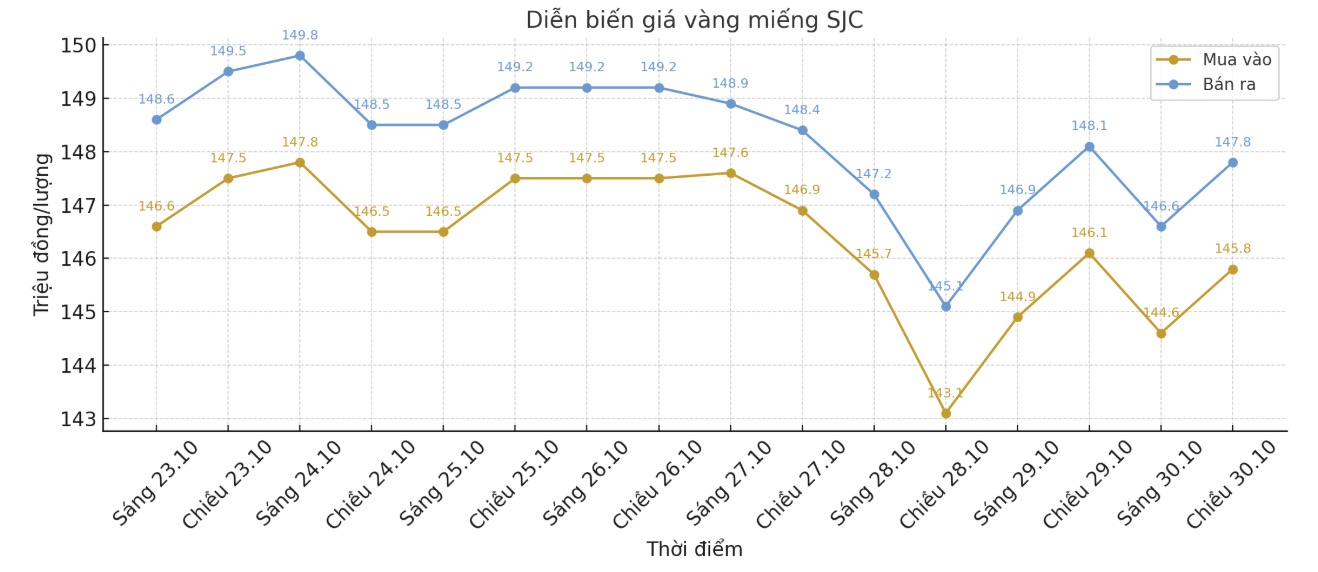

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 145.8-147.8 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.5-147.8 million VND/tael (buy - sell), down 600,000 VND/tael for buying and down 300,000 VND/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.3-147.8 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

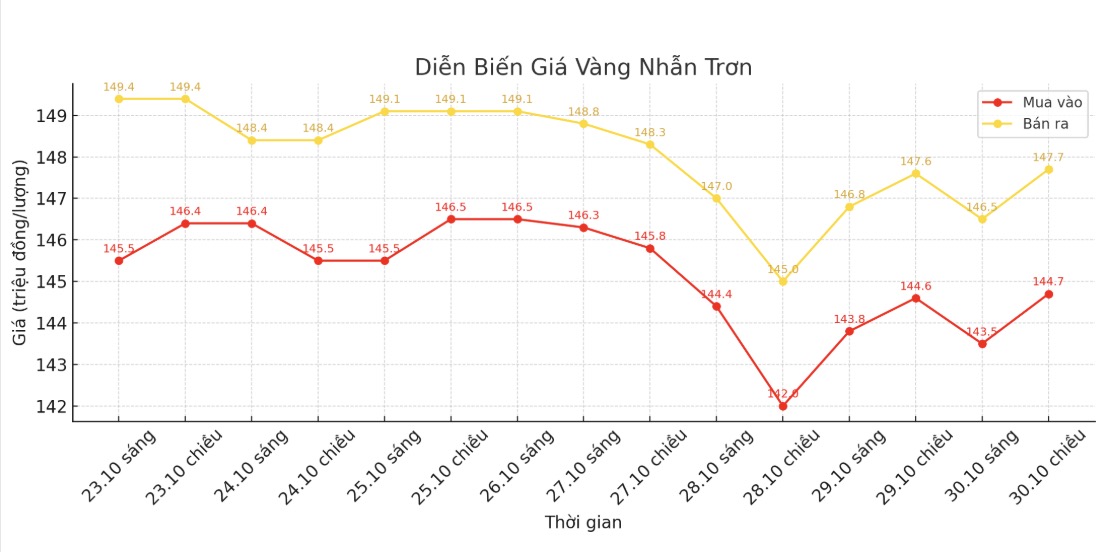

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 144.7/47.7 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 145.9-148.9 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 144.8-147.8 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

