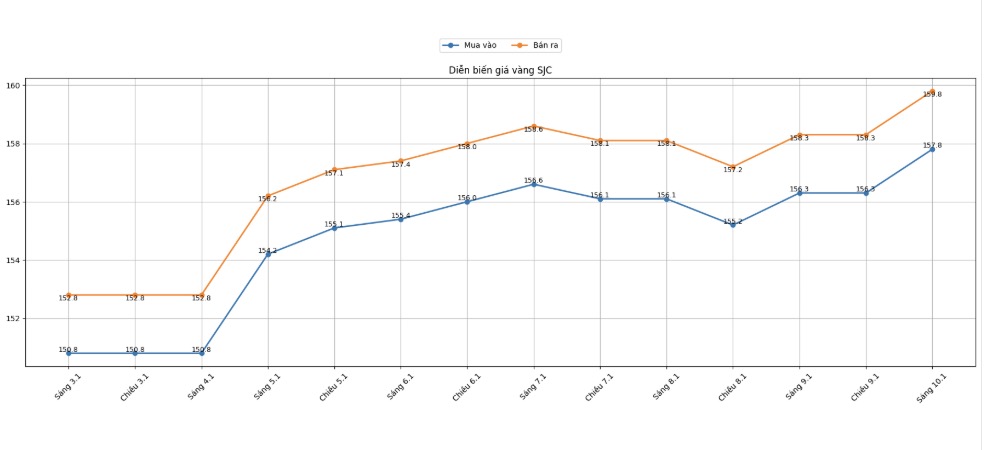

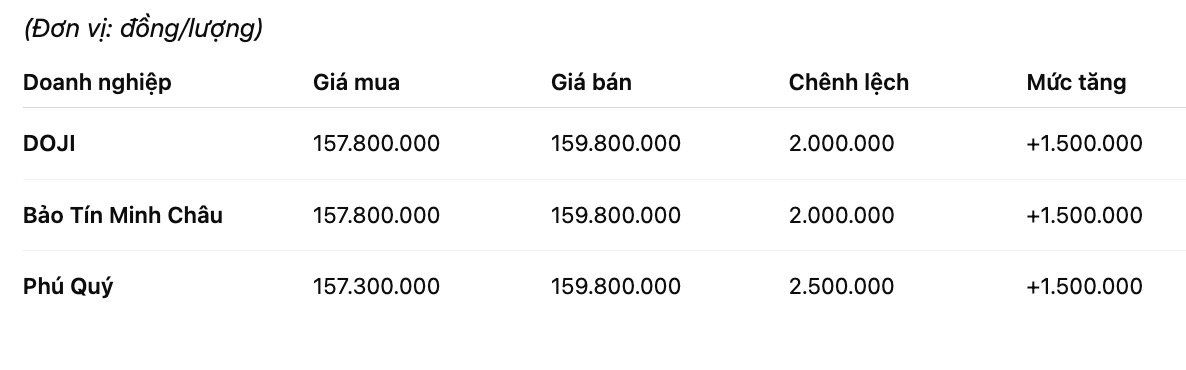

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 157.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of SJC gold bars at 157.3-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

