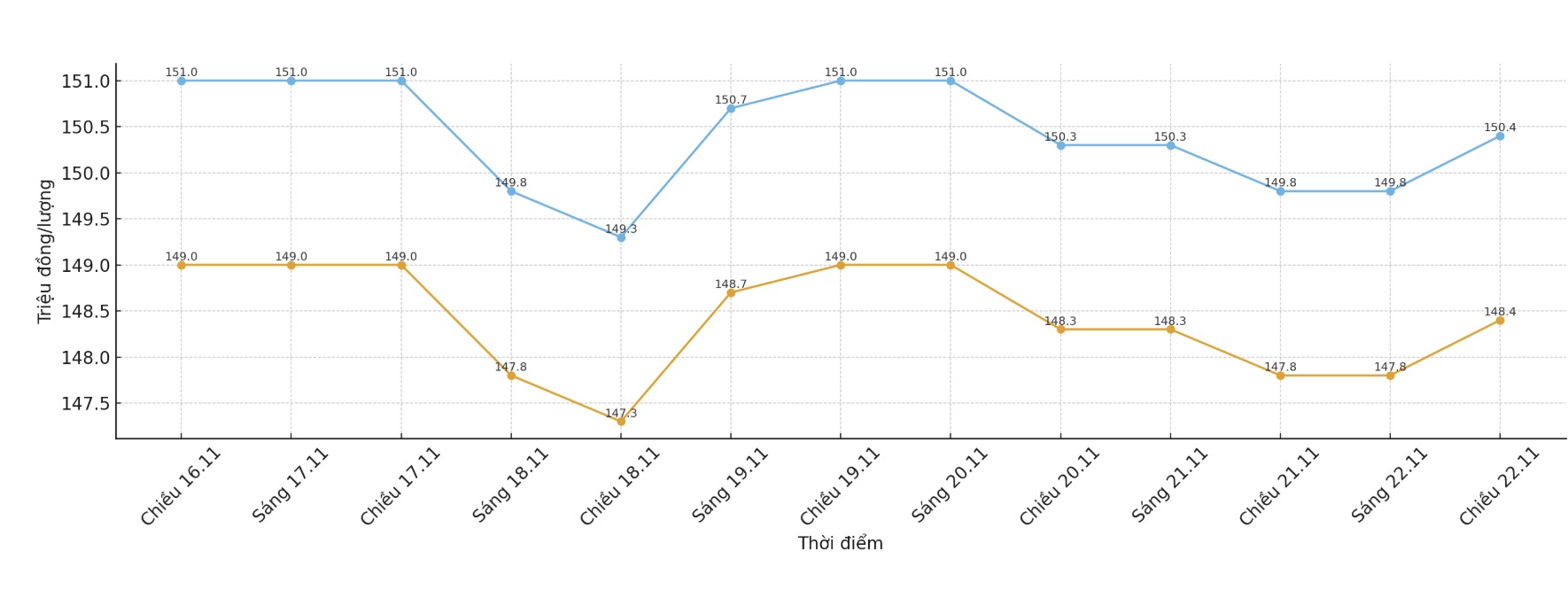

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 148.4-150.4 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 148.9-150.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 147.9-150.4 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