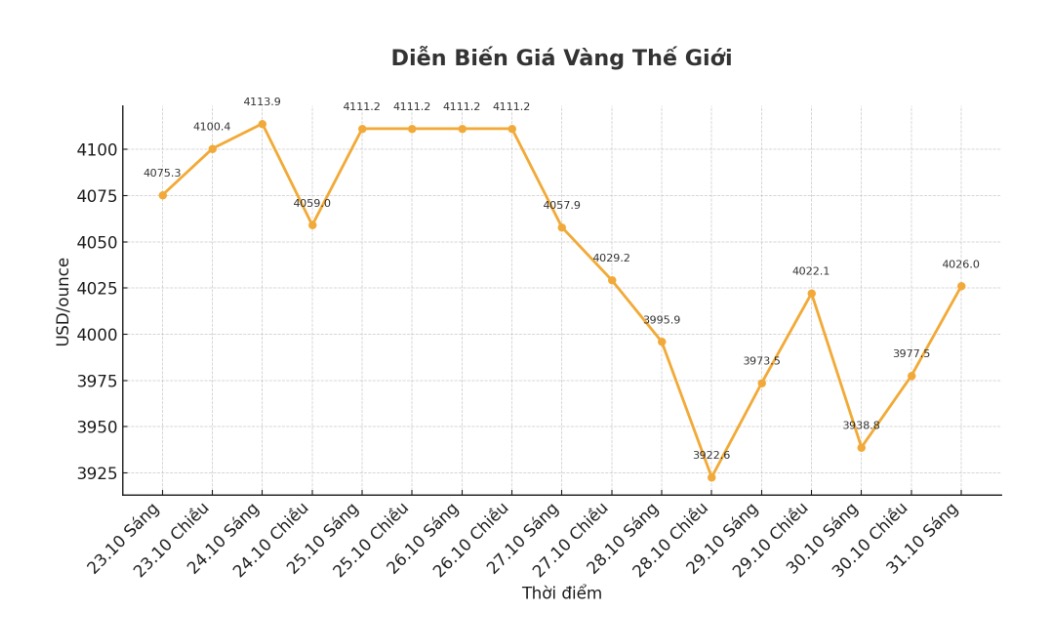

World gold price

The world gold price was listed at 6:00 a.m. at 4,026 USD/ounce, up 85.4 USD/ounce.

Gold price forecast

World gold prices rebounded strongly after Federal Reserve Chairman Jerome Powell gave more "hawlish" statements than expected on monetary policy on Wednesday, putting pressure on the precious metal market later that day and throughout the night.

The Federal Open Market Committee (FOMC) lowered the federal interest rate target range by 0.25% on Wednesday, in line with market expectations, with disagreements in both directions.

However, Mr. Powell warned investors not to expect too much about the possibility of a rate cut in December, emphasizing the growing division within the Fed in terms of employment prospects and inflation. He said: "continuing to cut interest rates at the December meeting is not certain - it is far away to say so."

Mr. Powell's tough tone has caused US Treasury bond prices to fall (increase yields), leaving the possibility of the Fed cutting interest rates in December at only average.

While some officials are concerned that the job market is cooling, others have warned that persistent inflation will limit the room for further easing, according to Bloomberg. The delay in releasing official economic data during the US government's shutdown has deepened this division.

In another development, central banks continue to increase gold reserves. The World Gold Council (WGC) said that central banks' gold purchases in the third quarter accelerated, with many buyers returning to the market despite record gold prices, in order to bet on the value of this precious metal as a protective channel against the weakness of the USD.

Central banks bought 220 tonnes of gold in the July-September period, up 28% from the previous quarter, and raised the total amount of gold purchased in the first 9 months of the year to 634 tonnes.

The WGC forecasts total purchases for the whole year of 2025 to reach 750 to 900 tons, due to escalating geopolitical tensions, prolonged inflationary pressures and instability in global trade policies continuing to boost demand for safe-haven assets.

The gold market operates mainly through two pricing mechanisms: the spot market - where prices are reported for immediate transactions and deliveries; and the futures market - where prices are established for future deliveries. Due to liquidity factors and year-end position, the December gold contract is currently the most actively traded contract on the CME exchange.

In outside markets, the USD index rose and hit a three-month high. Crude oil prices are almost flat at around 60.50 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.078%.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...