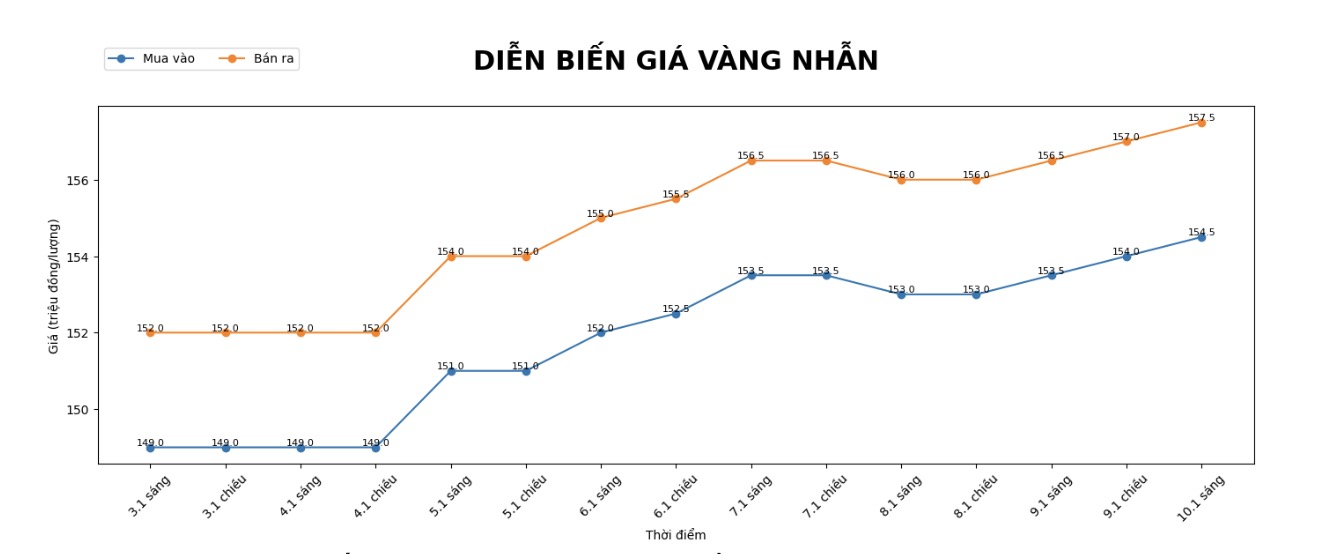

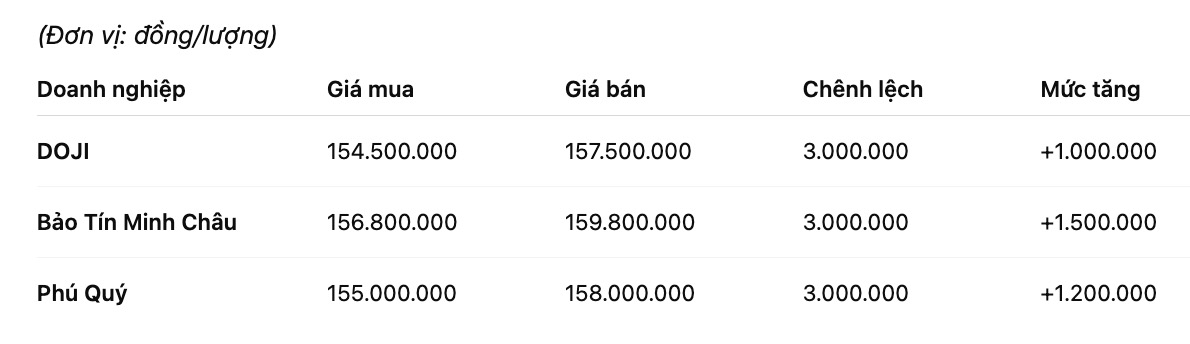

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 154.5-157.5 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.8-159.8 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

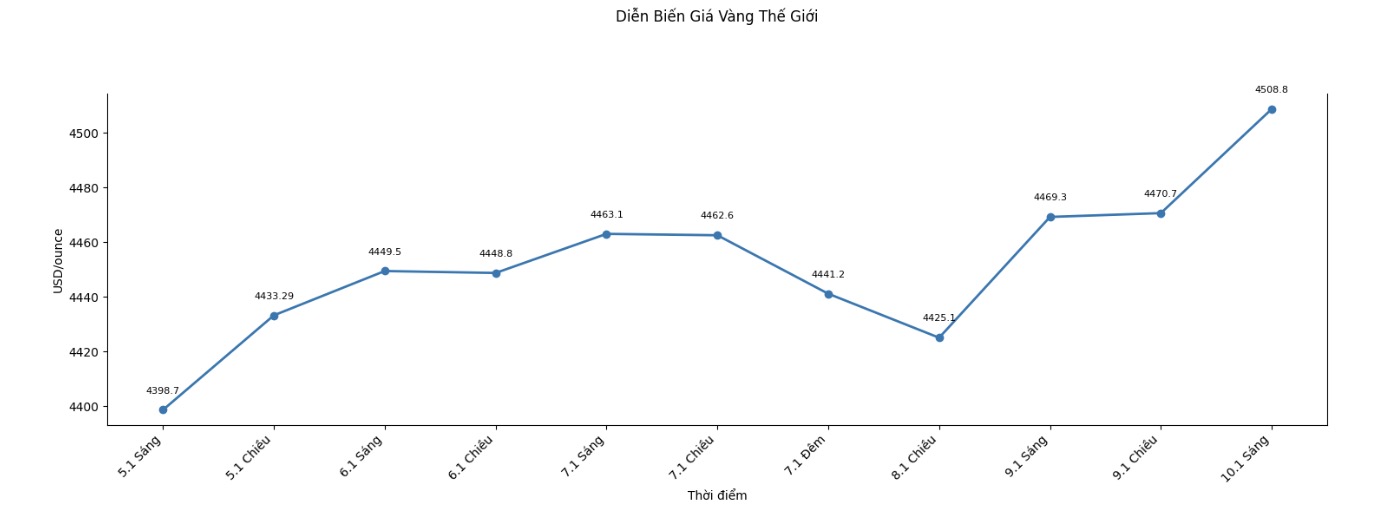

World gold price

At 9:12 am, world gold prices were listed around the threshold of 4,508.8 USD/ounce, up 39.5 USD compared to the previous day.

Gold price forecast

World gold prices have surpassed the 4,500 USD/ounce mark and are maintaining a high price base in the context of many supporting factors appearing simultaneously. From negative US economic data, loosening monetary expectations to geopolitical tensions, all are creating a favorable environment for cash flow to continue to turn to precious metals.

The clearest driving force comes from the US labor market. The latest report shows that the number of non-farm jobs in December only increased by 50,000, significantly lower than forecast. Not only that, data from previous months was also adjusted down, reflecting a less bright employment picture than initially estimated. Immediately after this information was announced, gold prices rebounded, showing a fairly sensitive market reaction to the weakening US economic outlook.

Meanwhile, wages in the US are still increasing steadily, with an increase of nearly 3.8% in the past 12 months. The combination of a cooling labor market and high wage pressure is reinforcing expectations that the US Federal Reserve (Fed) will have to continue to ease monetary policy in 2026. According to analysts, as real interest rates fall, the opportunity cost of holding gold – a non-interest-generating asset – also decreases, thereby supporting the price of the precious metal.

Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank - said that the current environment is "very similar to the periods when gold often enters a long-term uptrend cycle, when economic risks increase but monetary policy tends to be softer.

Besides macroeconomic factors, safe-haven cash flow is also playing an important role. Geopolitical tensions and instability in the energy and international financial markets make risk hedging demand maintained at a high level. Thanks to that, gold recorded a strong weekly increase, although in the middle of the week it was under profit-taking pressure when some US economic data was temporarily more positive.

In addition, the market must also "neutralize" the rebalancing activities of large commodity index funds such as Bloomberg Commodity Index or S&P GSCI. Because gold and silver prices have increased very strongly in the previous year, these funds are forced to sell off to bring proportions back to the standard level, which may create short-term corrections. However, many experts believe that this process is only technical and will soon end, while the long-term support base of gold remains unchanged.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...