Mr. Ray Jia - Head of China Market Research at the World Gold Council (WGC) said that the Chinese gold market in October grew much stronger than the usual at this time of year, and in November it still maintained its upward momentum.

At the same time, China's gold ETFs attracted a large amount of capital and the volume of gold futures also increased sharply.

In the latest updated report on the Chinese gold market, Jia commented that October is a "story of two halves". He said gold prices rose sharply in the first half of the month, continuously setting new highs due to increased risks and strong buying from ETFs, before cooling down at the end of the month as geopolitical tensions eased and profit-taking activities took place. At the end of October, both LBMA Gold Price PM and SHAUPM gold prices recorded positive increases, bringing the total increase since the beginning of the year to 44% and 42%, respectively.

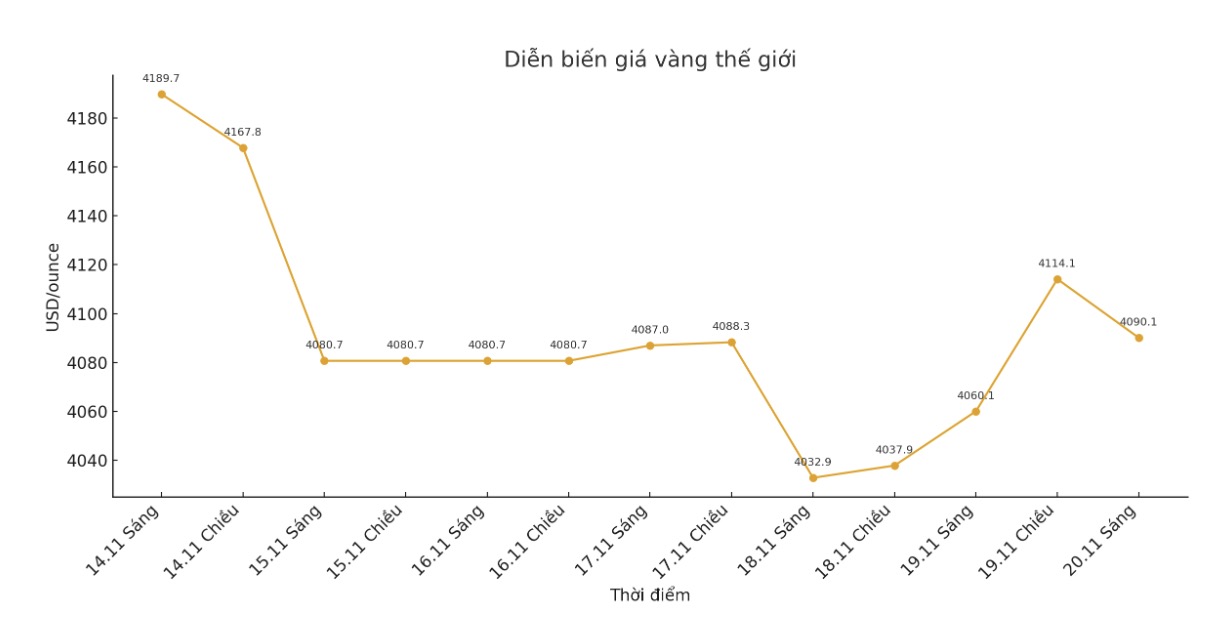

Gold prices also continued to rise in the first half of November, supported by escalating geopolitical risks and stronger capital flows into gold ETFs. According to Jia, the LBMA Gold Price PM index in USD and SHAUPM in yuan increased by 1.5% and 3.3% respectively in the first two weeks of the month.

The demand for wholesale gold also overcame the seasonal weakening trend. Shanghai Gold Exchange (SGE) gold withdrawal reached 124 tons in October, up 6 tons from the previous month and up 17 tons compared to the same period last year, nearly the same as the 10-year average of 127 tons.

Investment demand continues to improve, especially in the first half of October when US-China trade tensions increased, the domestic stock market slowed down and gold prices escalated, contributing to supporting wholesale demand.

Although consuming gold jewelry quite strongly during the National Day and Mid-Autumn Festival holidays lasting nine days in the first days of the month, retailers are still cautious about adding goods due to large price fluctuations in the first period of the month.

Gold ETF capital flows also increased with gold prices. China's gold ETFs attracted 32 billion yuan ($4.5 billion) in October, the highest level since April.

Total assets under management of funds increased by 24% to 210 billion yuan ($29 billion), while gold holdings increased by 33 tons to 227 tons, all of which were records.

Earlier this month, geopolitical tensions and a weakening of the stock market forced investors to seek a safe haven, gold ETFs. However, as trade risks ease after a meeting between US and Chinese leaders, along with the Fed cutting interest rates in a Hawl direction, reducing expectations of policy easing, demand for shelter has also weakened.

By early November, cash flow into gold ETFs increased again thanks to a stock market correction, a recovery in gold prices and increased geopolitical tensions.

As gold prices fluctuated strongly, gold futures trading at the Shanghai Commodity Exchange (SHFE) also exploded, reaching an average of 647 tons/day in October, up 64% compared to the previous month. According to Jia, with fluctuations continuing to increase in early November, gold futures trading volume in Shanghai remained high.

Despite gold prices at record levels, China's official gold holdings continued to increase during the month. The People's Bank of China (PBoC) reported its 12th consecutive month of gold purchases in October, with 0.9 tons added. Continuous buying since the beginning of 2025 has increased the total official gold reserves to 2,304.5 tons, an increase of 24 tons compared to the end of 2024. China's share of gold in foreign exchange reserves also increased from 5.5% to 8%.

Gold imports also increased beyond the trend in September with data reaching 93 tons, 5 tons higher per month and 36 tons per year. According to Jia, this is in line with the recovery in wholesale demand in September, when the amount of gold withdrawn from the SGE increased both monthly and annually.

In terms of prospects, Jia said that China's adjustment of value-added tax (VAT) on gold could put pressure on demand for gold jewelry due to increased tax rates. However, the WGC believes consumer price sensitivity may be declining after three consecutive years of rising gold prices.

He noted that the VAT change does not apply to gold bars sold by SGE members, gold ETFs or gold accumulation programs (GAP) and there is still room for growth for gold bar sales when consumers can buy gold bars to serve jewelry making.