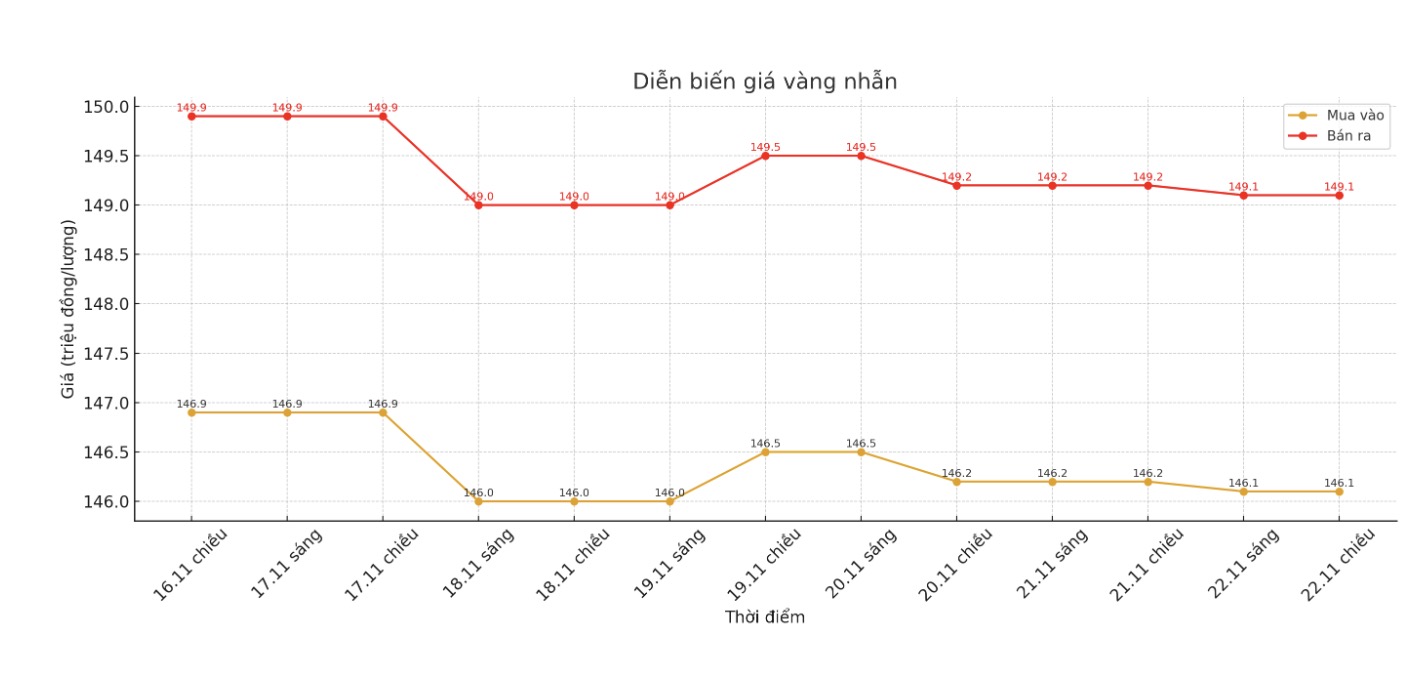

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 146.1-149.1 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 147.6-150.6 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 147-150 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

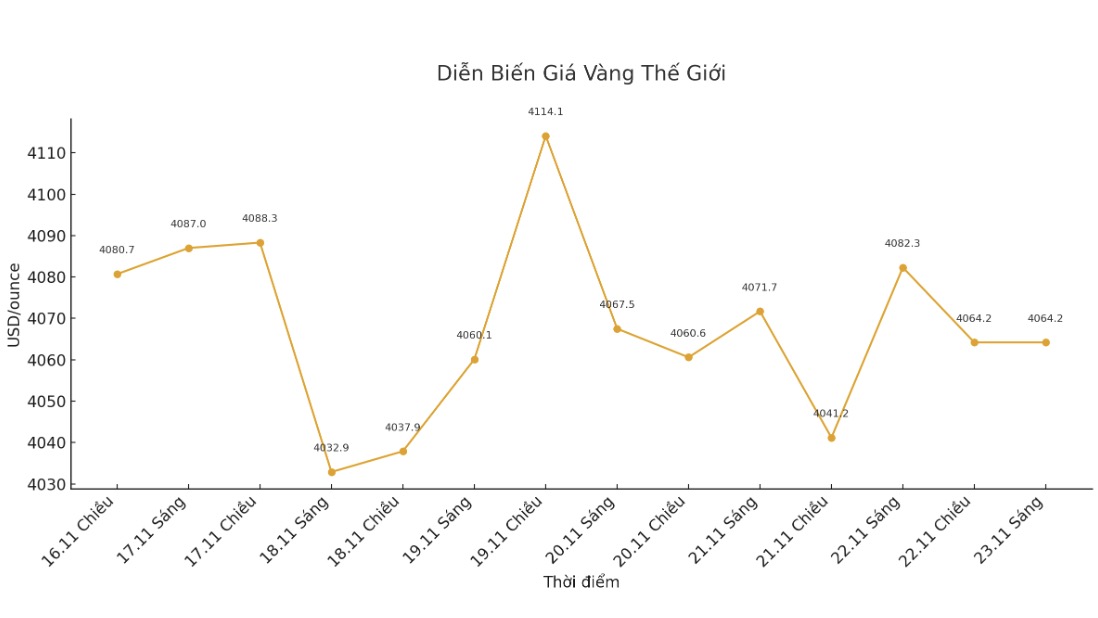

World gold price

The world gold price was listed at 1:05 am at 4,064.2 USD/ounce, down 18.1 USD.

Gold price forecast

The latest weekly gold survey by an international financial information platform shows that the majority of Wall Street experts are shifting to a bearish or neutral view, while individual investors maintain a majority optimistic ratio.

This week, 13 analysts participated in the gold survey, with only a small group of Wall Street experts holding an upward view. Only two people (equivalent to 15%) predict gold prices will increase next week, while four others (accounting for 31%), predict prices will decrease. The remaining seven analysts (equivalent to 54%) expect the precious metal to move sideways next week.

Meanwhile, the online survey recorded 228 votes, with the optimistic sentiment of investors on Main Street somewhat decreasing compared to last week. 138 individual investors (61%), while 44%, see gold prices rising next week, see prices falling. The remaining 46 people (equivalent to 20%), expect gold prices to enter the accumulation phase next week.

Adrian Day - chairman of Adrian Day Asset Management commented that gold prices next week will not change. Gold may need more time before it can increase more sustainably, although the US Federal Reserves interest rate decision next month could change the picture. I don't see much room to decrease from the current level; there are still basic factors and there is a lot of money waiting outside to buy if prices decrease".

David Morrison, senior market analyst at Trade Nation, is pessimistic about gold in the short term. The outlook for gold is currently quite uncertain, he said.

Economic data to watch next week

Next week will see a series of important economic reports piled up in the first three days of the week, as the US government continues to handle the data backlog after the closure.

On Tuesday morning, the market will receive the US PPI and Retail Sales reports for September, along with the data for Ho Chi Minh City's pending sales in October.

On Wednesday, traders will monitor a series of published data including long-term commodity orders, preliminary GDP for the third quarter, Personal Consumption Expenditures Index (PCE), New home sales and weekly jobless claims.

The US market will close for the Thanksgiving holiday on Thursday, and although it will resume operations on Friday, there will be no other notable economic reports released.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...