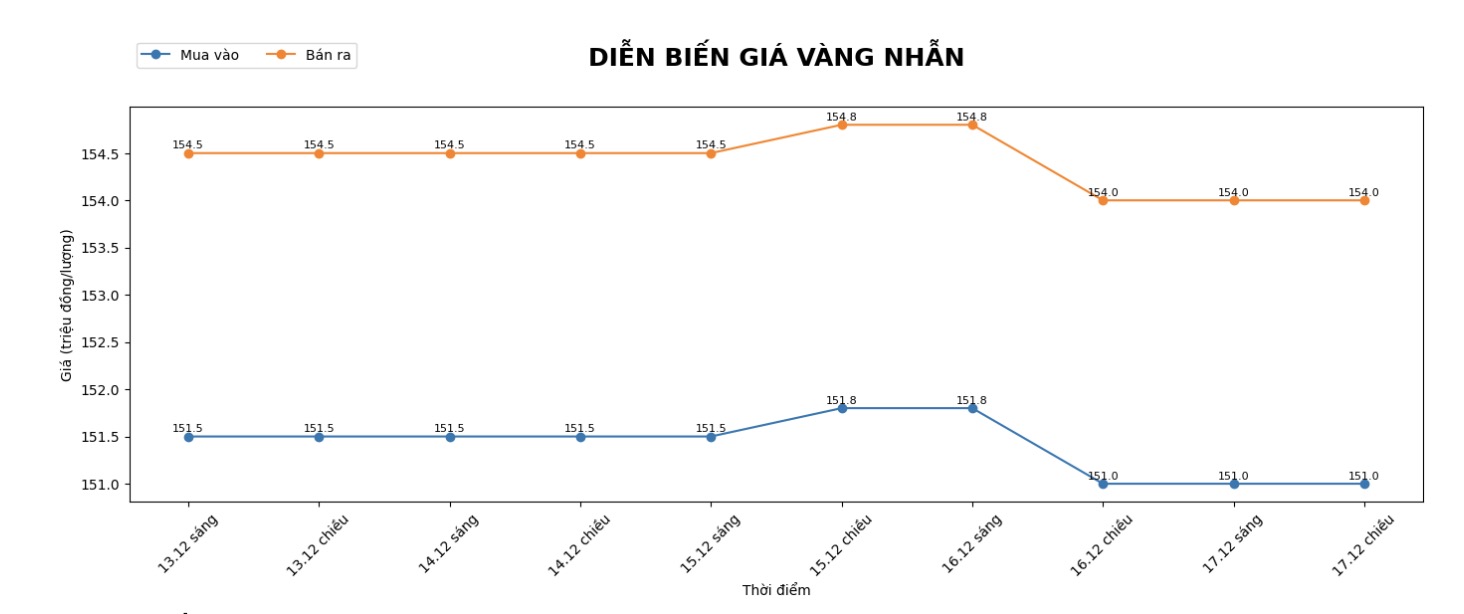

9999 gold ring price

As of 6:00 p.m., DOJI Group listed the price of gold rings at 151-154 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.2-155.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 151.3-154.3 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

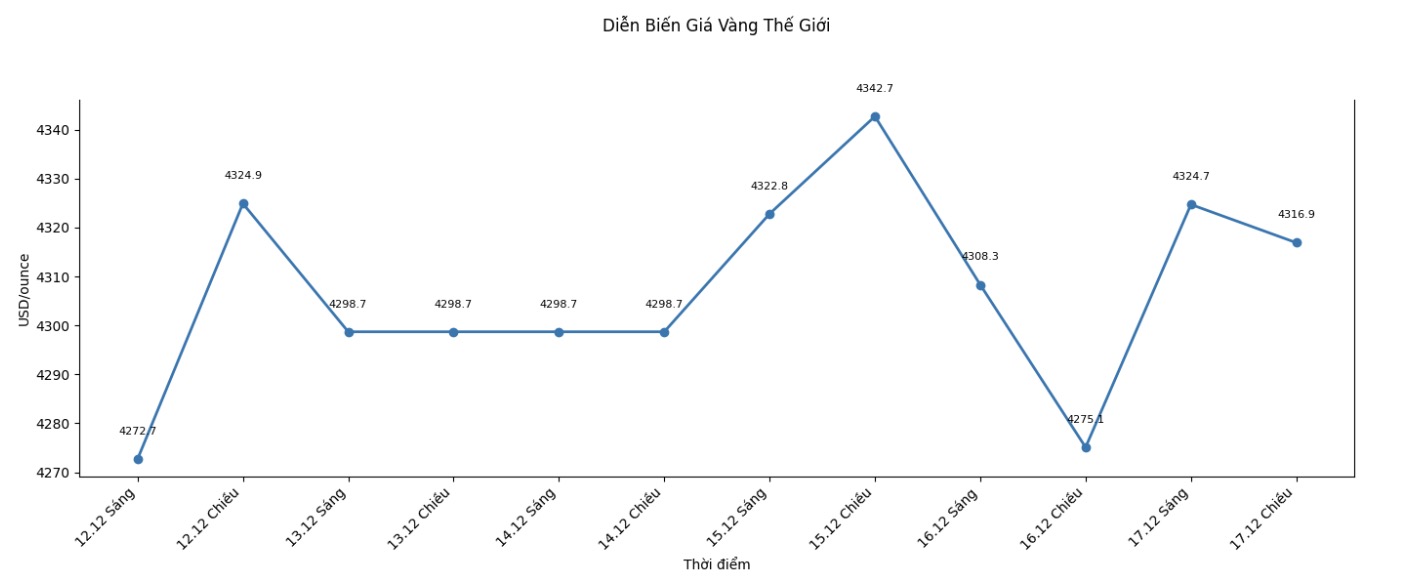

World gold price

The world gold price was listed at 6:17 p.m., at 4,316.9 USD/ounce, up 41.8 USD compared to a day ago.

Gold price forecast

Silver prices broke above $65/ounce, breaking above record highs in the trading session on Wednesday, while gold prices also increased after lower-than-expected US employment data showed the labor market was cooling down, thereby increasing expectations that the US Federal Reserve (Fed) will cut interest rates more next year.

Gold prices continue to be supported by expectations that the Fed will pursue a loose monetary policy, along with economic uncertainty and geopolitical tensions, according to Ricardo Evangelista, an analyst at ActivTrades.

In another development, avi Gilburt - a veteran technical analyst and founder of Elliott WaveveTrader - said that after one of the strongest breakthroughs in the precious metal in decades, the gold price increase may be entering its final stage.

This expert commented that the increase in gold and silver starting from the bottom of 2015 - 2016 is entering the final stage. Although prices may continue to rise in the short term, he warned investors to prepare early for a multi-year adjustment period, which could start as early as 2026.

Gilburt believes the current rally is not the start of a new cycle, but rather the end of a cycle that has lasted for nearly a decade.

He emphasized that this cycle formed after the post- 2015 restructuring period, when the precious metals market was under great pressure from the sell-off of ETF funds and a sharp decline in investor interest.

With gold prices currently trading above the support zone around $4,300/ounce, Gilburt said upcoming developments will depend on the ability to overcome the important resistance level at $4,383/ounce. If it cannot break out, gold could face a deep correction, even returning to the $3,800/ounce zone.

See more news related to gold prices HERE...