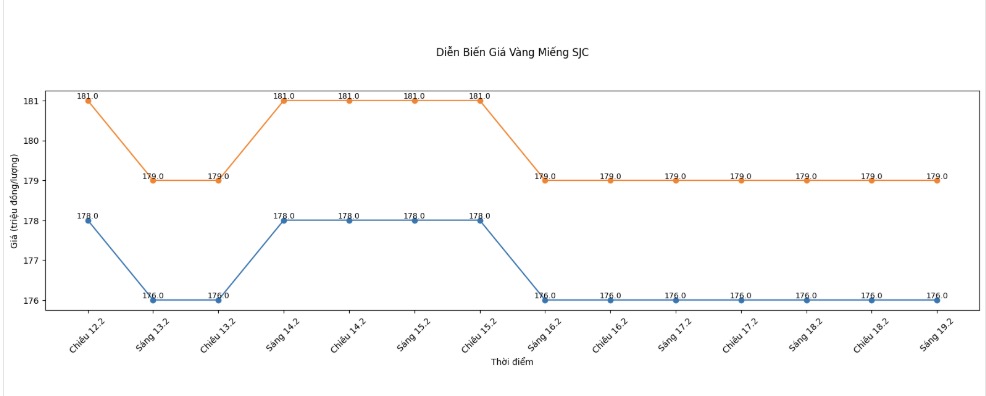

SJC gold bar price

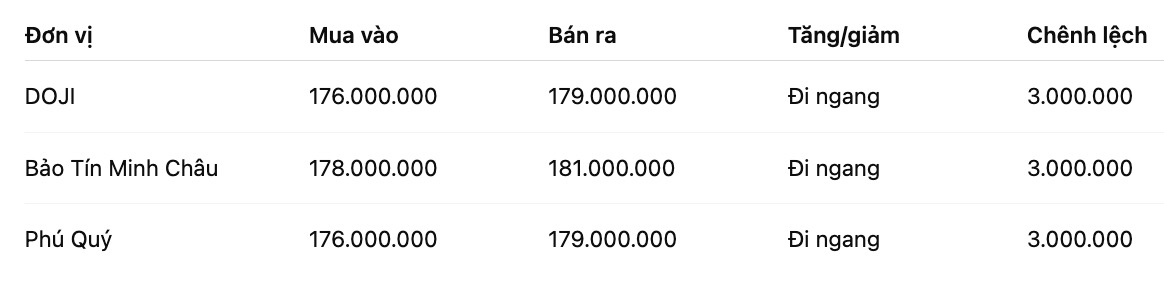

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

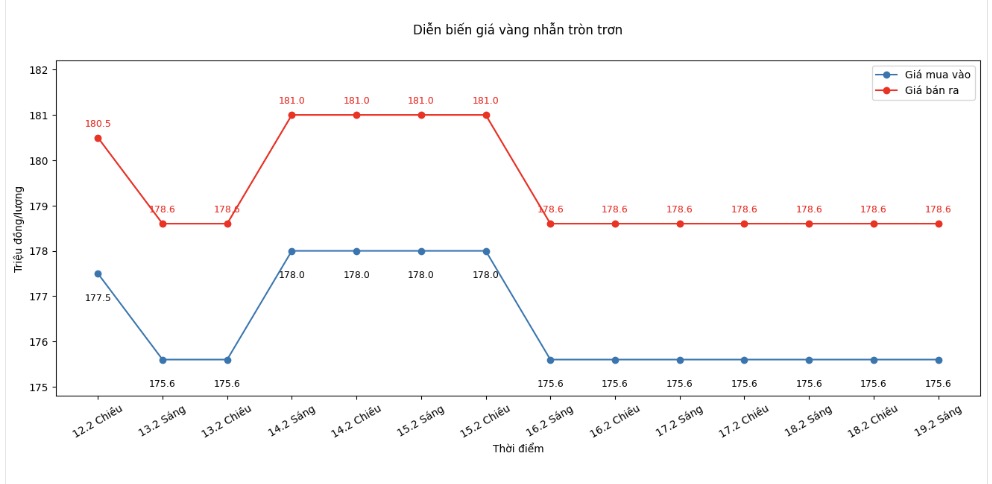

9999 gold ring price

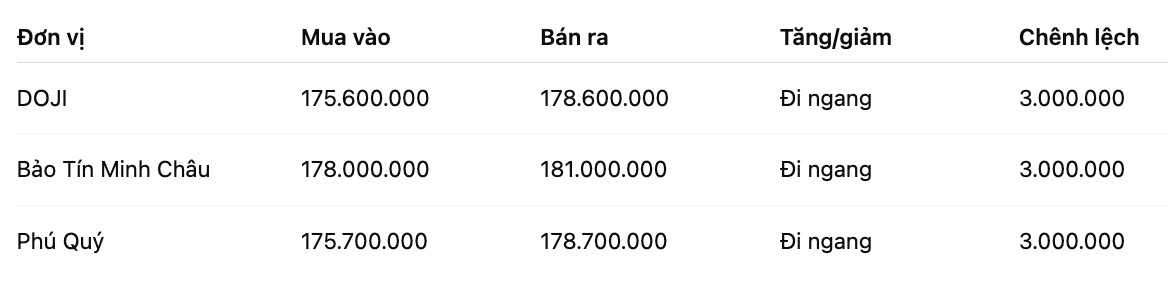

As of 6:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

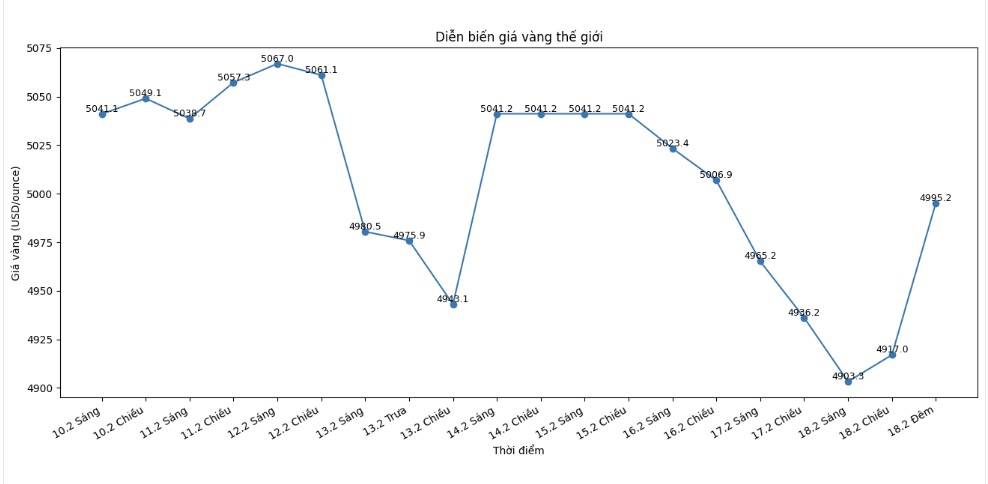

World gold price

At 1:23 AM, world gold prices were listed around the threshold of 4,995.2 USD/ounce, up 117.1 USD/ounce.

Gold price forecast

World gold prices continue to maintain around the high zone, approaching the psychological milestone of 5,000 USD/ounce as a series of US economic data released recently sends mixed signals. This development is strengthening expectations that the precious metal still has room to increase in the short term, but the risk of correction is still present.

A report from the US Department of Commerce shows that the housing sector improved better than forecast. The number of houses started in November increased by 3.9%, reaching an annual rate of 1.322 million units, far exceeding analysts' expectations. In December, this index continued to increase to 1.448 million units. Although construction permits slightly decreased, the decrease was lower than expected, reflecting that housing demand has not weakened sharply despite high mortgage interest rates.

Immediately after the housing data was released, gold prices surged sharply, at one point jumping to nearly 4,970 USD/ounce. According to analysts, positive information from the real estate market helps ease concerns about the recession, but at the same time also makes investors consider the monetary policy outlook of the US Federal Reserve (Fed).

In another development, durable goods orders in December decreased by 1.4%, lower than the 2% decrease forecast by the market. Notably, core orders - excluding the highly volatile transportation group - increased by 0.9%. This figure shows that production activities still maintained certain resistance, thereby limiting economic slowdown pressure.

Mr. Ole Hansen, Head of Commodity Strategy at Saxo Bank, commented: "Gold prices are being supported by expectations that the Fed may ease policy this year. However, any signal that the US economy is too strong could slow down the interest rate cut process, putting pressure on precious metals.

Meanwhile, the minutes of the upcoming FOMC meeting in January are considered key factors. Previously, the Fed decided to keep interest rates unchanged.

Fed Governor Michael Barr said that interest rates need to remain stable for a while to ensure inflation returns to the 2% target. Conversely, Chicago Fed Chairman Austan Goolsbee left open the possibility of further interest rate cuts if inflation continues to cool down.

Observers believe that if the Fed sends more moderate signals, gold may conquer the 5,000 USD/ounce mark. Conversely, a tough stance will trigger a correction after the recent hot rally. Investors are advised to be cautious in the face of strong market fluctuations.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...